By Alex Longley

Though demand concerns are returning in some of the world’s largest consuming regions, it remains a far from uniform picture. Japan’s fuel demand is just 4% lower than a year earlier, and there have been steady recoveries in nationwide consumption in the U.K. and the U.S.

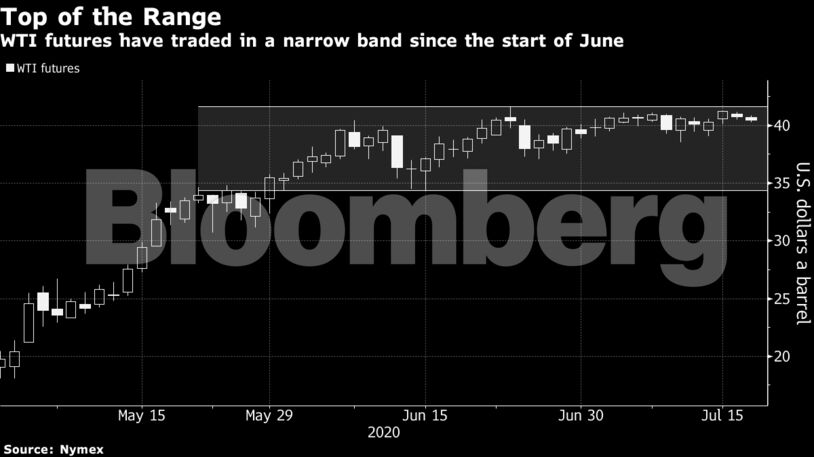

After rebounding rapidly from its nadir in April on supply cuts and returning demand, crude has traded in a narrow range since early June and has run into technical hurdles at its high for that month. OPEC+ said it would start tapering output cuts from next month, though there are signs that additional output from Saudi Arabia and Russia will be consumed domestically.

“Whatever OPEC+ does could be futile if the needed demand doesn’t follow,” said Louise Dickson, oil markets analyst at consultant Rystad Energy A/S. “As traders come to realize that road fuel demand is in danger, prices naturally took a small hit today.”

| Prices: |

|---|

|

Goldman Sachs Group Inc. said it also sees the oil consumption recovery slowing, mainly due to the virus surging in the U.S. The daily rate of demand gains has dropped from 125,000 barrels a day in the first half of June to just 50,000 over the past three weeks, it said in a note.

With prices treading water, there’s been little to get excited about for traders. Volumes on the global Brent benchmark in July are heading for their lowest month since 2014, while those for WTI are set for their quietest month since 2015.

| Other oil-news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Survey Finds Canadian Women Want More Balanced Energy Policy