By Grant Smith and Sharon Cho

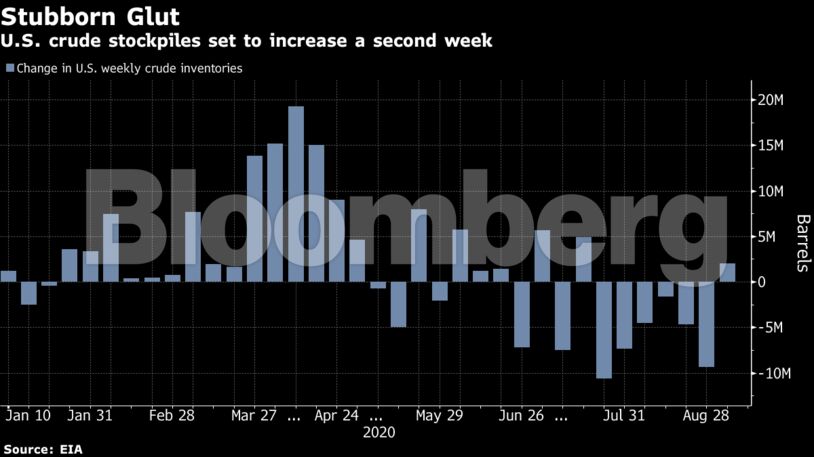

Prices — down about 12% this month after rising in the previous four — also face some headwinds from the latest expectations for U.S. crude stockpiles. Inventories in the world’s biggest consumer rose by about 2.3 million barrels last week, according to a Bloomberg survey before official government data on Wednesday. Industry figures are due later Tuesday.

“The market has now priced in the bleak demand recovery projections and the supply comeback,” said Bjornar Tonhaugen, an analyst at consultant Rystad Energy A/S in Oslo. “We are now at a stage where until things get better at the demand front, prices may swing around the same mark for a while.”

| Prices |

|---|

|

U.S. gasoline stockpiles probably fell by 600,000 barrels last week, according to the survey, which would be a sixth weekly decrease if confirmed by Energy Information Administration data. Distillate inventories, which include diesel, are also expected to decline.

OPEC this week cut its demand forecasts ahead of a meeting with its allies on Thursday to determine if their output curbs are enough to stave off a glut as many countries struggle to contain surging virus infections. Meanwhile, Nigeria’s crude — often viewed as a bellwether for the wider oil market — is again selling slowly as traders report lackluster demand for the grades.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS