By Grant Smith and Alex Longley

Prices initially picked up on Tuesday as dozens of Iraqi militiamen and their supporters stormed the U.S. Embassy complex in Baghdad to vent their rage over deadly American airstrikes against an Iranian-backed force. President Donald Trump blamed Iran for organizing the demonstration. Prices then sank after Sky News reported the protesters had been removed from the compound.

The U.S. had launched air strikes on five bases in Iraq and Syria used by an Iranian-backed militia as a warning to Tehran over its aggressive moves in the region, the State Department said. The attack heightened concerns of destabilization in Iraq, which pumps nearly 5 million barrels of oil each day, or roughly 5% of global supplies. Iran, which the U.S. blamed for September’s strike on Saudi Arabia and earlier attacks on oil tankers, said this week that it detained a ship carrying smuggled fuel near the Strait of Hormuz.

WTI for February delivery was 56 cents lower at $61.12 a barrel on the New York Mercantile Exchange as of 8:40 a.m. local time. Prices have advanced by about $16 a barrel this year.

Brent for March settlement fell 55 cents to $66.12 a barrel on London’s ICE Futures Europe exchange. Front-month prices are up about 23% this year, also set for the biggest annual gain since 2016. The global benchmark crude was trading at a $5.22 premium to WTI for the same month on Tuesday.

See also: Commodities Set for Best Year Since 2016 as Trade Worries Ebb

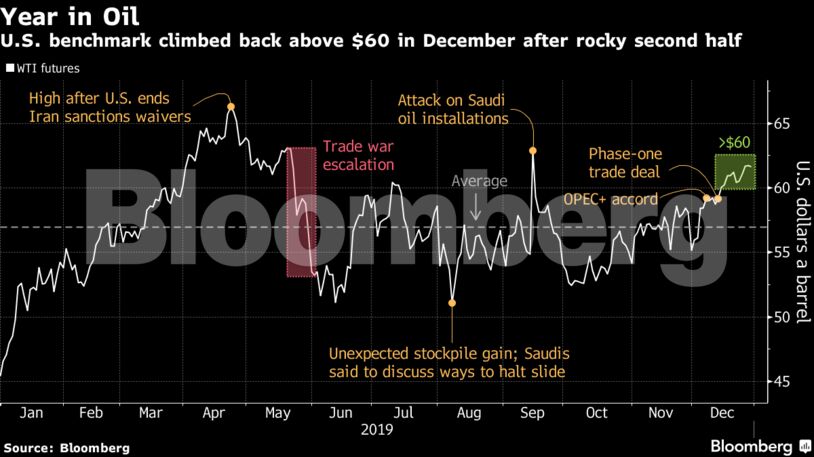

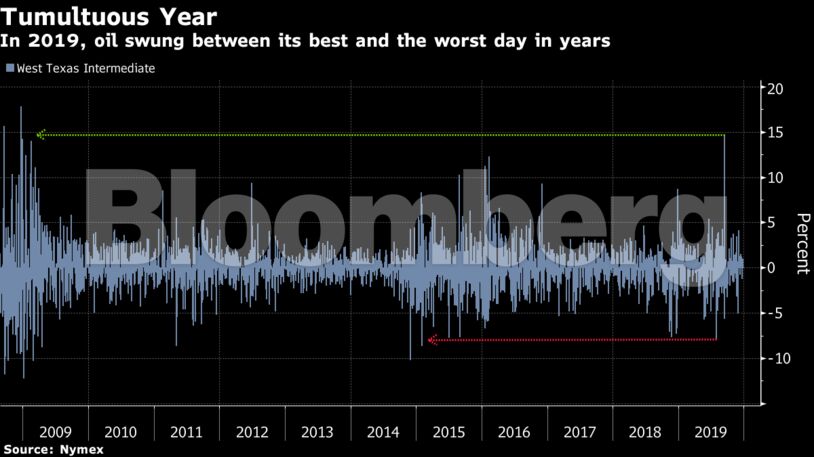

Oil markets have faced a tumultuous year, with much of WTI’s gains coming in its first few weeks. Prices saw their steepest one-day loss in four years on Aug. 1 after President Trump threatened to impose more tariffs on China, then soared the most in more than a decade in September when key oil facilities in Saudi Arabia were disabled in a missile attack.

“The U.S.-China trade war was in the driver’s seat when we entered 2019 and remains there as we exit the year,” said Vandana Hari, founder of industry consultant Vanda Insights in Singapore.

In 2020, oil prices are likely to remain in check as OPEC+ production cuts are offset by higher output from other countries and a mixed outlook for demand, analyst forecasts show. Nevertheless, prices are seen climbing in the middle of the year amid stronger emerging-market consumption.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS