By Andres Guerra Luz and Grant Smith

“We’re at a very delicate point here,” said Bob Yawger, head of the futures division at Mizuho Securities. OPEC+ has “to make sure the associated demand is there before increasing the barrels and not kill the golden goose here, which is what they’ll do if they add everything at once.”

Meanwhile, a deepening energy crisis is still playing out in the U.S., with some 3.5 million barrels a day of American output halted, according to traders and industry executives, as a cold blast freezes well operations and cuts power across the central U.S. That’s being offset, however, by the suspension of more than 3 million barrels a day of refining capacity, according to Energy Aspects Ltd.

“The production loss is significant and could last for several days if not weeks,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd.

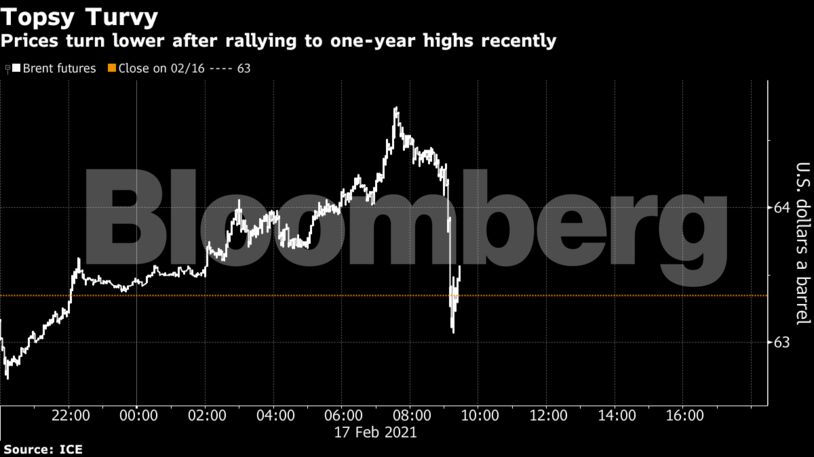

| Prices |

|---|

|

Temperatures in Texas are now low enough to freeze oil and gas liquids at the well head and in pipelines laid on the ground. They’re put under the surface in colder regions. Before the crisis, the U.S. was pumping about 11 million barrels a day, according to government data. Production in the Permian Basin alone — America’s biggest oil field — has plummeted by as much as 65%.

In Russia, meanwhile, freezing temperatures are also contributing to production curtailments. The expected increase in the nation’s February oil output has so far not materialized, as some fields curb pipeline flows due to the abnormally cold weather.

While WTI’s prompt timespread has flipped back into contango, the similar spread for Brent has moved more into a bullish backwardation structure. The April contract is 64 cents a barrel more expensive than for May, indicating tight prompt supplies, compared with 29 cents at the beginning of last week.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works