By Low De Wei and Alex Longley

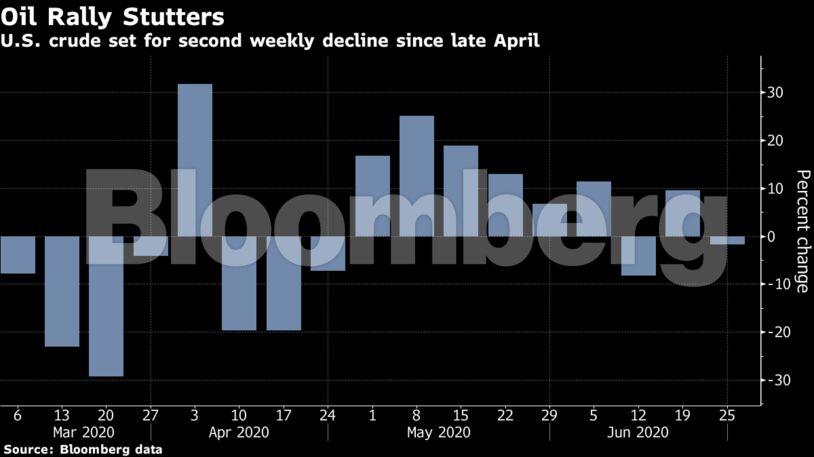

While massive OPEC+ output cuts and a pickup in demand have helped crude climb from its April low, price gains have slowed this month. Infections continue to soar in many parts of the world, consumption is still a long way off pre-virus levels and many refiners are struggling with low margins. There’s also a risk that U.S. shale producers start bringing back output.

“Markets have got ahead of themselves,” said PVM Oil Associates analyst Stephen Brennock. “With the coronavirus pandemic still doing the rounds, there remains plenty of volatility on the horizon.”

In the U.S., the flood of virus cases is coming in some of the most important places for oil demand. Nine of the top 20 gasoline-consuming states are showing an increase in infections, Standard Chartered Plc said in a note.

Nevertheless, oil prices on Friday reflected a planned slump in Russia’s crude exports, with shipments of the flagship Urals grade from its three main western ports plunging by 40% next month, according to loading programs seen by Bloomberg. The steep reductions underscore the OPEC+ alliance’s commitment to eliminate the oil glut that built up earlier this year.

| Prices and other oil news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow