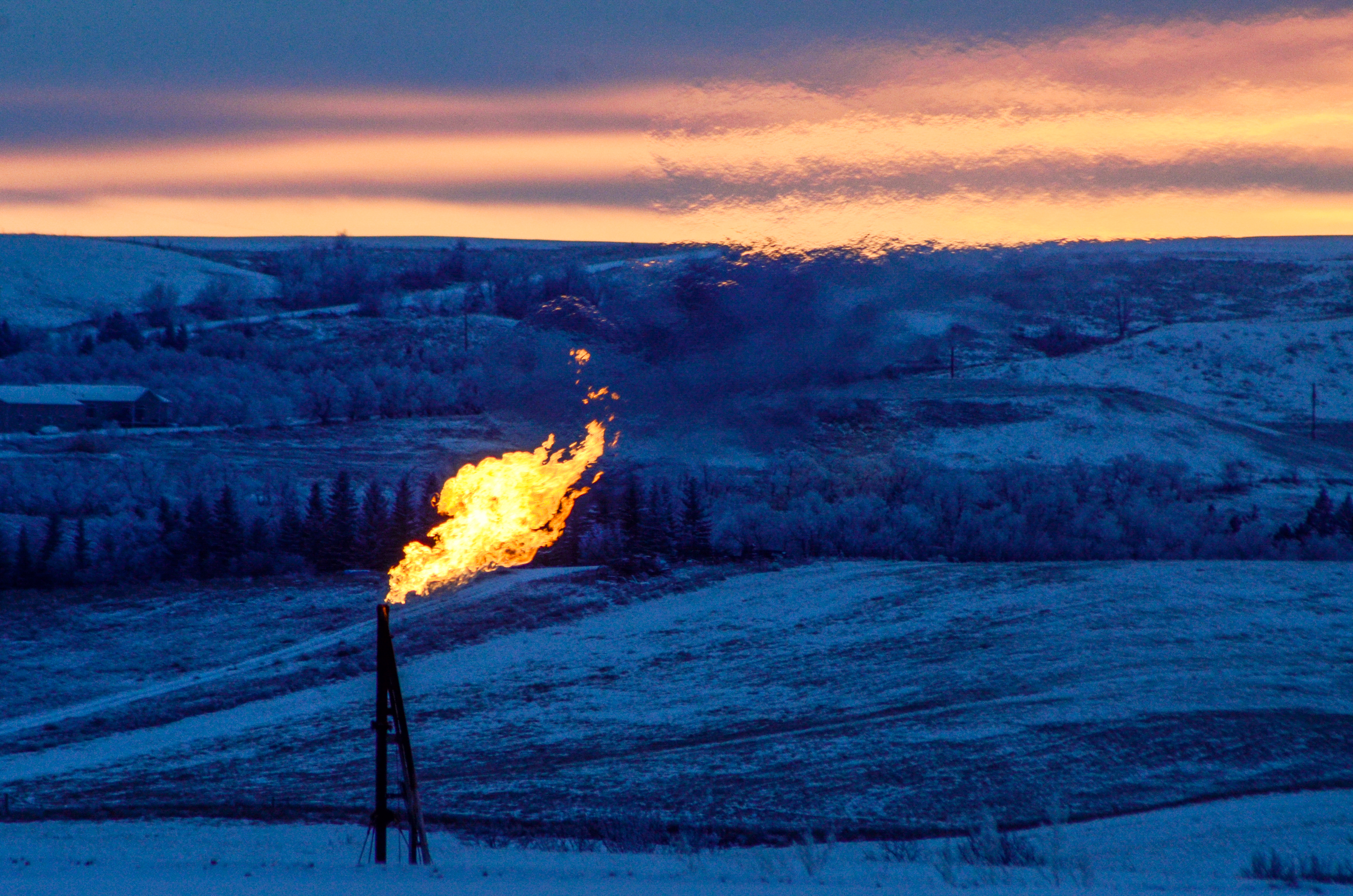

A natural gas flare on an oil well pad burns as the sun sets outside Watford City, North Dakota January 21, 2016. REUTERS/Andrew Cullen

Natural gas’ status as the acceptable face of hydrocarbons has suffered a grievous blow. Until recently the biggest players – energy majors like Royal Dutch Shell (RDSa.L), or Total (TOTF.PA) and states like Qatar – rested contentedly on forecasts of demand rising for decades to come. Yet the influential International Energy Agency now says that for the planet not to overheat, “peak gas” has to arrive in the next five years.

The shift in attitude to the fuel, usually seen as a bridge between dirtier coal and cleaner wind and solar power, has been dramatic. Only this month energy analysts at Wood Mackenzie called the top of the market around 2035, based on a scenario that would keep global temperature increases to 2 degrees Celsius above pre-industrial levels. That implied mid-century demand around 2020’s 3.8 trillion cubic metres. In February McKinsey predicted a 6% increase in gas demand by 2050. Yet the IEA, aiming for a tougher 1.5 degrees Celsius temperature limit, reckons demand by then should actually be just 1.75 trillion cubic metres – a 55% drop from today.

That would be a problem for all the oil majors. The most conservative forecasts of Total, Shell, BP (BP.L) and Equinor (EQNR.OL) see global demand staying roughly the same as now. The IEA scenario would thus mean way less cash to finance their pivot towards wind and solar, penalising the more leveraged players like BP and Shell. It could also mess up the much-fancied market in liquefied natural gas, the hydrocarbon’s most freely tradeable form. McKinsey assumes LNG will be 23% of the gas market by 2050. If the IEA is right, that means 400 billion cubic metres of LNG, more than 15% below today.

That’s bad for gas-pumping nations, but particularly bad for those with higher production costs. Boston Consulting Group analysts reckon it costs players in the United States up to $8 to produce a million British thermal units (mmBtu), with Russia slightly less and Australia slightly more. LNG from Qatar, however, only costs $4 per mmBtu. In a shrinking market, that means the emirate could grow its share appreciably beyond its current 20%. On the downside, the IEA’s projections have average LNG prices staying below $4 per mmBtu. That makes everybody a loser.

CONTEXT NEWS

– The International Energy Agency said on May 18 investors should not fund new oil, gas or coal supply projects if the world wanted to hit net-zero carbon emissions by mid-century.

– The IEA said demand for natural gas would bounce back from its 2020 dip, but peak in the middle of the decade at 4.3 trillion cubic metres, before dropping to 1.75 trillion cubic metres in 2050.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works