Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

As asset retirement obligations have begun to get more attention from producers, it’s understandable for producers to get discouraged when looking at their long-term budgeting. It’s not uncommon for a producer to look at their long-term liability obligations and see future years with dramatic spikes in abandonment and reclamation costs, spikes that will be difficult to manage, particularly if those costs come due in periods of downturn.

Proactive producers attack this issue by aligning their budgets to future liabilities. Rather than stay reactive and only address liabilities at the times mandated by the jurisdictions in which they operate, a proactive producer can look ahead to future costs and spread out their liability spending to earlier years to balance their obligations. Balancing their abandonment projects, rather than just tackling them on an as-needed basis, can also allow producers to take advantage of area-based discounting and use periods of lower drilling opportunity to lower their deemed liabilities and improve their balance sheet.

Do you have suspended wells not currently due to be abandoned that could be in the next few years? Tackling them early will get them off your books and even out abandonment cost spikes in future years. You could even take advantage of programs like the AER’s Area Based Closure program to find efficiencies in your abandonments to lower your overall liabilities now and later.

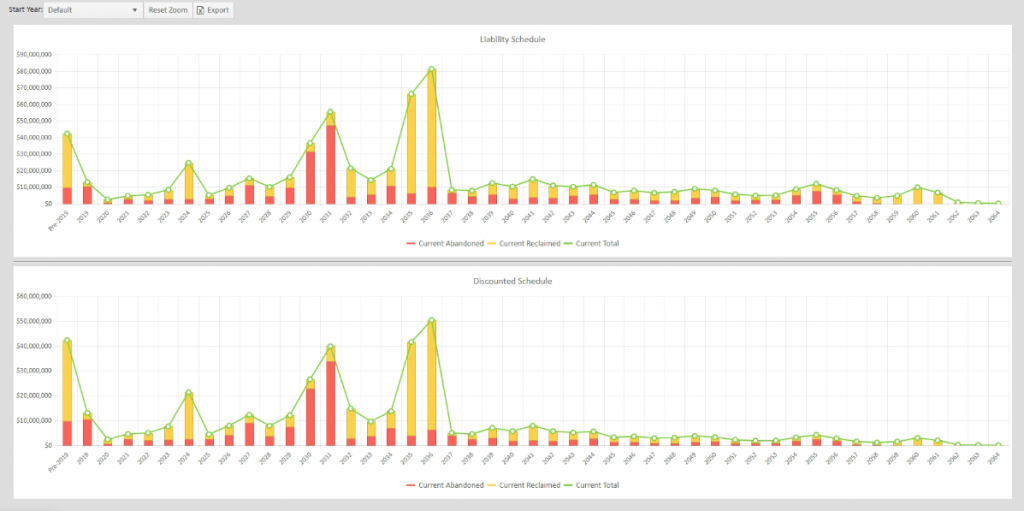

XI Technologies’ ARO Manager provides a simple way to view future liabilities and adjust your budget to balance your abandonment costs. Using the Liability Schedule in ARO Manager, a producer can forecast all their future liabilities by their projected abandonment date. Using this forecast, the producer can then adjust the planned abandonment dates for specific assets and get an updated view of what this does to their liability and discounted schedules.

Figure 1- Using an editable liability forecasting tool, like the one shown here from XI Technologies ARO Manager, can help producers balance their future abandonment liabilities.

To see how easy it can be to allocate some of your current budget to future liabilities, watch this video.

ARO Manager is a tool to help companies evaluate, track, manage, and report on asset retirement obligations. Companies can utilize a standardized cost model to assess total liabilities, or they can import alternate cost models and perform scenario analysis to determine the most efficient, low-cost approach to meeting the mandatory abandonment and reclamation deadlines.

For a more in-depth look at ARO Manager book a personalized demo, or contact XI Sales.

Upcoming Webinars

XI is hosting two free webinars in December to address common questions when it comes to asset retirement obligations. These webinars will be 30 minutes each and will demonstrate how ARO Manager addresses the following:

- How to Find Working Interest Partners in ARO– Wednesday, Dec 4th, 10:30 am

- Creating a Standardized ARO Cost Model – Wednesday, Dec 11th, 11:00 am

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS