By Alex Longley

The worsening demand outlook is coinciding with Libya’s push to almost double crude output, as it reopened its last major oil field. The nation’s production could top 1 million barrels a day within weeks.

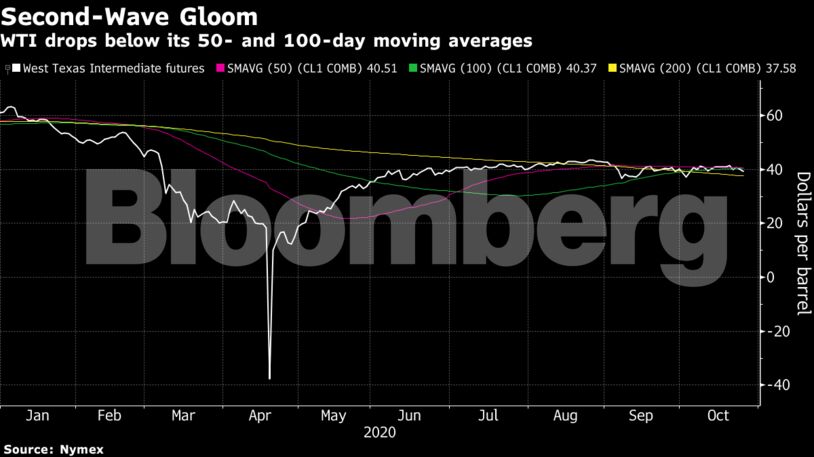

A little more than six months after Covid-19 sent oil prices into a tailspin, a second wave is threatening to take another bite out of energy demand. Saudi Arabia’s energy minister said at a conference on Monday that the oil market isn’t yet out of the woods, despite a strong recovery in recent months. It comes as demand in Asia holds up well, but concerns grow over other parts of the world as the virus spreads.

See also: It’s Asia to the Rescue Again as Oil Demand Wavers Elsewhere

“Demand weakness is definitely the biggest worry and problem in the market right now,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “Supply is still fairly contained and controlled even with Libya coming back into the market.”

| Prices |

|---|

|

A lack of commitment by OPEC+ producers to the group’s cuts could force the market to penalize them, Saudi Energy Minister Prince Abdulaziz bin Salman said at the Singapore International Energy Week 2020 on Monday. The oil market is going through “serious harsh times,” he said.

Russian President Vladimir Putin last week signaled openness to delaying scheduled production hikes by the OPEC+ alliance . The group will decide whether to stick to the current plan at a meeting scheduled for Nov. 30-Dec. 1.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works