Though crude is up this week, concerns persist over the demand recovery as waves of coronavirus spread elsewhere, including in key crude importer India. The Organization of Petroleum Exporting Countries and its allies are also gradually restoring supplies that were halted when the pandemic struck last year, though they’re confident the market can absorb the extra production.

“The strong recovery of demand in the second half of the year, coupled with continued good production discipline on the part of OPEC+, is likely to tighten supply considerably and lend support to oil prices,” said Eugen Weinberg, head of commodities research at Commerzbank AG.

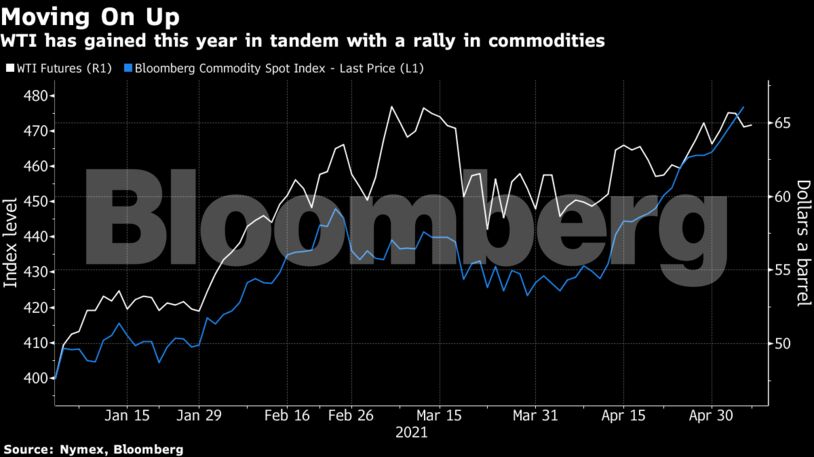

| Prices: |

|---|

|

With crude prices gaining this week, trading of oil options that could profit from a move up toward $90 and $100 a barrel has surged. The equivalent of more than 30 million barrels of $100 calls have changed hands so far this week.

In India, the third-largest oil importer, a model prepared by advisers to Prime Minister Narendra Modi suggests the Covid-19 outbreak could peak in the coming days. Still, the group’s projections have been changing and were wrong last month.

| Related news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors