Each week, XI Technologies scans their unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

In a move that other western Canadian provinces will be watching and likely echoing, the BC Oil and Gas Commission (the Commission) has announced the Dormancy and Shutdown Regulation and Comprehensive Liability Management Plan (CLMP) legislation effective May 31, 2019. With this announcement, BC becomes the first province to introduce mandatory timelines for site closure. While Alberta’s Directive 013 and Inactive Well Compliance Program (IWCP) has influenced significant closure activity in Alberta over the last four years, neither of these were actual closure directives. BC is clearly hoping to nip its dormant well issue in the bud, before it reaches the magnitude of Alberta’s inactive well inventory.

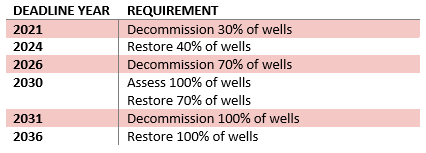

To that end, BC’s new legislation provides a straightforward framework for site closure, with specific targets and deadlines for what the Commission classifies as “Type A” sites (dormant as of December 31, 2018) as outlined in the chart below:

This ambitious timeline puts the onus on permit holders to come up with strategies – such as collaborating with partners or other operators in the area – to best optimize their closure programs and find economies of scale. In Alberta, the Area-Based Closure (ABC) Program was introduced on January 1, 2019, as an attempt to encourage cooperative closure initiatives among operators. But again, BC’s program is mandatory while Alberta’s ABC is still currently voluntary.

So how can companies take action to meet these new BC regulations? For BC operators with little or no closure history it may be challenging to establish a long-term closure strategy. Many will likely need to identify and quantify their total inactive liability before they can even begin to formulate execution strategies.

A tool like XI’s AssetBook ARO Manager can be invaluable for every operator. XI’s ARO Manager makes it easy for companies to identify, estimate, track, manage, and report asset retirement obligations across the lifecycle of every asset. Based on a well data management model, the ARO Manager separates license data from cost data. This allows companies to easily maintain visibility of their permitted sites and perform scenario analysis to gauge the impact of various retirement schedules and cost models. This gives companies the power to assess and make strategic decisions about which closures are most economical, or which can have the greatest positive impact on overall corporate liabilities or LLR position.

More information available

For a list of BC dormant sites by permit holder, click here. To see how XI’s ARO Manager can work for you, book a personal demo, or register for a June 20th webinar on Streamlining your ARO Process.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS