By Jacquelyn Melinek

(Bloomberg)

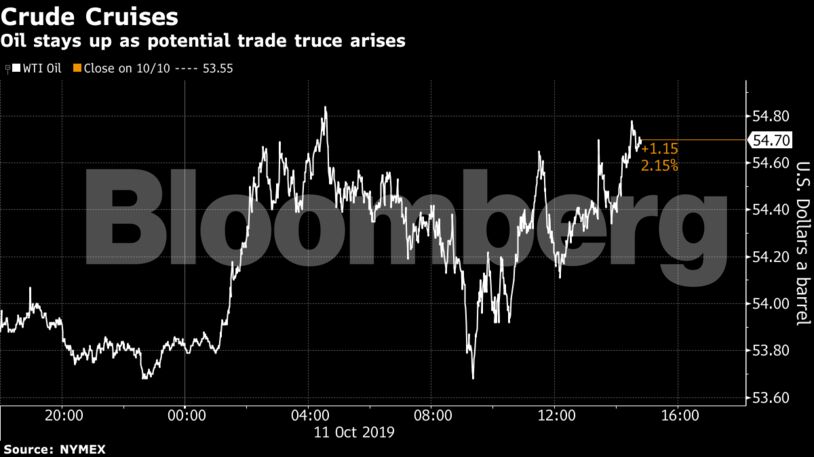

Oil jumped to the highest in two weeks after the U.S. and China reached a partial agreement following trade talks and as an Iranian oil tanker was struck.

Futures in New York climbed 2.2% on Friday and the global benchmark Brent closed above $60 a barrel for the first time in nearly two weeks. The U.S. and China reached a partial agreement Friday that would broker a truce in the trade war. Further adding fuel to the oil rally, a National Iranian Tanker Co. ship caught fire after a blast off the coast of Saudi Arabia.

“We had some good statements come out of the U.S.-China talks,” Ashley Petersen, an oil analyst at Stratas Advisors LLC in New York. The discussions seemed to end “very peacefully and now we are going to see what next steps entail. That was the best case scenario for these talks today.”

While optimism around U.S. and China trade talks, as well as the tanker explosion, have pushed crude higher, bearish factors in the market remain. The International Energy Agency, which advises major economies, trimmed forecasts for global oil demand growth this year and next by 100,000 barrels a day amid a deteriorating economic backdrop.

West Texas Intermediate for November delivery advanced $1.15 to settle at $54.70 a barrel on the New York Mercantile Exchange, the biggest gain in more than three weeks. Prices advanced 3.6% this week.

Brent crude for December settlement rose $1.41 to end the session at $60.51 a barrel on the ICE Futures Europe Exchange. The contract is up 3.7% this week. The global benchmark traded at a premium of $5.73 a barrel to WTI for the same month.

The partial agreement reached Friday may broker a truce in the trade war and lay the groundwork for a broader deal that Presidents Donald Trump and Xi Jinping could sign later this year, according to people familiar with the matter. As part of the deal, China would agree to some agricultural concessions and the U.S. would provide some tariff relief.

The Sabiti, a tanker capable of carrying 1 million barrels a of crude, was damaged on Friday near the Saudi port of Jeddah after being hit by suspected missiles, Iranian state media said.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Alberta’s World-Class Regulator and Regulatory System – Brian Jean, Minister of Energy and Minerals for Alberta