Crude futures in New York advanced above $83 a barrel, erasing an earlier decline as the dollar cooled. While headline prices have been volatile over the past two sessions, the market’s structure has surged as Cushing stockpiles sink toward critically low levels.

One key physical market gauge, the so-called cash roll, has climbed to its strongest level since 2018 — one of a number of signs this week that traders are pricing in increasingly tight supplies at the vital U.S. hub.

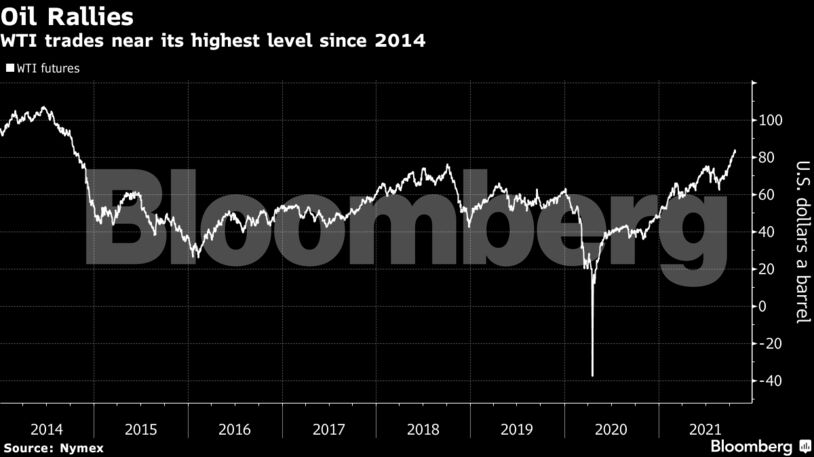

Oil rallied to its highest since 2014 earlier this week on concern that soaring demand is racing ahead of supply. U.S. President Joe Biden said Americans should expect gasoline prices to remain high into next year because OPEC is withholding production, and analysts are predicting supplies will slump further.

“What I see is a market correctly pricing very tight conditions, and conditions that will get tighter,” said David Martin, head of commodity-desk strategy at BNP Paribas. “We’re going to draw stocks this quarter and next.”

| Prices |

|---|

|

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: BC Energy Faces a Complicated Puzzle – Margareta Dovgal, Resource Works