FOR: KELT EXPLORATION LTD.

TSX Symbol: KEL

Date issue: October 06, 2017

Time in: 4:30 PM e

Attention:

CALGARY, AB –(Marketwired – October 06, 2017) – Kelt Exploration Ltd.

(“Kelt” or the “Company”) (TSX: KEL) has subscribed to TransCanada

Corporation’s Dawn Long Term Fixed Price (LTFP) service and in addition, has

entered into various natural gas sales contracts in order to provide the

Company with exposure to diversified gas price hubs and reduce exposure to a

single market.

Effective November 1, 2017, Kelt’s gas market sales portfolio will consist of

the following contracts:

/T/

—————————————————————————-

Percent

Market Term (Sales) Volume @ Market Price

(MMBtu/d) Nov/1/17

—————————————————————————-

Nov/1/17 âÇô Oct/31/27 23,695 31% DAWN USD Daily Index

—————————————————————————-

Nov/1/17 âÇô Oct/31/20 15,000 20% MALIN USD NGI FOM Index less

US$0.70/MMBtu

—————————————————————————-

Nov/1/17 âÇô Oct/31/20 11,990 16% SUMAS USD Monthly Index less

US$0.679/MMBtu

—————————————————————————-

Nov/1/17 âÇô Oct/31/18 3,000 4% SUMAS USD Monthly Index less

US$0.76/MMBtu

—————————————————————————-

Nov/1/17 âÇô Oct/31/18 * 10,330 14% CHICAGO City Gate USD Gas Daily

Index

—————————————————————————-

Nov/1/17 âÇô Oct/31/18 11,305 15% AECO CAD Daily (5A) Index

—————————————————————————-

TOTAL (effective 75,320 100%

Nov/1/17)

—————————————————————————-

* The Company also has access to priority interruptible transportation

service (“PITS”) equating to 25% (2,580 MMBtu/d) of its firm service volume

on the Alliance pipeline system under which Kelt can increase the amount of

gas sales from its British Columbia properties into the Chicago market.

/T/

During 2017, Kelt expects that its oil and NGLs production will contribute

approximately 76% of its aggregate operating income and gas production will

contribute the remaining 24%.

Due to the recent volatility in AECO gas prices, Kelt has elected to

temporarily shut-in approximately 21.4 MMcf/d of dry gas production (3,770

BOE/d including associated NGLs) at its Grande Cache and West Pouce Coupe

properties in Alberta. AECO CAD Daily (5A) Index prices have averaged

$1.55/GJ, $1.65/GJ and $0.93/GJ during the months of July, August and

September 2017, respectively. The Company has elected to shut-in production at

its dry gas properties due to the weakness in the current AECO price primarily

caused by transportation bottlenecks on the entire Western Canadian pipeline

transportation system. Kelt expects to keep this production shut-in until AECO

prices improve or until November 1, 2017, at which time the Company can direct

its gas to non-AECO priced contracts in its gas market sales portfolio. The

impact to 2017 guidance based on previously forecasted commodity prices during

a 30-day shut-in period with respect to these production volumes would reduce

Kelt’s 2017 average production guidance of 22,500 BOE per day by 310 BOE per

day (1.4%) and previously forecasted 2017 funds from operations of $124.0

million would be reduced by approximately $750,000 (0.6%).

In addition, the Company currently has approximately 4.8 MMcf/d of gas

production (1,000 BOE/d including associated NGLs) behind pipe in British

Columbia awaiting new compression. In light of the current low gas price

environment, the Company has delayed adding compression in order to bring the

behind pipe production on-stream and expects to time the production additions

with its new gas price contracts starting in November 2017.

FLOW-THROUGH EQUITY FINANCING

Kelt has determined to issue, by way of a non-brokered private placement, 1.4

million common shares on a “flow-through” basis in respect of Canadian

Development Expenses (“CDE”) at a price of $7.75 per share resulting in gross

proceeds of $11.0 million (the “Private Placement”). Along with certain other

subscribers, directors, officers and employees of the Company have subscribed

to purchase approximately 8.3% of the Private Placement.

Kelt shall, pursuant to the provisions in the Income Tax Act (Canada), incur

eligible CDE (the “Qualifying Expenditures”), after the closing date and prior

to December 31, 2017 in the aggregate amount of not less than the total amount

of the gross proceeds raised from the Private Placement. Kelt shall renounce

the Qualifying Expenditures so incurred to the purchasers of the flow-through

common shares with an effective date on or prior to December 31, 2017. The

Private Placement is subject to certain conditions including normal regulatory

approvals and specifically, the approval of the Toronto Stock Exchange. The

common shares issued in connection with the Private Placement will be subject

to a statutory hold period of four months plus one day from the date of

completion of the Private Placement, in accordance with applicable securities

legislation.

Closing for approximately 89% of the Private Placement is expected to occur on

or about October 11, 2017. The remaining 11% of the Private Placement is

expected to close on or around October 27, 2017.

This press release does not constitute an offer to sell or a solicitation of

any offer to buy the common shares in the United States. The common shares

have not been and will not be registered under the U.S. Securities Act of 1933

and may not be offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of such Act.

OPERATIONS UPDATE

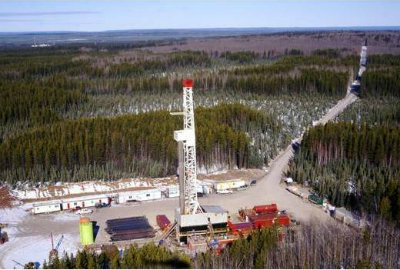

Proceeds from the Private Placement will be used to increase the Company’s

budgeted drilling and completion expenditures during the remainder of 2017.

Kelt expects to increase its 2017 capital expenditure budget with the drilling

of five wells on its second pad at Pouce Coupe, Alberta, targeting Montney

Oil, where wells from the first multi-well pad at Pouce Coupe paid out in

under a year during 2017 (in the current commodity price environment). These

five new wells are expected to be completed in January 2018 and will be put on

production thereafter into the Company’s expanded compression and pipeline

infrastructure recently installed at Pouce Coupe.

At Inga, British Columbia, Kelt believes it has fully delineated the Upper

Montney on its lands and expects to drill and complete five development wells

off a pad. This operation is expected to commence in 2017 and is expected to

be completed in the first quarter of 2018. The Company expects to drill its

fifth Middle Montney well at Inga in the fourth quarter of 2017 as it

continues to delineate the Middle Montney with encouraging results from the

first four wells. Kelt has drilled its first Upper Middle (IBZ) well at Inga

and expects to complete and test this well by the middle of November 2017.

At Wembley/Pipestone, Alberta, Kelt is targeting the Montney formation in the

volatile oil window where the reservoir is expected to be over-pressured. The

Company has completed its first exploration well located at 00/04-01-072-08W6.

The well was completed using the ball drop hydraulic fracturing method. The

horizontal lateral of the well was approximately 2,900 metres and the well was

completed using slick-water comprising 50 fracture stages. The well cost

approximately $5.7 million to drill and complete. After flowing the well back

on a 12 day clean-up, the well, over the last five days of the test, produced

average sales volumes of approximately 1,567 BOE per day (64% oil, 20% NGLs

and 16% gas). The high NGLs (35% are condensate/pentane) are a result of the

high heat value of the gas and the ensuing deep-cut recoveries at the Wembley

Gas Plant where Kelt has an ownership interest. The well has now been tied in

to the Wembley Gas Plant, however, due to a compressor failure at the plant,

the well is not expected to be put on production until mid-November 2017.

Given the encouraging results from its first exploration well, the Company

expects to follow-up with at least three more wells on its large

Wembley/Pipestone land block prior to the end of 2018.

Kelt expects to release its 2017 third quarter results on or about November 9,

2017. At that time, the Company expects to provide shareholders with 2018

guidance including forecasted capital expenditures, production and funds from

operations.

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any

of the words “expect”, “anticipate”, “continue”, “estimate”, “objective”,

“ongoing”, “may”, “will”, “project”, “should”, “believe”, “plans”, “intends”

and similar expressions are intended to identify forward-looking information

or statements. In particular, this press release contains forward-looking

statements pertaining to the following: the composition of Kelt’s gas

marketing contract sales portfolio effective November 1, 2017; the expected

duration of the temporary shut-in by Kelt of certain dry gas properties; the

Company’s plans to incur and renounce Qualifying Expenditures and the expected

closing and closing dates of the Private Placement; the various expected

drilling and completion operations to be carried out in 2017 and 2018; and the

timing of the release of Kelt’s third quarter results and 2018 guidance.

Statements relating to “reserves” or “resources” are deemed to be forward

looking statements, as they involve the implied assessment, based on certain

estimates and assumptions, that the reserves described exist in the quantities

predicted or estimated and that the reserves can be profitably produced in the

future. Actual reserves may be greater than or less than the estimates

provided herein. Test results and initial production rates disclosed herein

may not necessarily be indicative of long-term performance or of ultimate

hydrocarbon recovery.

Although Kelt believes that the expectations and assumptions on which the

forward-looking statements are based are reasonable, undue reliance should not

be placed on the forward-looking statements because Kelt cannot give any

assurance that they will prove to be correct. Since forward-looking statements

address future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ materially from

those currently anticipated due to a number of factors and risks. These

include, but are not limited to, the risks associated with the oil and gas

industry in general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of reserve

estimates; the uncertainty of estimates and projections relating to

production, costs and expenses; failure to obtain necessary regulatory

approvals for planned operations; health, safety and environmental risks;

uncertainties resulting from potential delays or changes in plans with respect

to exploration or development projects or capital expenditures; volatility of

commodity prices, currency exchange rate fluctuations; imprecision of reserve

estimates; and competition from other explorers) as well as general economic

conditions, stock market volatility; and the ability to access sufficient

capital. We caution that the foregoing list of risks and uncertainties is not

exhaustive.

In addition, the reader is cautioned that historical results are not

necessarily indicative of future performance. The forward-looking statements

contained herein are made as of the date hereof and the Company does not

intend, and does not assume any obligation, to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise unless expressly required by applicable securities laws.

NON-GAAP MEASURES

This press release contains certain financial measures, as described below,

which do not have standardized meanings prescribed by GAAP. As these measures

are commonly used in the oil and gas industry, the Company believes that their

inclusion is useful to investors. The reader is cautioned that these amounts

may not be directly comparable to measures for other companies where similar

terminology is used.

“Operating income” is calculated by deducting royalties, production expenses

and transportation expenses from oil and gas revenue, after realized gains or

losses on associated financial instruments. The Company refers to operating

income expressed per unit of production as an “Operating netback”. “Funds from

operations” is calculated by adding back transaction costs associated with

acquisitions and dispositions, provisions for potential credit losses,

settlement of decommissioning obligations and the change in non-cash operating

working capital to cash provided by operating activities. Funds from

operations and operating income or netbacks are used by Kelt as key measures

of performance and are not intended to represent operating profits nor should

they be viewed as an alternative to cash provided by operating activities,

profit or other measures of financial performance calculated in accordance

with GAAP.

MEASUREMENTS

All dollar amounts are referenced in thousands of Canadian dollars, except

when noted otherwise. This press release contains various references to the

abbreviation BOE which means barrels of oil equivalent. Where amounts are

expressed on a BOE basis, natural gas volumes have been converted to oil

equivalence at six thousand cubic feet per barrel and sulphur volumes have

been converted to oil equivalence at 0.6 long tons per barrel. The term BOE

may be misleading, particularly if used in isolation. A BOE conversion ratio

of six thousand cubic feet per barrel is based on an energy equivalency

conversion method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead and is significantly different

than the value ratio based on the current price of crude oil and natural gas.

This conversion factor is an industry accepted norm and is not based on either

energy content or current prices. References to oil in this press release

include crude oil and field condensate. References to natural gas liquids

(“NGLs”) include pentane, butane, propane, and ethane. References to gas in

this press release include natural gas and sulphur. Such abbreviation may be

misleading, particularly if used in isolation.

ABBREVIATIONS

/T/

MMcf million cubic feet

MMcf/d million cubic feet per day

MMBtu million British Thermal Units

GJ Gigajoule

BOE barrel of oil equivalent

BOE/d barrel of oil equivalent per day

NGLs natural gas liquids

AECO Alberta Energy Company “C” Meter Station of the Nova Pipeline

System

NGI Natural Gas Intelligence

FOM first of month

USD United States dollars

CAD Canadian dollars

CDE Canadian Development Expenses

TSX Toronto Stock Exchange

KEL stock trading symbol for Kelt Exploration Ltd. common shares on the

TSX

/T/

– END RELEASE – 06/10/2017

For further information:

For further information, please contact:

KELT EXPLORATION LTD.

Suite 300, 311 âÇô 6th Avenue SW

Calgary, Alberta, Canada T2P 3H2

DAVID J. WILSON

President and Chief Executive Officer

(403) 201-5340

SADIQ H. LALANI

Vice President and Chief Financial Officer

(403) 215-5310

Visit our website at: www.keltexploration.com

COMPANY:

FOR: KELT EXPLORATION LTD.

TSX Symbol: KEL

INDUSTRY: Energy and Utilities – Oil and Gas

RELEASE ID: 20171006CC008

Press Release from Marketwired 1-866-736-3779

All press releases are written by the client and have NO affiliation with the news copy written by The Canadian Press. Any questions that arise due to the content or information provided in the press release should be directed to the company/organization

issuing the release, not to The Canadian Press.

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats