By Saket Sundria and Alex Longley

At the same time, the market is contending with returning supply. Oil traders have reported a sharp increase in Iraqi exports for next month, while output from Libya has shown signs of rising this week.

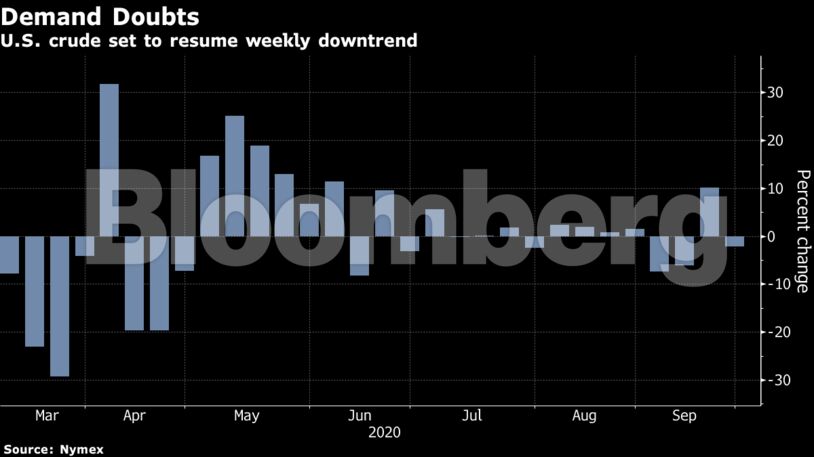

Oil’s weekly loss has been stemmed by the prospect of resuming stimulus talks in the U.S., and a more optimistic demand view from some analysts. Goldman Sachs Group Inc. said oil consumption is currently just above 93 million barrels a day and may rise 1.8 million a day to the end of the year. That said, a virus surge in the U.K. and France is deepening short-term risks.

“This month has not been kind to the oil market,” said PVM Oil Associates analyst Stephen Brennock. “Economic growth anxieties are likely to persist, which in turn will keep oil prices under the cosh.”

| Prices |

|---|

|

On the supply side, OPEC has allowed Iraq to pump more crude next month by giving it extra time to make up for breaching its quota this year. But the puzzle for the market is whether an increase in cargoes means Iraq could exceed its new limit of 3.6 million barrels a day.

There have also been signs of growing weakness in the global Brent benchmark this week. On Thursday, the crude traded at its smallest premium to U.S. WTI since May. It’s also at its weakest to the Middle Eastern Dubai benchmark in four months.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

A Taxpayer Guide to Trudeau’s Terrible, Horrible, No Good, Very Bad Budget 2024 – Canadian Taxpayers Federation