The year is looking brighter for oilfield services on news producers have collectively bumped up capital spending plans in 2017 by $1.13 billion from original expectations.

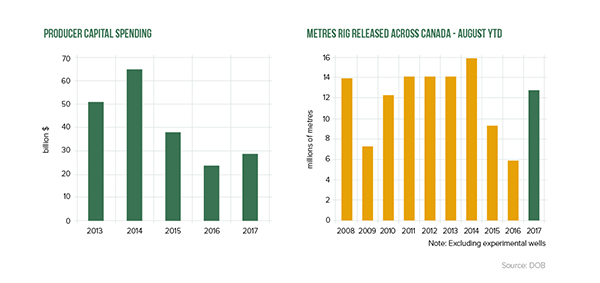

Spending plans totaled $29.6 billion, up from roughly $28.45 billion set in late 2016 or early 2017, according to information from close to 65 companies tracked in August by theDaily Oil Bulletin (DOB). While that would be up roughly 25 percent on 2016 spending, it’s still less than half the roughly $64.92 billion in capex for 2014 from 90 companies tracked by the DOB and $50.93 billion from 91 companies for 2013.

During the most recent second quarter earnings season, some producers raised capital plans, others lowered budgets, while most producers decided to stand pat.

Factors Influencing the Revised Budget Decisions

A number of companies have decided to move spending forward to the last half of 2017 that had previously been earmarked for 2018. Companies often use this tactic to accelerate development of a particular project or to take advantage of a guarantee on service costs.

Vermillion Energy Inc., for instance, will bump-up 2017 spending to $315 million from previous guidance of $295 million to accommodate an accelerated fourth quarter Canadian drilling and completions program that had been previously planned for 2018, the company announced in late July.

Anthony Marino, president and CEO, said the move will allow it to lock-in current services costs and avoid the pre-breakup service constraints it experienced during the first quarter of this year.

Birchcliff Energy Ltd. increased its 2017 capital expenditure budget to approximately $404 million, up from the $355 million that was previously announced in February of this year.

In its second quarter release, the company said net capital expenditures in 2017 are expected to be approximately $262 million. A significant portion of the expanded budget relates to bringing 2018 capital forward in order to ensure the efficient execution of Birchcliff’s 2018 capital program.

Meanwhile, given a re-sequencing of projects within ARC Resources Ltd.’s long-term plan, the board of directors approved an increase to its 2017 capital program to $830 million, from the $750 million previously announced.

The increased budget will accelerate initial investments in the Sunrise Phase II and Dawson Phase IV facilities, enter the demonstration stage at Attachie West with the addition of a multi-well pad to the 2017 drilling program, continue to advance ARC’s understanding of the Lower Montney, which includes increased investment at Sunrise, and load-level drilling and completion operations at Tower to maintain crude oil production near facility capacity.

The timing of its capital expenditures is also an issue for BlackPearl Resources Inc., which will spend $195 million to $200 million on capital projects this year, up from a previous guidance of $185 million to $190 million.

Increased capital spending is the result of adjusting the timing of expenditures on the Onion Lake thermal expansion. The company’s production should average between 10,000 and 11,000 boe per day in 2017.

Uncertainty Still Weighs on Markets

Unsettled market conditions continue to apply downward pressure on spending levels.

West Texas Intermediate oil prices have mostly been stuck just below US$50 a barrel in 2017. On Sept. 20 of this year, U.S. benchmark West Texas Intermediate closed above US$50 for the first time since July as positive signs begin to emerge about a tighter market as the deal between OPEC and non-OPEC countries to cut output begins to tackle the glut. In addition, OPEC and the International Energy Agency have recently provided positive forecasts for higher demand later this year and during 2018.

In Canada, daily index AECO gas prices have fluctuated more wildly over the summer, with extreme daily lows tending to parallel outages on TransCanada Corporation’s pipeline system.

Obsidian Energy Ltd. (the former Penn West Petroleum Ltd.) said it’s curtailing planned spending in 2017. Responding to faltering oil prices at the time and a less favourable Canada/U.S. exchange rate, the company said it has cut its 2017 capital budget by $20 million.

“About three-quarters of that reduction comes in the form of reduced development, including 19 fewer waterflood injectors and another one-quarter reduction in non-productive capital,” David French, president and CEO, told an analyst conference call after Obsidian released its second quarter results.

The reduced capital budget is $160 million (including $15 million in decommissioning expenditures), down from $180 million (including $20 million for decommissioning).

Cost-Cutting Continues

Some companies have reduced capital spending guidance due to their ability to improve “efficiencies.”

In late July, Cenovus Energy Inc. announced it had cut its planned 2017 capital spending by about $200 million to $1.7 billion at the midpoint, with no expected impact to forecast production volumes.

On the company’s second quarter results conference call, Brian Ferguson, Cenovus’s president and CEO, said the updated spending guidance reflects new spending cuts and cost improvements.

“We have suspended our drilling program at Palliser for the balance of the year and reduced capital there by approximately $75 million,” he said. “In addition, in our oilsands, we expect to realize capital reductions of approximately $80 million related to continued improvements in drilling performance, development planning and optimized scheduling of well startups.”

In its second quarter release, Husky Energy Inc. said capital expenditures of $580 million in the second quarter remained in line with the guidance range it had lowered by $100 million for 2017.

During the release of second quarter results, Imperial Oil Limited said full-year expenditures are now expected to be about $800 million, as the company maintains its focus on capital discipline and capturing market and productivity benefits in the current business environment. The company previously anticipated spending of $1 billion this year.

Pressure Pumpers and Drillers Respond to Activity Resurgence

- Calfrac Well Service Ltd. lifted capital spending to $65 million from $45 million in response to increased demand. The added funding will be mostly maintenance capital for a bigger North American pumping fleet, due to more fleet activations than planned, the company said during its second quarter release.

- Trican Well Services Ltd. expects to spend roughly $25 million on capital equipment during the second half of 2017 targeting equipment to improve the company’s operational efficiencies, particularly regarding proppant logistics and handling. They are well head of the pace of last year with capital expenditures for the three and six months ended June 30, 2017, totalled $6.6 million and $9.3 million, respectively, compared to spending of $181,000 and $243,000 in and the first half of last year. In the current commodity price environment, Trican said if activity levels remain high and sufficient personnel are recruited, “our entire fracturing fleet could be activated within the next 12 months.”

- Precision Drilling Corporation forecasts spending $138 million this year, up from $119 million. “Our 2017 capital program has increased by approximately $19 million as we elected to upgrade our existing [enterprise resource planning] ERP system,” said Kevin Neveu, Precision’s chief executive. The upgrade is aimed at increased operating efficiency, improving fixed-cost leverage and helping the contractor better handle increased data flow, he said.

- Western Energy Services Corp. to boost capital spending to $20 million from $13 million due to higher producer spending and rising demand for rigs led. Most of the expansion funds will go to rig upgrades in Western’s contract drilling division.

- Ensign Energy Services Inc.’s raised its 2017 capital budget to $90-to-$95 million from $61 million due to higher spending on new-build rigs.

- Essential Energy Services Ltd. hiked its 2017 capital budget 44 per cent to $23 million in response to stronger field activity.

- Strad Energy Services Ltd. increase to its 2017 capital expenditure program of $11 million, to $26 million from $15 million. Most of increase will be used to fund organic growth opportunities within the Energy Infrastructure customer segment with a focus on the company’s matting product line.

Contact MNP’s Oilfield Services Team

MNP understands the oilfield services industry – its drivers, challenges and opportunities. We are proud to provide insight into the latest industry news and trends in our newsletter.

MNP understands the oilfield services industry – its drivers, challenges and opportunities. We are proud to provide insight into the latest industry news and trends in our newsletter.

For more information on MNP’s OFS services, contact Jason Kingshott, CPA, CA, Business Advisor, Oilfield Services at 403.537.7615 orjason.kingshott@mnp.ca

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Survey Finds Canadian Women Want More Balanced Energy Policy