By Elizabeth Low and Alex Longley

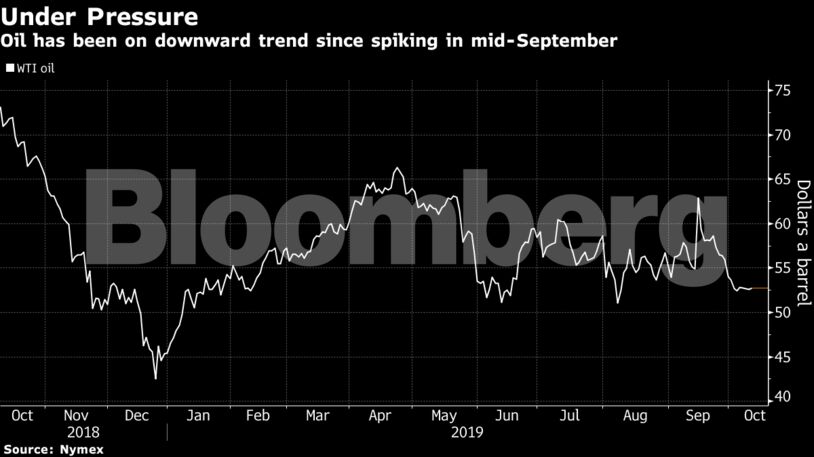

Oil has now slumped more than 16% since jumping in the wake of September’s attacks on Saudi Arabia, with the kingdom quickly restoring production and investors turning their attention to the global economic slowdown. The protracted trade war is denting the demand outlook for oil, with the heads of major trading houses predicting prices in the $50s a year from now.

“This is such a sentiment-driven market right now,” Mike Tran, an analyst at RBC Capital Markets, said in a Bloomberg Television interview. “Fundamentals of the oil market don’t look that bad at the moment. We certainly believe that there’s not enough supply-disruption risk premium in the market.”

West Texas Intermediate for November delivery slipped 4 cents to $52.55 a barrel on the New York Mercantile Exchange as of 10:20 a.m. London time.

Brent for December settlement dropped 16 cents, or 0.3%, to $58.16 a barrel on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $5.61 premium to WTI for the same month.

U.S. crude stockpiles rose by 2.93 million barrels last week, according to data Wednesday from the Energy Information Administration. That’s a bigger gain than the 1.9 million barrels anticipated in a Bloomberg survey of analysts.

See also: U.S. Weighs Currency Pact With China as Part of Partial Deal

The prolonged spat between Beijing and Washington has sapped global demand, with Citigroup Inc. predicting last month that oil-consumption growth has almost halved. A team of Chinese negotiators has now arrived in Washington to resume trade talks starting Thursday. The White House is weighing a currency pact as part of a partial deal, according to people familiar with the matter.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS