The OPEC+ decision last week to keep output largely unchanged, along with an attack on the world’s largest crude terminal in Saudi Arabia, briefly sent Brent oil futures above $71 a barrel early Monday. Futures in New York sagged on Tuesday, with West Texas Intermediate crude for April trading at $63.76 a barrel as of 4:15 p.m. in New York.

Investors are increasingly confident that any oversupply will be absorbed by soaring demand as more people are vaccinated and life slowly returns to normal.

“The fear of peak demand is leading us to the reality of peak supply,” said Eric Nuttall, senior portfolio manager of the Ninepoint Partners LP energy fund in Toronto, which has gained about 70% this year.

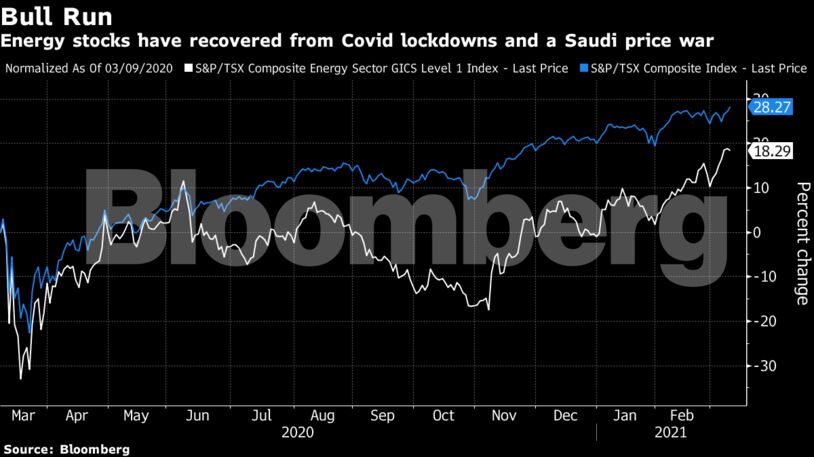

There was less planning involved in last year’s oversupply. Last March, coronavirus lockdowns began in western economies just as Saudi Arabia began flooding the market with oil in an all-out price war. Energy equities plummeted: At one point Canada’s energy index was down 53% for the year. It’s risen 19% to start 2021, with Vermilion Energy Inc. being among a handful of stocks that have risen over 60% during the same period.

Then in January, in one of his first acts as U.S. president, Joe Biden canceled the Keystone XL oil pipeline, the type of move that would normally be a major setback for the patch. But with construction under way on other pipelines, the Canadian portion of Enbridge Inc.’s Line 3 online, and a drive for profitability through spending cuts, bulls have sent signals that this cycle may be different from its predecessors.

Nuttall, whose holdings include MEG Energy Corp. and NuVista Energy Ltd., says he thinks Canadian energy stocks have more upside versus those south of the border, where a new Biden administration is more hostile to fossil fuels. At the same time, Canadian pipeline capacity is improving despite the Keystone XL decision. Nuttall said that small- to mid-cap shares have aided his fund’s performance this year.

Generalist investors, who seek to own assets in a wide range of industries, have avoided oil and gas stocks because of price volatility over the last few years. Stabilizing prices could change that equation, Nuttall said, as margins increase and as other equities become overvalued.

“We’ve selectively added energy” as energy companies cut spending amid rising demand, said David Picton, chief executive officer of Toronto-based Picton Mahoney Asset Management, which managed about C$8.9 billion ($7 billion) in client assets at end of February.

In an interview, Picton called those investments “more of a trading call” because he’s not convinced that energy is a good long-term bet.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Alberta’s World-Class Regulator and Regulatory System – Brian Jean, Minister of Energy and Minerals for Alberta