Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

For years, the Alberta Energy Regulator (AER) has provided monthly detailed liability management rating (LMR) reports that many in the industry used for over the fence evaluations of assets in Alberta. Producers used these figures for quick evaluations of potential acquisitions. Banks used these figures to evaluate liability on potential borrowers. But as of last week, this summary report with individual company LMR ratings is no longer available.

XI noticed that the detailed report was submitted over the first weekend of December, then pulled from the AER website the next day. Upon reaching out to the regulator, XI Technologies was informed that the change is a result of resources and budget reallocations. It is the AER’s position that the LMR value alone isn’t a good indicator of a company’s financial health, and therefore they are broadening their assessment processes and focusing their resources on those means. They are, however, in the process of reviewing the current LMR program and what, if any, impact there is on not posting individual reports.

The AER is still providing licensees with LMR reports on their own assets available through the AER Digital Data Submission System., but as of right now, the industry can no longer use the report provided by the AER for evaluating outside assets for potential acquisition or investment. They will need to find another solution for these purposes.

An Alternative Solution

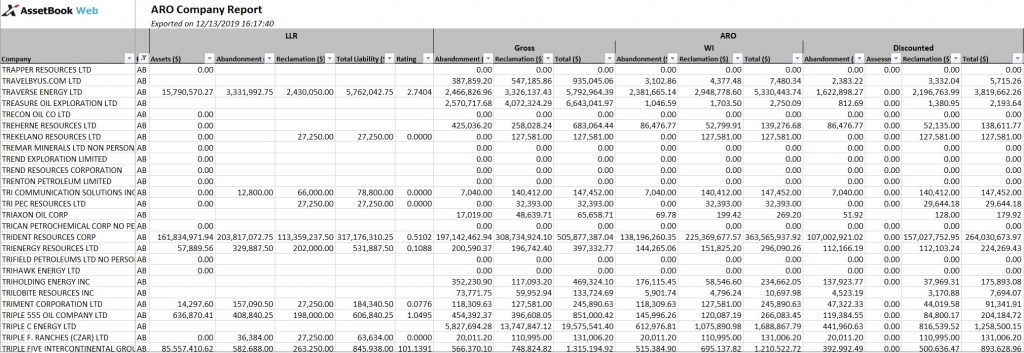

XI Technologies offers solutions for those looking to assess liabilities of licenses they do not operate with its AssetSuite platform of applications. AssetBook LLR is the most reliable and recognized way to easily calculate and analyze the LLR for a company, a group of assets, or an individual well or facility. With XI’s LLR module, users can easily generate reports similar to those previously provided by the AER and use the tools within the application to do a variety of assessments on potential liabilities.

Figure 1 – XI Technologies’ LLR module

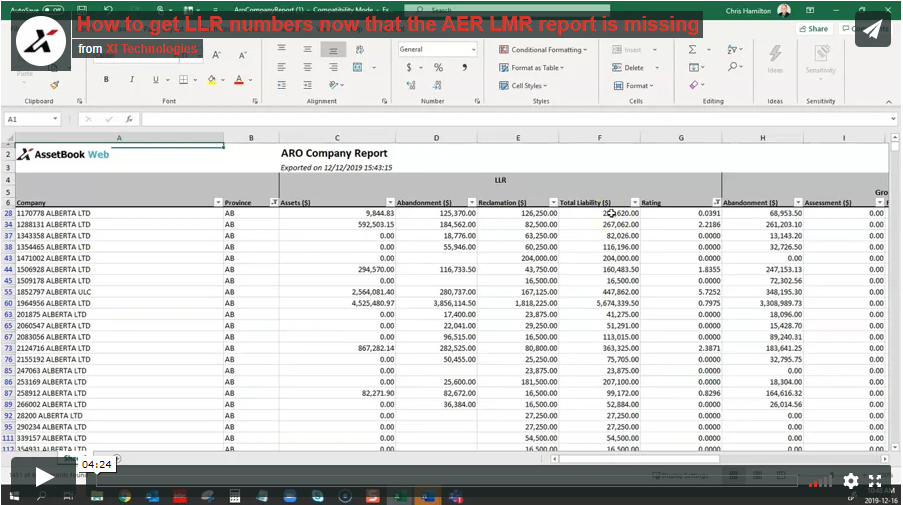

In addition to the LLR module, AssetSuite also features ARO Manager, which helps companies evaluate, track, manage, and report on asset retirement obligations. ARO Manager can provide more robust assessments of liabilities of both current and potential assets, closing the gaps identified by the AER in the LMR program. Users of ARO Manager have access to a report that lists a company’s LLR and ARO side-by-side.

Figure 2 – XI Technologies’ ARO Company Report, available to users of ARO Manager.

To better illustrate the change to the LMR report by the AER, alongside the solutions XI Technologies provides for this gap, XI has put together the following video:

Click here to watch the video.

For more information on this change to liability data delivery, or to discover how AssetSuite can help you manage your liability analysis, contact XI Sales.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats