By Sharon Cho and Grant Smith

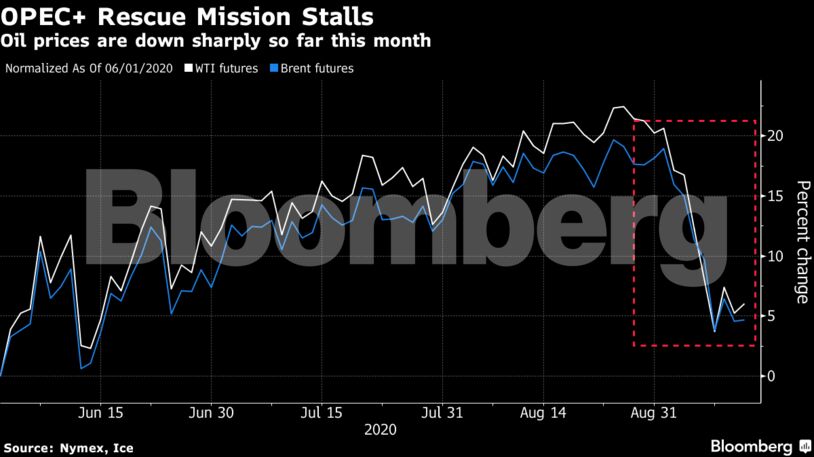

Oil has tumbled back below $40 a barrel after staging a comeback from a rout below zero in April, as rising coronavirus infections across major economies raises doubts about a sustained recovery. There is at least a glimmer of hope, with the University of Oxford and AstraZeneca Plc saying that they have restarted a U.K. trial of an experimental vaccine after it was halted over concerns about a participant who fell ill.

READ: Trader Trafigura Sees Market Returning to Surplus: APPEC UPDATE

| Prices |

|---|

|

Compliance with OPEC+ output cuts may be an issue during talks this week after new signs of exporters reneging on the deal, while a widening contango in Brent crude is heightening concerns about over-supply. Iraq has cut pricing for all of its crude grades to Asia and the U.S. for October following similar curbs by Saudi Arabia and other Gulf producers as demand stalls.

See also: Flagging Asian Demand Sees Oil Sellers Brace for Price Battle

“The sentiment has shifted from positive to negative,” said Giovanni Staunovo, an analyst at UBS AG in Zurich. “Concerns on a stalling oil demand recovery and concerns of cheating OPEC members have been a drag on oil prices. The oil demand recovery is still taking place — it’s just uneven.”

There could even be more barrels on the way from beleaguered member Libya. A military commander seeking to oust Libya’s United Nations-backed government will let the country’s oil industry re-open after an eight-month blockade that’s all but halted exports, according to U.S. diplomats.

“When demand concerns are in focus the last thing the market needs is bearish developments on the supply side,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London.

Meanwhile, even BP’s most bullish scenario sees demand no better than “broadly flat” for the next two decades as the energy transition shifts the world away from fossil fuels, according to a report from the company. Vitol Group, however, predicts there will be 10 years of growth before a steady decline.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow