By Jackie Davalos

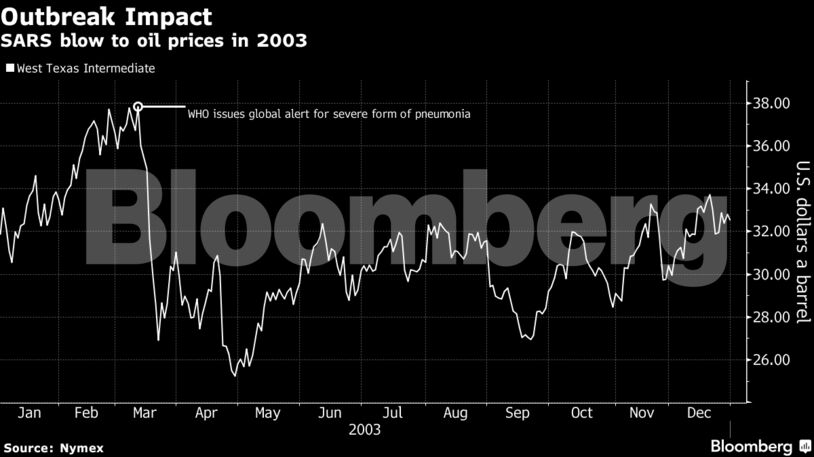

“Contagion fears are spiking ahead of the biggest yearly migration ahead of new year,” said Daniel Ghali, a commodities strategist at TD Securities. “The fear factor is the risk of contagion, synonymous to what happened in 2003 with SARS which led to a 2% drop in Chinese economic growth.”

The fast-spreading virus is the latest challenge for a market that’s been buffeted this year by geopolitical turmoil in the Middle East and North Africa, as well as the phase-one trade deal between Beijing and Washington. Goldman Sachs Group Inc. said earlier this week that, if the coronavirus has an impact similar to the 2003 SARS epidemic, demand could be curbed by 260,000 barrels a day. While this is not the first time global oil markets contend with an epidemic threatening demand, the current supply environment could worsen the situation.

“The slightest fear of any economic slowdown will spur a long wave of liquidations because the market is so oversupplied,” said Walter Zimmermann, chief technical strategist at ICAP Technical Analysis.

Some businesses in China including McDonald’s Corp. and Starbucks Corp. temporarily shut some stores in efforts to contain the virus.

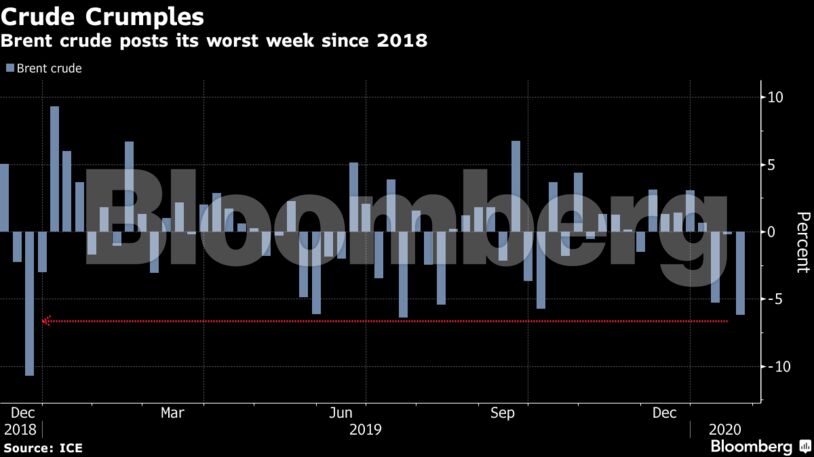

Brent crude for March settlement fell $1.35 to settle at $60.69 a barrel on the ICE Futures Europe exchange in New York putting its premium over WTI for the same month at $6.50 a barrel. Brent futures fell 6.4% this week.

West Texas Intermediate futures for March delivery slipped $1.40 to end the session at $54.19 a barrel on the New York Mercantile Exchange, the lowest level since October. Meanwhile, based on the commodity’s relative strength index, WTI is sitting in oversold territory and is due for a rally.

Options traders are paying the most since Oct. 31 for protection against price swings, according to the CBOE/CME WTI volatility index.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow