By Alex Longley

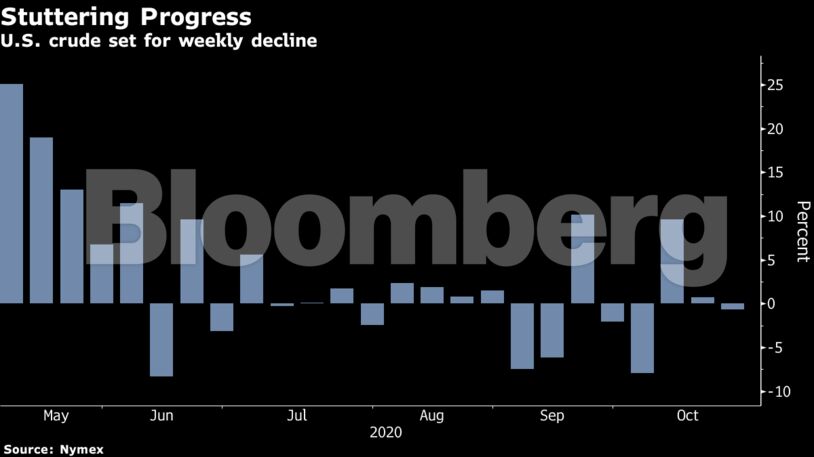

With futures stuck below $41 a barrel, attention is turning to the next major events on the horizon: the imminent U.S. election and an OPEC+ meeting at the end of next month. On Thursday, Russia indicated for the first time that it’s open to delaying an oil-output hike planned for January. Meanwhile, American presidential candidate Joe Biden said fossil fuels need phasing out over time, a comment seized on by Donald Trump as a dangerous threat to the industry.

“At the moment, there is little that seems to change this playing field for the oil market,” said Hans van Cleef, senior energy economist at ABN Amro. “However, two crucial events — namely the U.S. elections on Nov. 3 as well as the OPEC+ meeting at the end of November — may cause the oil market to move significantly in the coming weeks.”

| Prices |

|---|

|

Healthy manufacturing data in Europe is the latest sign that corners of the market are proving resilient amid the virus. In a potential boon for diesel demand, the region’s top trucking company said this week that its volumes are set to rise about 10% this year.

Another emerging bright spot for crude has been the return of Asian demand in recent weeks. Purchases by a Chinese mega-refiner have helped tighten the market, with Oman crude trading at a premium to the Middle Eastern Dubai benchmark for the first time in two months on Thursday.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow