Article 2 of 6 by Deidra Garyk

Read Article 1 Here: – What is ESG?

The world has aligned on the Environmental, Social and Governance (ESG) movement that has taken hold of the financial sector, giving the Canadian oil and gas industry an opportunity to showcase its achievements.

ESG ratings can help investors choose what companies they invest in based on ESG rating quality, including those in the oil and gas sector. It is a myth that the entire industry will be left out, with only harm coming from the ESG movement.

Understanding the essentials can give a company a competitive advantage and a chance to measure and report on the work they’re already doing.

ESG isn’t only for publicly traded companies – private companies need to track their ESG progress too

Public companies may be getting pressure from investors to present a strong ESG score; however, private companies cannot dodge the requirements. Private equity firms are asking the companies they fund to disclose more non-financial information.

Disclosing early, before going public, can be a competitive advantage — ESG strategies can enhance a company’s bottom line. Getting ahead of the reporting requirements before they become an obligation will make it easier to meet the provisions later on.

With ever-increasing reporting demands, everything from pension funds to venture capital firms to insurance companies to banks have to disclose sustainability risks and how they’re managing them. This is in part due to the European Union’s new Sustainable Finance Disclosure Regulation. Even though it isn’t a requirement in Canada yet, the pressure is on, and it’s important for leaders to know what is material to their sector.

It isn’t only the financial sector that wants to know who they’re doing business with. More frequently, private oil and gas service companies are being asked to show they have similar values to the big companies they are doing contract work for. They may not need a full ESG report, but they do need an ESG narrative.

ESG Reports and narratives aren’t related to only business operations or climate change; topics of social importance need to be addressed too. This could include details about how the company is keeping staff safe during the COVID-19 pandemic or addressing diversity.

Materiality and metrics matter most

Information accuracy is important. It’s not enough to say you’re going to do something; a company has to measure its performance and prove they’re walking the talk.

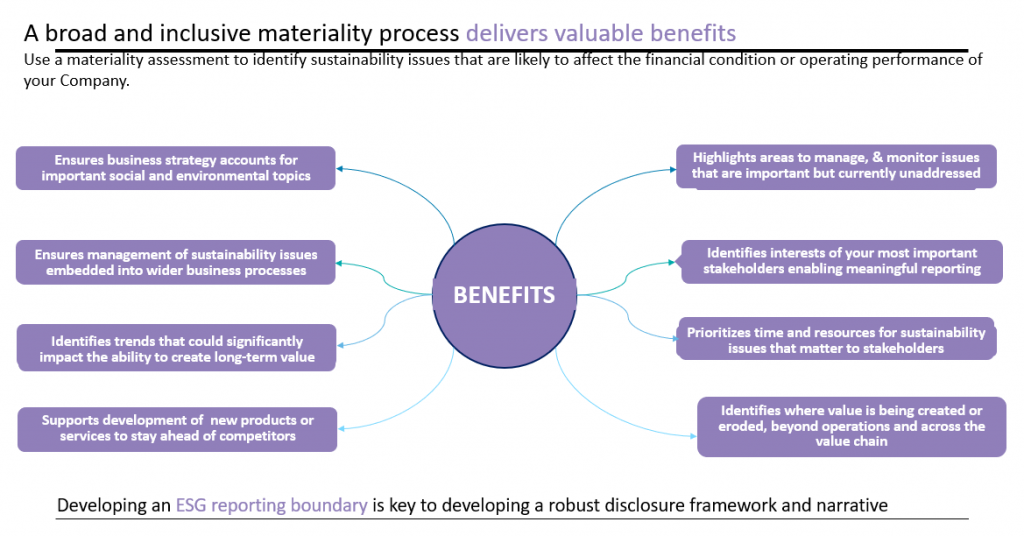

“Materiality assessments are the most important step in starting your ESG journey,” says Shauna Mason, Manager of Investor Relations and Stakeholder Communications at Deloitte.

Shauna is an influential ESG and sustainability leader with 17 years of experience. Her areas of expertise include: ESG reporting, investor relations, public affairs, and corporate governance. Shauna has been responsible for analyzing corporate ESG readiness and reports, developing a reporting boundary and executing materiality assessments, coordinating data collection for different reporting frameworks, writing ESG reports, developing ESG engagement plans, and implementing governance frameworks. Shauna is skilled at developing integrated sustainability strategies that guide organizations to engage stakeholders in a meaningful way.

The materiality assessment is helpful for companies to determine what ESG issues have the greatest impact on their operations. All sizes of companies should go through this strategic process to review their ESG impacts. This requires talking with stakeholders because the purpose of a company should be to create value for all stakeholders.

Therefore, buy-in from stakeholders, internal and external, is needed. Stakeholders include regulators, customers, MLA’s and other public officials, employees, professional associations, and anyone else your business impacts.

It is imperative that companies build relationships with their investors and the ratings agencies – both are stakeholders and are critical to securing necessary capital to run operations.

A materiality assessment helps companies see where they are now and how they can move forward to meet the challenges and demands of the future.

A key tool to complete this assessment is a materiality matrix, which helps gather information on the topics that are material to the company or industry. Focusing on what is important allows the company to narrow the focus from 700+ topics to 5-10.

Is the oil and gas sector embracing ESG?

In Shauna Mason’s experience, the reviews are mixed. Globally, the COVID-19 pandemic has heightened awareness of ESG; however, Canada lags behind Europe and the US in all industries, not only oil and gas.

Some small oil and gas service companies are panicked, feeling this new reporting requirement has been forced upon them. They not only have to prove health and safety compliance and profitability, but ESG adherence too. It’s a lot for small companies to take on.

Other companies view ESG as an opportunity to set themselves apart by highlighting their competitive advantages. Companies can showcase their accomplishments by getting their name on awards and other means of recognition that garner media attention.

The big oil and gas companies are embracing it, knowing that ESG is important to their financial health and access to capital. They are even going as far as to force their suppliers and vendors to show complementary ESG values to do business with them. These companies know ESG is evolving, so they are investing more money and focus into it. With that comes a shift in job responsibilities and the creation of new jobs in the sector.

Even the Alberta government established an ESG Secretariate within the premier’s office in Budget 2021, at a cost of $1 million a year, funded by the province’s carbon tax on large emitters. The province intends to create its own ESG report and will play a role in promoting the energy sector to show Alberta is open for business. Getting the necessary data to ensure transparency and accuracy is going to be a challenge, but obviously something the Alberta government is prepared to take on, even if the critics are skeptical.

There’s a push by investors to find ways to support net-zero by 2050, so the oil and gas sector cannot hide. Sustainability has to be imbedded in the business.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow