The dispute leaves the global economy stranded in uncertainty — with little indication of whether the cartel will pump more crude to ease an inflationary price surge, or allow crude to extend its rally above $75 a barrel.

In dueling TV interviews, energy ministers from the two Middle Eastern countries escalated an increasingly personal and unusually public fight. Behind the scenes, mediation attempts by other cartel members made little progress, delegates said, asking not to be named.

Riyadh painted its opponent as the sole obstacle to an output boost that had support from every other OPEC+ member. Abu Dhabi continued to demand better terms for itself, arguing that the proposed agreement to extend quota limits to the end of 2022 was unfair.

The bitter clash has forced OPEC+ to halt talks twice already, with the next meeting scheduled to start at 3 p.m. Vienna time on Monday. Failure to reach a deal could leave existing OPEC+ output limits in place, squeezing an already tight market and potentially sending crude prices sharply higher.

But a more dramatic scenario is also in play — a full breakdown of OPEC+ unity that risks a production free-for-all and could crash the market in a repeat of last year’s Saudi-Russia price war.

Public Fight

In an indication of the seriousness of the diplomatic dispute, Saudi Energy Minister Prince Abdulaziz bin Salman signaled the UAE was isolated within the OPEC+ alliance.

“It’s the whole group versus one country, which is sad to me but this is the reality,” he said in an interview with Bloomberg TV on Sunday. He reiterated that the proposal backed by the rest of the group had to be passed, allowing for gradual production increases in the coming months plus the extension of the OPEC+ accord from April to December 2022.

Hours earlier, his Emirati counterpart Suhail Al-Mazrouei had reiterated that the UAE would only agree to an extension of the deal if it was granted the same terms for calculating its quota as the Saudis. As an alternative, Mazrouei suggested the group could proceed with just a short-term increase.

“The UAE is for an unconditional increase of production, which the market requires,” Al-Mazrouei told Bloomberg Television. Yet the decision to extend the deal until the end of 2022 is “unnecessary to take now,” he said.

Tensions between the two Gulf states emerged last year, when the UAE unsettled the cartel by floating the idea of leaving. It hasn’t repeated the threat again this week, but when asked if the UAE might quit, the Saudi prince only said: “I hope not.”

The Organization of Petroleum Exporting Countries and its allies are likely to find a compromise, said Jeff Currie, global head of commodities at Goldman Sachs Group Inc. The group will probably approve the August to December supply increase without extending the duration of the OPEC+ deal beyond April.

“The market environment today is probably the best we’ve seen in decades, so it’s very unlikely you would see one of these parties jeopardize this opportunity right now by starting a price war,” Currie said in a Bloomberg TV interview.

Brent crude rose 0.3% to $76.38 a barrel as of 11:44 a.m. in London.

No Deal, No Oil

In absence of an agreement, Prince Abdulaziz said there’s a fall-back deal in place — under which oil output doesn’t increase in August and the rest of the year, potentially risking an inflationary oil price spike. Asked if they could hike production without the UAE on board, Prince Abdulaziz said: “We cannot.”

OPEC+ nations, oil traders and consultants were taken aback by the fight, and the apparent lack of communication between the two. Prince Abdulaziz said he had not spoken to his counterpart in Abu Dhabi since Friday — even as he insisted he remained his friend.

“I haven’t heard from my friend Suhail,” he said, adding he was ready to talk. “If he calls me, why not?” Asked if more senior officials had been in touch, he declined to comment.

The dispute goes beyond oil. The UAE’s de facto ruler, Crown Prince Mohammed bin Zayed, once enjoyed close relations with the Saudi Crown Prince, Mohammed bin Salman. But the relationship between the two heirs appears to have cooled in recent months as Abu Dhabi flexes its muscles geopolitically, asserting its own foreign policy from Israel to Yemen, independent of its old Saudi ally.

Saudi Arabia’s call this year for foreign companies to move their regional headquarters to Riyadh was also seen as a direct threat to Dubai. And as the OPEC standoff intensified on Friday night, Saudi Arabia moved to restrict citizens’ travel to the UAE.

Cartel Math

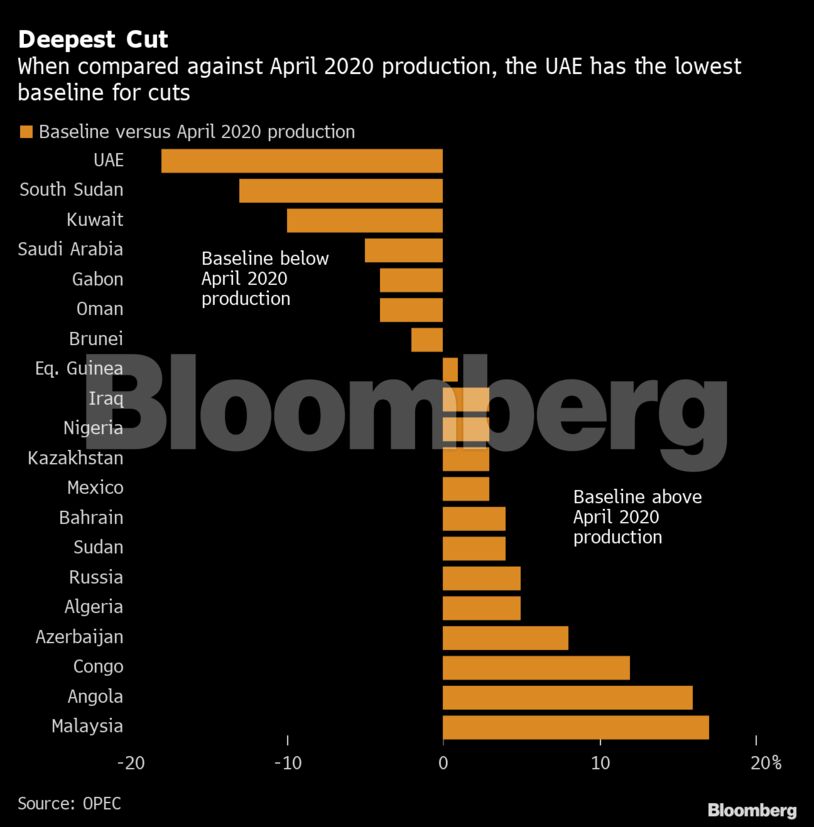

At the center of the dispute is a word key to OPEC+ output agreements: baselines. Each country measures its production cuts or increases against a baseline. The higher that number, the more a country will be allowed to pump. The UAE says its current level, set at about 3.2 million barrels a day in April 2020, is too low, and says it should be 3.8 million when the deal is extended into 2022.

Saudi Arabia and Russia have rejected re-calculating the output target for the UAE, fearing that everyone else in OPEC+ would ask for the same treatment, potentially unraveling the deal that took several weeks of negotiations, and the the help of U.S. President Donald Trump as broker.

Prince Abdulaziz suggested that Abu Dhabi was cherry picking its new output target, and it would set a bad precedent. “What kind of compromise you can get if you say my production is 3.8 and this is going to be my base,” he said.

In April 2020, Abu Dhabi accepted its current baseline, but it doesn’t want the straitjacket to stay on for even longer. It has spent heavily to expand production capacity, attracting foreign companies too. With Iran potentially returning to the oil market soon if it reaches a nuclear deal, patience for getting new terms is wearing out.

OPEC+ is scheduled to meet again virtually on Monday at 3 p.m. Vienna time, although Prince Abdulaziz suggested it wasn’t set in stone. He wouldn’t comment on the chances of finding a consensus, saying he would work hard to seek one. “Tomorrow is another day.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors