By David Yager (Part 2 of 2)

Read Part 1 Here: 2021 Outlook Part 1: COVID Vaccine Will Prevent More False Predictions About Oil’s Future – David Yager

December 29, 2020

“The brave man is not he who does not feel afraid, but he who conquers that fear.”

Nelson Mandela

2020 will go down in history as the year of fear. Because nothing gets your attention like a threat to your own mortality. It triggers a default survival mechanism deep in your mental DNA, making you accept massive personal and economic sacrifices if you think that’s what it takes to stay alive.

The COVID-19 pandemic did that to almost everybody. A nasty virus by any measure, coronavirus -combined with instantaneous global communications and the belief that governments can and should protect everyone from everything – created the fastest, coordinated and most unprecedented shutdown of the world’s economy in history.

By March we were all locked in houses scouring the internet for rubber gloves, face masks and hand sanitizer. By Christmas we were ratting on our neighbors, telling the province where to dispatch the police if those living nearby violated government orders not to have visitors. Families were not permitted to share Christmas with their own children if they didn’t live at the same address.

The economy was sustained by the most massive increase in government borrowing and spending since the Second World War. Millions lost their jobs, businesses went broke and major sectors of the economy were crippled.

Incredible.

As the year ended, Justin Trudeau’s Liberal government doubled down on the fear factor by announcing the increased levels of carbon taxes necessary for Canada to meet its 2030 emission reduction commitments from the 2015 Paris climate agreement. This will see carbon levies rising to $170 per ton, higher costs for carbon-based energy through the Clean Fuel Standard, and billions more in borrowed spending for renewable energy and conservation projects.

Because if COVID-19 doesn’t kill you, climate change will. After you get your vaccination sometime in 2021, you can resume fearing the global climate apocalypse; assured environmental devastation unless we replace fossil fuels no matter what the lifestyle or economic cost.

Right or wrong, after three decades of increasingly dire predictions about the perils of continued fossil fuel consumption we must accept that many people are genuinely scared. A poll conducted in the spring of 2019 was reported by Fox News under the headline, “Majority of Americans think climate change will cause humanity’s extinction”.

In his recent book False Alarm Bjorn Lomborg, the famous self-described skeptical environmentalist wrote, “People are terrified of climate change, above all else. Half the world’s surveyed population believes human extinction is likely, and that faced with possible annihilation, any expenditure is justified.”

Fear is a powerful force. Fear gets your attention because it activates the survival folder of your cerebral hard drive. Fear sells. The media knows it, and so do politicians. Give the public what they want, not what they need. Fear is not rational. Fear does not respond to economics, common sense or even facts.

Nobody knows this better than the oil and gas industry. The only good news after six years of crushing low prices and years of relentless vitriol and misinformation is that demand for the products remains strong all over the world.

There is no evidence that the world’s 7.8 billion inhabitants are prepared to live without airplanes, trucks, trains, ships, gasoline, natural gas, fertilizer, reliable electricity, lubricants, petrochemicals, plastic, international trade, tourism, heat, air conditioning or the myriad of other services and products derived from fossil fuels.

As life returns to normal, demand for oil and gas is also returning to normal. Energy consumption will continue to increase with population and GDP. As costs fall, renewables will capture a larger share of future demand. But no matter what you hear, see and read; hydrocarbons will be with us for decades to come.

The bigger question is whether or not the world will return to the pre-COVID political playbook. Will climate change remain as important as it once was? Will heavily indebted governments continue to force higher energy costs on economically weakened consumers, ostensibly for their own good?

Because large, cold and underpopulated Canada alone cannot save the world from climate change through massive domestic carbon tax increases and debt-funded government support for non-carbon energy and conservation programs.

Fear and its political exploitation are the only major obstacles to a strong recovery for oil and gas in Canada, the huge resource industry that exists because it is a proven, reliable, profitable, wealth and employment creating supplier of the necessities of modern life.

**********

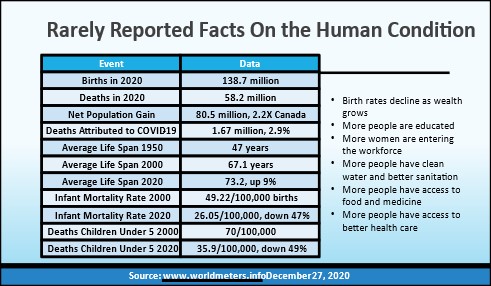

If there is anything good going on in the world, you have really to hunt for it. Once of my favorite sources of big picture statistics about the global human condition is www.worldmeters.info, a website that keeps a running tally on all manner of data about the state of mankind.

If the world is really going to hell in a carbon emissions handcart, there is no evidence from this data. For decades all the key metrics of human success have been improving thanks in large part to plentiful and reliable supplies of coal, oil and natural gas. Cheap energy has always been and will remain a key driver of human prosperity.

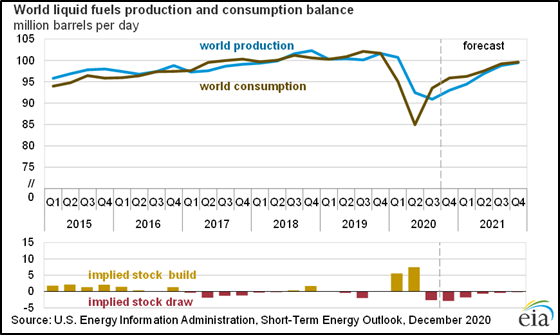

World oil consumption is recovering nicely, as are prices. While the second lockdown that most of the western world endured over the holidays is causing concerns about demand, we will exit 2020 at about 95 million b/d.

The EIA’s December consumption forecast (brown line) sees steady recovery with 2021 finishing the year at 100 million b/d, essentially pre-COVID levels. The blue line is supply which is well below demand because OPEC+ is maintaining supply management. This allows inventories to be drawn down (red bars at the bottom).

The International Energy Agency (IEA) – a high profile promoter of renewable energy and the need to replace fossil fuels – sees Q4 2021 demand at 99.2 million b/d, a 5.7 million b/d gain over the same period this year.

Continuous geopolitical drama causes daily gyrations in the price and long-term supply outlook. After years of civil war Libya has brokered a peace agreement among rival factions which has allowed it to resume producing over 1 million b/d. Iran is ready to add another 2 million b/d if and when US President Joe Biden removes sanctions if Iran promises to honor its commitment to not develop weapons-grade nuclear materials.

But as demand recovery continues, more analysts are starting to look at supply. According to the EIA, the US will finish the year with oil production over 2 million b/d lower than the peak of 13.1 million b/d in February. The December 2020 EIA Drilling Productivity Report analysed by SAF Group sees production from the major shale light tight oil plays down 1.64 million b/d in January 2021 compared to a year earlier. With the Baker Hughes active US oil rig count down 61% from a year earlier at only 264 on December 23, high decline rates and restricted access to capital for more drilling are likely to cause further production declines in 2021.

More analysts are speculating about higher oil prices in 2021 and beyond. While the institutionally conservative EIA forecasted WTI averaging US$45.78 next year on December 8, investment banks like Goldman Sachs saw Brent reaching US$65 as recently as December 15. Other analysts seen WTI at US$60 in 2021.

The really good news is that nobody predicts that oil prices will revisit the horridly low prices of the second quarter of 2020. The energy mix will change with time and technology, but incumbent oil will retain much more market strength than is commonly acknowledged.

Closer to home, 2021 will be catch-up time for domestic operators. Sustaining production will still cost in excess of $45 billion even if production is slightly lower. CAPP reported that in 2019 operating costs for conventional production totalled $23.1 billion and oil sands was $23.8 billion, a total of $46.9 billion and the highest in five years. Companies and workers that keep the wheels turning and the production flowing can count on steady income and employment next year.

ESG pressures, direct anti-fossil fuel investment restrictions and poor historical performance mean debt and equity will be restricted for all but the best operators. Unless there is a significant commodity price spike to spark investors, the Canadian industry will operate primarily on cash flow from existing production in 2021. The numbers were horrible for 2020, but 2021 will be much improved.

ARC Energy Research Institute’s weekly upstream oil and gas macro statistics from December 14 estimated total cash flow available for reinvestment this year will only be $23.1 billion, the lowest in 10 years and just under the last low water mark of $23.7 billion in 2016. This is based on an average price of only $28.28 per boe; $45.63 for oil and $2.18 for gas.

But that figure includes the blood bath of last spring. During March, April and May, WTI averaged only US$29.21, US$16.55, and US$28.56, respectively. For September, October and November the average was US39.99, a 62% improvement. At the last trade before Christmas, WTI closed at US$48.30, nearly triple April’s historic low.

The really good news for 2020 is natural gas averaged the highest average price since 2015, a trend futures markets indicates will continue. Plug in a higher average oil price and the free cash available for investment from existing production in 2021 could easily rise by 50% or more. ARC’s free cash flow figures for 2017, 2018 and 2019 were $45, $48 and $53 billion, respectively.

One sage E&P CEO observed that no matter how much better things look for 2021, 2019 will still look pretty good by comparison. This is primarily because of balance sheet issues for many producers. With new debt and equity capital extremely tight because of moral imperatives and horrid returns, only the companies with the best balance sheets will be able to reinvest their free cash back into their business. Continued consolidation into more efficient entities generating more cash to sustain their producing asset base will be essential.

But the industry as a whole must put money back into the business to arrest reserve declines. In 2020 the C-suite was focused on the balance sheet and the staff was focused on the C-suite. Maintaining assets and replacing production was pared back to the bare necessities.

That will change in 2021. With the massive uncertainty of an unknown oil price removed, more money will go back into the field and into the ground. Multiple operators have announced increased capital budgets for 2021. Highly levered producers will get permission from lenders to sustain the value of the borrower’s collateral base if the investment makes money, something that was impossible to calculate during much of 2020.

Takeaway capacity continued to make progress in 2020 making the future look more promising. In March, COVID-19 eclipsed national blockades in support of hereditary Indigenous leaders against the Coastal Gas Link pipeline as the nation’s most pressing issue. LNG Canada soldiers on. Construction on TMX continued. Enbridge outlasted the state of Minnesota and it now appears the Line 3 replacement could be finished late next year.

What US President Joe Biden will actually do with Keystone XL remains unknown. This will have a lot more to do with the US Senate runoff elections in Georgia early in January than one of the many promises he made on the campaign trail.

TC Energy announced an historic equity partnership with five First Nations under which they could own 12% of KXL. This follows multiple agreements with Indigenous groups on multiple major resource projects through which they can participate directly at all levels. No industry in Canada has greater participation by Indigenous Canadians than oil and gas.

The only really bad news is that the governor or Michigan is yet again attempting to shut down the underwater crossing of Enbridge Line 5 under the Mackinac Strait. It has never leaked but the governor is convinced a horrible oil spill is all but inevitable. The same administration is also obstructing a safer replacement.

If successful, Ontario’s refining hub in Sarnia and Quebec will be denied pipeline access to western Canadian supplies of petroleum and propane. This significant interruption of international trade will trigger a major conflict between the US and Canada and is probably illegal under the new USMCA.

But modern politics is increasingly about fear and votes, not economics or reality.

Overall, 2021 looks greatly improved for Canada’s oilpatch. What really matters is human nature and fear. In the post-COVID era, will there be a return to common sense? Intelligent and informed debate?

Or will too many cling to the comforting but disingenuous belief that high Canadian carbon taxes and virtue signaling alone will actually change the composition of the global atmosphere and protect Canada from climate change?

**********

For reasons that remain unfathomable to this writer, polls indicate that if an election were held tomorrow Justin Trudeau’s Liberals would be returned to office, possibly with more seats.

Help Wanted. Confidence is crucial in attracting capital from international investors and convincing domestic investors to stick with Canada.

There are four major events that should change Canadian politics significantly in 2021.

The first is a $350+ billion increase in the deficit for 2020/21, allegedly a one-time event related to the pandemic. Trudeau recently assured the country that the deficit would be brought under control and the budget balanced. This is the same message he has repeated then ignored since the 2015 campaign. Tax increases are inevitable.

The second will occur when the tax payments on the CERB funds become due in April. That income taxes must eventually be paid was clear when applications were made on-line. The Liberals will not be as popular clawing back the money as they were while handing it out.

The third big issue is Canada’s rate of vaccinations. As the year ends, Canada is way behind several other countries in gaining access to vaccines.

As with all coronavirus data, this is tracked daily. As of December 287, in Israel 4.37 people per 100 had received a vaccination. Number two was Bahrain at 3.15. The UK ranked third at 1.18, the US fourth at 0.64. Canada was fifth at only 0.14. This was 78% below the US rate using this measurement.

Polling by Nanos Research reveals that this year COVID-19 eclipsed all other major issues by a wide margin. In January, the environment was very important for 20.5% of those polled, ahead of the economy which was only at 15.4% The virus was not yet an issue.

By December coronavirus was the most important issue for 49% of those surveyed, while the environment had fallen to only 6.9%.

This leads into major problem number four, big carbon tax increases. Some commentators say the scheduled carbon tax increases will give business and citizens certainty. Indeed. They will be certain to search for cheaper places to operate and live.

It is not intuitive to this writer how these huge tax increases will be a vote-getter with the priorities of so many so radically altered.

The real question that remains is will the pre-COVID political playbook still be relevant in a post-COVID world of huge deficits, higher taxes, higher costs and tepid economic recovery?

Since the world financial crisis of 2008/09, western governments have heavily supported the economy with growing public debt, borrowed liquidity and historically low interest rates. With the exception of Canada’s oil and gas sector, this has kept the rest of the country reasonably strong allowing people to focus on non-economic issues. Like social justice or what the weather may or may not be in 10, 20 or 30 years.

The federal Liberals were running big deficits BEFORE the pandemic. At an estimated $381 billion for the current fiscal year, this is more than six times the last record of $55 billion set during the financial crisis of 2009. If and when a full budget is tabled next year, it will be the first one in two years.

What will matter more to Canadians in 2021? Will it be fear or fundamentals?

Are Canadians ready to accept the massive debt, inevitable tax increases from the pandemic, plus face rising costs for everything to meet our Paris 2030 commitments? Will they willingly pay the price when anyone who studies the subject knows that our targeted reductions in emissions will be immeasurable unless the rest of the world participates? That 98% of all oil is consumed outside of Canada?

Canada’s oil industry can go back to work next year and beyond and bring the rest of Canada along with it if our fellow Canadians can, as Mandela suggests, conquer fear and replace it with common sense and economic reality.

As the industry repeats regularly, Canada is and will remain a leader in the responsible production of oil and gas until such time that technology solves an emissions problem that world governments have repeatedly demonstrated they cannot.

What our country desperately needs is an intelligent, fact-based debate about the climate change challenge and what Canada can contribute. Chanting “net zero by 2050” as a symbol of moral commitment without a plan, without the technology and without a true cost or impact is a fear-pacifying slogan, not a solution.

A federal government representing 1.6% of global emissions and 0.5% of the world’s population cannot solve this problem alone, even if it helps the climate terrified sleep better at night because they are convinced Canada must try no matter what the cost or outcome.

Because the worst problem with virtue signaling is that it takes your mind away from the immensity of the problem and the complexity of the solution.

Let’s hope our fellow Canadians will engage the rest of their grey matter and think this through. Perhaps the learnings from 2020 in the post-COVID era will result in a desperately needed change in the public discourse.

David Yager is an oil service executive, energy policy analyst, oil writer and author of From Miracle to Menace – Alberta, A Carbon Story. More at www.miracletomenace.ca

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS