By Alex Longley

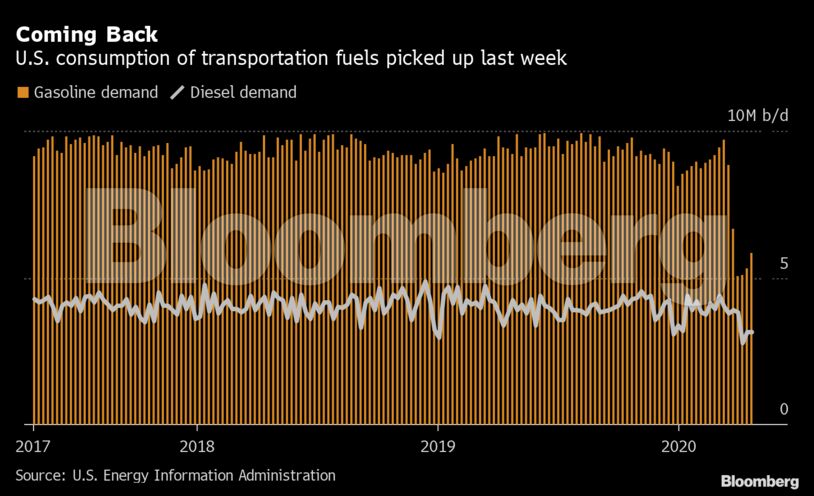

Meanwhile, data on Wednesday showed signs of improved demand in the U.S. and Europe. In China, traffic is returning to the streets, supporting a boost in fuel use and refining rates.

Physical markets are also showing early signs of improving, although from exceptionally weak levels, with crude from Russia to the Mediterranean being bid higher. Key price contracts, known as swaps, have also rallied in the North Sea. But while crude has ticked up from its lows, storage capacity is filling fast and oil major Royal Dutch Shell Plc warned it doesn’t expect a market recovery even in the medium term.

“As storage fills up, producers will be forced to act with additional production shut-ins, and lower prices can be expected,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy. “If more countries curtail their supply, then we really can start talking about a possible resolution to the crisis and may see prices rising back to healthier levels.”

| Prices: |

|---|

|

U.S. output will fall by 2 million barrels a day in May compared with March and the price of crude has probably bottomed out, according to the head of trading house Mercuria Energy Group Ltd.

Still, Shell said Thursday that the coronavirus outbreak is going to have a lasting impact on consumer behavior, meaning there’s a higher chance that oil demand will peak this decade. Lifestyles will probably “be altered for some time to come” as the pandemic changes the economy, business, and people’s attitudes, Chief Executive Officer Ben Van Beurden said.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors