By David Yager

March 1, 2021

You can’t call it a boom yet but OMG – it is a huge improvement!

Alberta is back in the natural gas business. Or at least climbing out a seven-year hole. The most significant but too often overlooked economic driver of Alberta’s prosperity has returned from the dead. Higher natural gas prices will drag the entire provincial economy along with it.

The discussion about Alberta is invariably focused on oil. But the commodity that has created enormous wealth, jobs, industries and opportunities for over a century has been natural gas.

First discovered by the Canadian Pacific Railroad while drilling for water at Langevin near Medicine Hat in 1883, gas powered one of Alberta’s first industrial booms in Medicine Hat at the turn of the last century. The combination of the South Saskatchewan River, the transcontinental railroad and unlimited supplies of cheap fuel created secondary industries in the southeast corner of the province years before much of Alberta was even settled.

A region in the middle of nowhere with some of Alberta’s most challenging agricultural land thrived because of fossil fuels. While agriculture has long remained a core and important Alberta industry, the whole province would eventually share similar prosperity for similar reasons.

Further drilling found lots more gas. Discoveries at Bow Island supplied Calgary with gas for heat and light by 1912. Gas kicked off the first Turner Valley oil boom 1914. Looking for more oil following Leduc, explorers instead found major gas fields at Nevis, Rimbey, Pembina, Westerose, Crossfield, Jumping Pound, Pincher Creek, Waterton, Cessford, Harmatten, Crossfield, and Edson.

Alberta’s Social Credit government in the 1950s considered gas too valuable to export. However, after gas pipelines were built from Texas to California and Chicago, Canada chose to get with the program. Driven more by the need for gas imports into Ontario than gas exports from Alberta, the Liberal government of Louis St. Laurent pushed through the construction of the TransCanada Pipeline in 1958. This changed Alberta forever and ushered in a new era of prosperity.

With the exception of the oil sands, Alberta’s geology has proven to be more prone to gas than oil. But once Ontario and Quebec were connected, gas was protected in the “national interest” by Ottawa. Onerous export surplus tests were created. At one point gas could not be exported to the US until producers first proved they had a 25- year supply for Canadian consumers.

That all ended in the 1980s under deregulation. What followed was a pipe construction and gas export boom that would see Alberta gas sales double between 1985 and 2000. While conventional oil production peaked in 1973, gas just kept going and growing. Most of the economic recovery in Alberta’s oilpatch and economy in the 1990s was powered by natural gas. The oil sands were still in the future, and conventional oil was in the past.

The impact of natural gas on Alberta’s economy and treasury is seldom fully recognized. Following is a table of natural royalties collected by the province this century. Natural gas helped more than one premier look exceptionally capable. While Premier Ralph Klein is given the political credit for retiring the provincial debt early this century, gas provided the cash.

All this excitement about gas had the commensurate impact on drilling and investment. The drilling data below illustrates the changes this century. (As a cautionary note, the type of wells drilled has morphed from shallow and vertical to longer and horizontal resulting in materially fewer wells. But the activity shift from gas to oil gas has been dramatic).

At the same time gas was filling the Alberta treasury, it was filling the pockets of the drilling and service industry, a myriad of E&P companies, their head offices downtown Calgary, and most of the other communities in Alberta. Gas dominated drilling until 2009. Thereafter, gas tanked and oil drilling rose. The oil drilling data includes conventional oil and bitumen drilling in SAGD projects.

The gas boom was ultimately collapsed by the unlocking of shale gas in the US using extended reach horizontal drilling and multi-stage hydraulic fracturing. It began in the Barnett Shale in Texas and expanded across North American to places like the Haynesville and Marcellus in the US and Horn River in Canada.

When development moved to light tight oil in the Permian Basin in the US and Montney in Canada, the target was more valuable oil or natural gas liquids. But the by-product was significant quantities of natural gas. This associated gas kept a lid on North American prices even as activity in the prolific pure shale gas plays levelled off or declined.

In Canada, gas prices were further depressed by – you’ll never guess – pipeline takeaway capacity. This took place in BC and Alberta.

In BC, the discovery of the massive Horn River deposits kindled interest in LNG exports. By 2011 the NEB had estimated the Horn River basin had at least 78 tcf of marketable gas. Plus the Montney, Liard and Cordoba basins. By 2013 there were so many new projects on the books that the Liberal provincial government of the day under Premier Christie Clark had a massive LNG-export based plan for the province’s future with bold headlines like “Fuelling B.C.’s Economy for the Next Decade and Beyond”, “Natural Gas and our Low-Carbon Future” and “Vision – Global Leader in Natural Gas”. BC even created a dedicated government department to manage the impending economic windfall.

That was eight years, two elections and multiple LNG project cancellations ago. Only LNG Canada at Kitimat is soldiering on despite repeated attempts to stop it. Woodfibre LNG, a much smaller project, is determined to keep going.

Because it contains only dry gas, the Horn River play remains an interesting geological opportunity. The focus has continued in the liquids rich Montney and other plays with the associated gas production contributing to the North American glut and price collapse. The interconnection of BC and Alberta affects prices in both provinces.

If the Coastal Gas Link pipeline and LNG Canada can get up and running in 2025, it will start moving 2 bcf/day out of the country. This will have a significant impact on gas prices and development spending. However, because of the pandemic restricting labor and activity, project proponents are publicly expressing concerns about meeting the target startup date.

Alberta had a different problem. When gas prices collapsed, traditional areas like the southeast became uneconomic and all the new supplies were coming from the Montney and the northwest. This created a pipeline transportation issue because most of the historic gas storage reservoirs were in the southeast. While Nova committed to increasing takeaway capacity, this too struggled from delays and capacity restrictions as work was done in the summer months.

In the summers of 2018 and 2019 it was not uncommon for AECO spot prices for uncontracted gas trying to find its way to SE Alberta storage reservoirs to go to near zero. This was such a mess leading up to the 2019 Alberta election that the new UCP government created an associate minister of natural gas to work with producers and the regulators to help solve the problem. Natural gas strategy papers were solicited and prepared to find more ways to use this massive and formerly valuable resource.

This spot market issue was partly repaired in Q3 2019 after the CER (Canadian Energy Regulator, formerly the NEB) introduced tolling changes that stopped bumping non-contracted gas during pipeline capacity reductions. The NOVA expansion is nearing completion and this bottleneck will improve in 2021 and beyond.

The one silver lining in low gas prices has been cheap fuel for oil sands extraction, industrial feedstock and structural heating.

The impact of low gas prices on the working oilpatch has been devastating. The following figures show Alberta’s average monthly reference price from the last peak in February of 2014 to the most recent valley in June of 2019 before the aforementioned pipeline issues were resolved. From the highest to lowest price, gas lost nearly 90% of its value.

Besides the obvious problem to Alberta’s treasury, the gas price collapse changed the business entirely. Gas drilling, which dominated the drilling and service sector for decades, collapsed. As noted above, from 2000 to 2008 an average of 9,400 new wells for gas were drilled annually. From 2014 to 2019, the average was under 10% of that number, only 812. As capital has moved from conventional gas to the oil sands and liquids-rich plays like the Montney, Cardium, Viking and Duvernay, the composition of the service sector equipment base has changed dramatically. Billions were invested in new equipment and billions more was parked or mothballed as economically obsolete.

It has also created enormous financial challenges among formerly profitable gas producers. While the hollowing out of the independent E&P sector is well known, there is also a significant but not often connected linkage to the growth in suspended and abandoned wells. As numbers have grown, solutions such as increased asset retirement liability provisions and changed bank lending requirements have only made every problem worse. Public controversy over high municipal property taxes and delinquent surface rights payments on wellsite locations are usually related to the collapsed value of the resource for which they were created.

What is really required to make these problems go away is higher gas prices. It appears this has at least begun.

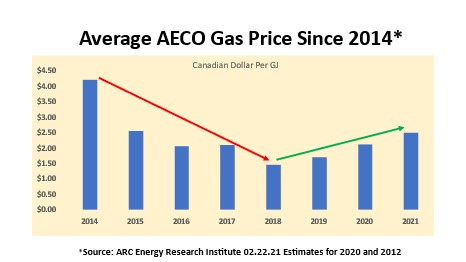

ARC Energy Research Institute publishes an average annual AECO gas price upon which it constructs its macro-financial model. Here’s the most recent version from February 22, 2021.

From 2014 to 2018 the average annualized price of gas fell from $4.23/GJ to only $1.46/GJ, a 65% reduction. While oil has had its troubles, ARC reports that in 2018 it averaged 73% of the 2014 price, not 35% like gas. The good news is that for 2020 gas was 31% higher than in 2018. Oil’s average price in 2020 was about one-third lower than the previous two years.

Despite all the bad news in 2020, for gas it was a big recovery year. Yesterday’s zero became 2020’s hero. This is expected to continue in 2021. The collateral benefit of the slowdown in light of tight oil drilling in the US is that there has been a corresponding reduction in associated gas. Futures prices in North America are stronger than they have been for years, with numbers on the sunny side of $3 GJ for next winter on both sides of the border. The forward strip for AECO for the next year is 50% higher or more than it was a year ago.

The completion of the massive LNG Canada natural gas export project will remove 2 bcf/day from Canadian markets, about 12% of current production. This will provide a significant boost to investment in supply replacement and put a firmer floor under gas pricing.

Other LNG projects in BC, Nova Scotia and Quebec could completely reshape Canada’s natural gas future. And most of that gas comes from Alberta.

Whatever Shell may or may not have said in 2020 about transitioning away from fossil fuels, the company remains bullish on LNG. A Reuters story February 28 reported, “Global liquified natural gas (LNG) demand is expected to almost double to 700 million tonnes by 2040, Royal Dutch Shell said in its annual LNG outlook. Demand was 360 million tonnes last year, up slightly from 2019’s 358 million tonnes, despite volatility cause by lockdowns caused during the coronavirus pandemic.”

Shell’s bullishness is based on demand growth in Asia, the expected market for 75% of future LNG exports. The article reported, “China’s target to become carbon neutral by 2060 is expected to continue driving up its LNG demand…A gap between supply and demand is expected to open in the middle of this decade with less new production coming on stream than previously project, the outlook showed.”

This year cold weather and the physical limitations of renewable energy combined to drive up LNG prices to levels not seen in years in Asia and Europe. LNG was once tied to the BTU equivalent of oil in long term contracts but the drop in oil prices and increasing LNG supply changed the marketplace. LNG has increasingly been sold on the spot market.

Which is great for consumers until you really need it. LNG was fetching as little as US1.85/MMBtu in Asia in May of 2020. In January of this year it spiked to over US$30/MMBtu. Europe was paying US$10MMbtu to keep the lights on earlier this winter.

Replacing coal with gas to reduce emissions is a no-brainer everywhere in the world except among anti-fossil fuel crusaders in North America. The US has led the world in real GHG reductions in the past ten years by using cheap shale gas to replace coal for electricity generation.

Of course to unlock this opportunity for Alberta, first LNG Canada must finish the Coastal Gas Link pipeline which continues to be plagued by opposition. In fact, natural gas development of any kind remains a target for to those religiously opposed to fossil fuels.

Recent electricity shortages caused by temperature extremes in California, Texas and the UK have not impaired the opposition to using more natural gas. Backup power for renewables is essential. The stop/start on demand feature of natural gas makes it ideal for this purpose.

Regardless, there is continuous political pressure to ban hydraulic fracturing among carbon energy’s opponents. Municipalities in Ontario have joined the virtue signalers in California by pushing for the elimination of natural gas from electricity generation, heating and even cooking.

The opportunity for Alberta and Canada to make a big economic comeback powered by natural gas is enormous. Canada has the advantages of market proximity to Asia from its west coast and the climate gives LNG exporters an energy advantage in the liquification process because of the ambient temperature. It takes a lot less energy to liquify methane in Kitimat than Qatar or Australia.

All our obstacles are internal.

Gas can help power a significant economic recovery for Alberta. Surely, the time has come that the proponents of common sense can finally shout louder than its opponents.

David Yager is an oil service executive, energy policy analyst, oil writer and author of From Miracle to Menace – Alberta, A Carbon Story. More at www.miracletomenace.ca

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Alberta’s World-Class Regulator and Regulatory System – Brian Jean, Minister of Energy and Minerals for Alberta