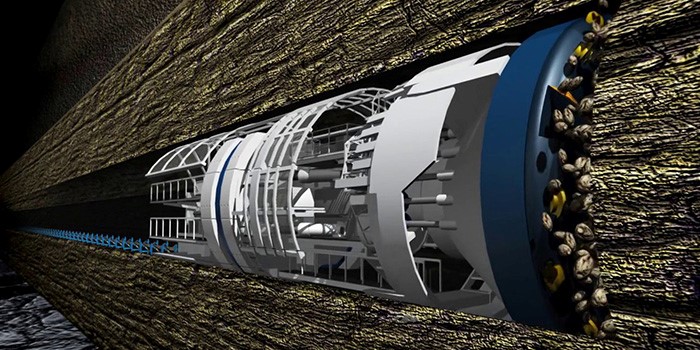

Tesla’s enigmatic leader, Elon Musk is building a series of massive tunnels at Space X outside of LA through his boring company called, what else? The Boring Company. This initiative is the precursor to his ambitious plan for a series of tunnels throughout the US—and presumably the globe—for a super-fast commute. And proof of concept for a series of tunnels for inhabitants of Mars. Enigmatic.

Currently the tunnels are being built to transport autos via pods on underground rail tracks to speeds of 200 mph, eventually reducing the infamous LA traffic congestion nastiness as well as replacing those cars with human commuters. Next, take the concept global, and then apparently, to provide the basis of travel within a permanent, underground Mars colony.

Arguably, many of the technologies Musk is developing will have wide ranging benefits in the technology of the building/replacement of critical infrastructure. Based on that assertion, investors need to get some quality infrastructure sector exposure.

Yes, it is a sector and likely the largest market globally.

Mighty Oaks from Little Acorns Grow

Somewhat smaller, actually a lot smaller, than Elon Musk’s Boring Company, Enterprise (TSX:E) addresses exactly the same challenges when it comes to underground tunnelling. Context? The Boring Company was given the go ahead to build a commuter tunnel between DC and New York as part of his Hyperloop project.

“The social and economic benefits of infrastructure, whether it is soldering a tiny motherboard to a control panel or building a five-level traffic interchange in Tokyo should not be discounted by investors,” states Desmond O’Kell, Senior Vice President of Enterprise, Inc. “Having grown the Company through the 2014 – 2016 resource downturn, in which we were unfairly painted with the ‘low oil price’ brush, we are closing many substantial new contracts and corporate plans are robust.”

Enterprise (TSX:E) shares trade at C$0.33 versus Elon Musk’s Tesla US$360, with market caps of C$18.4 million and US$60 billion respectively. What is not in dispute is that in varying scales, both companies are, in whole or part dedicated to accomplishing growth and value.

In the latest and most sweeping publicity effort, the nation’s American Society of Civil Engineers said Thursday (March 2017) that the nation’s roads, dams, airports and water and electrical systems need $4.6 trillion of work—more than the entire federal government spends in a year.

Society officials say the poor quality of U.S. infrastructure hampers economic growth and costs people thousands of dollars a year in extra travel time and car repairs from rutted streets.

The overall US infrastructure grade was a D+. And unfortunately, the Boring Company is still private… so there’s this;

Speculative Trade Suggestion

Here’s an interesting speculation. Tesla (NASDAQ:TSLA) is virtually impossible to rationally value. At a share price of US$360, the proceeds of a 100-share sale would be US$36,000. (C$45k)

Enterprise (TSX:E) trades at C$0.33 with a breakup value of approximately C$0.85. If you took the proceeds of the sale of 100 shares of Tesla (C$45k) you could buy 136,360 shares of Enterprise. Yes, the latter is speculative, but one could contend that Tesla (NASDAQ:TSLA) could well be riskier as its fortune turns on the ruminations and initiatives of Musk. If Tesla went up a dollar, you would lose opportunity of US$360. If Enterprise rose C$0.25 you would have a C$34,000 (US$27k) paper profit.

Kind of makes you wonder which company has more risk? The suggestion would work for any related stock in deep profit, which you might want to diversify a tad and need some good infrastructure exposure in your portfolio.

You can look beyond this premise and see that most of the infrastructure companies have done well. The main Infrastructure ETF iShares Global (NASDAQ: IGF) is up 21 percent over the last year to US$46, banging up against a new year high.

Finally, even though Enterprise (TSX:E) got nailed due to a low oil and gas market, the majority of its business is municipal, government or corporate. It appears that is reversing with growth apparent in the resource and overall infrastructure sector. The trick is finding late movers.

Maybe you will buy a Tesla car should Enterprise continue its move…

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow