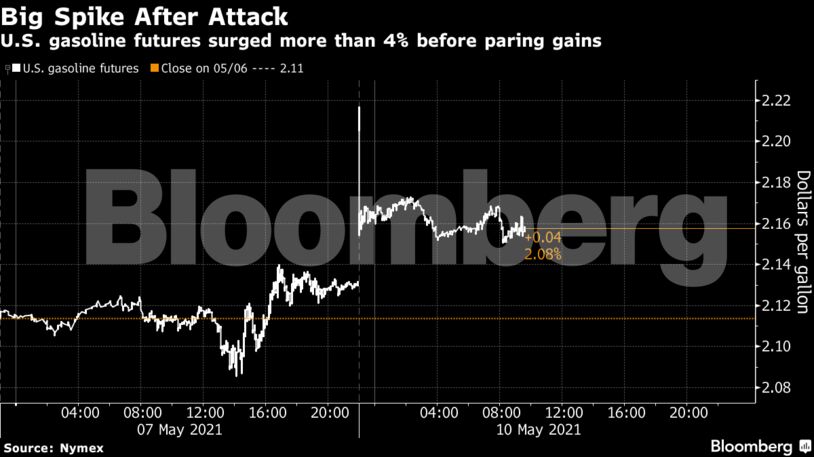

Oil has surged by a about a third this year as the rapid roll-out of coronavirus vaccines across the U.S. and Europe prompted the lifting of social-distancing measures and travel curbs. Consumption of fuels including gasoline and jet fuel has been rising as millions of people return to work, boosting personal mobility and the use of cars. The recovery in demand has the potential to make the Colonial outage feel all the more acute.

| Prices: |

|---|

|

The Colonial network is the main source of gasoline, diesel and jet fuel for the East Coast, with capacity of about 2.5 million barrels a day on its system from Houston as far as North Carolina, and another 900,000 barrels to New York. U.S. gasoline stockpiles have hovered near a four-month low since March, while distillate inventories are just below the five-year average for this time of year.

The shutdown is likely to cause fuel pile-ups, as well as shortages, along different parts of the extended supply chain, and there’s concern that some refineries may be forced to reduce processing rates.

“For now, the market is giving the company the benefit of the doubt that this will be resolved in short order,” said John Kilduff, founding partner at Again Capital LLC. Still, “the pain at the pump will go national, if New York Harbor and other East Coast supply points see supplies dwindle,” he warned.

Traders and shippers are seeking vessels to deliver gasoline that would have otherwise gone via the Colonial system, according to people familiar with the matter. Others are securing tankers to store gasoline in the Gulf, they said. At least one gasoline-hauling tanker has already halted outside the U.S. Gulf, as traders assess where the fuel will be needed most.

Amid the disruption, there could also be calls to suspend Jones Act, according to Again Capital’s Kilduff. The law requires goods shipped between U.S. ports to be moved on vessels built, owned, and operated by the nation’s citizens or permanent residents.

Even before Colonial’s system was forced offline, gasoline had rebounded strongly this year on rising demand from motorists. U.S. refiners were ramping up output for summer demand, with the biggest spike expected at the start of the Memorial Day holiday on May 31, a three-day weekend for most Americans.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS