By Grant Smith and Tsuyoshi Inajima

While there are risks to supply in the short term, further out the picture looks different. The Organization of Petroleum Exporting Countries warned Thursday of a glut in 2020 as U.S. shale production surges. The International Energy Agency said Friday there had been a surprise pile-up of inventories in the first half of this year, and that OPEC may need to cut output to the lowest in 17 years to prevent another overhang.

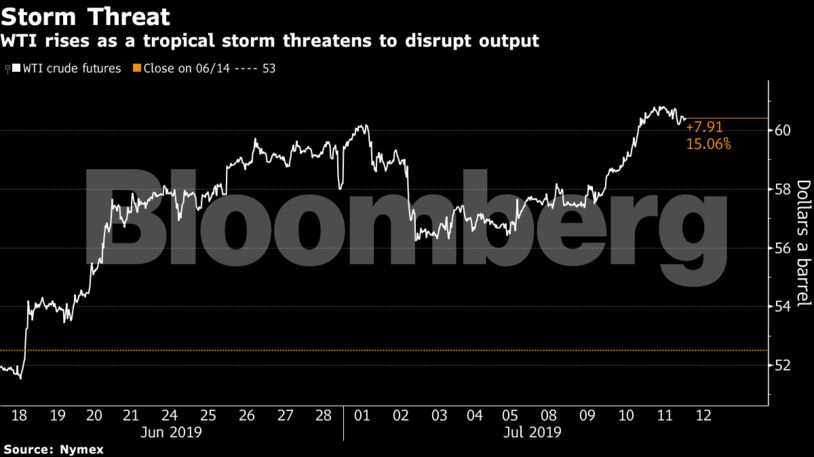

“The tropical storm that is brewing in the Gulf of Mexico” along with “the tensions between Iran and the U.K. over the seizure of an oil tanker” are supporting prices, said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt. West Texas Intermediate crude for August delivery gained 27 cents to $60.47 a barrel on the New York Mercantile Exchange as of 11:18 a.m. London time.

Brent for September settlement rose 42 cents, or 0.6%, to $66.94 a barrel on the ICE Futures Europe Exchange. Prices are up 4.2% this week. The global benchmark crude traded at a $6.44 premium to WTI for the same month.

Tropical Storm Barry, which was about 95 miles (153 kilometers) southwest of the Mississippi River’s mouth as of 5 a.m. New York time, may drop as much as 25 inches of rain in some places, according to an advisory from the U.S. National Hurricane Center. Gulf of Mexico operators have shut-in 1.01 million barrels a day of oil production because of the storm, the Bureau of Safety and Environmental Enforcement said in a notice.

The U.K. government said the British Navy intervened to stop Iran from blocking a BP Plc oil tanker in the Strait of Hormuz — the world’s most important oil choke-point. While Iran’s Revolutionary Guard Corps denied trying to impede the tanker, the incident follows the seizure by Britain of a vessel carrying Iranian oil, which prompted Iran to vow retaliation.

Other oil-market news:

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works