By Saket Sundria and Alex Longley

Oil’s recovery from the virus-driven demand crash and swollen stockpiles remains uneven. Consumption is showing signs of uptick in India, where Indian Oil Corp. is boosting processing at its refineries this month. Still, the OECD is forecasting a sharp contraction in the global economy this year, and one that could get worse if there’s a second wave of virus infections.

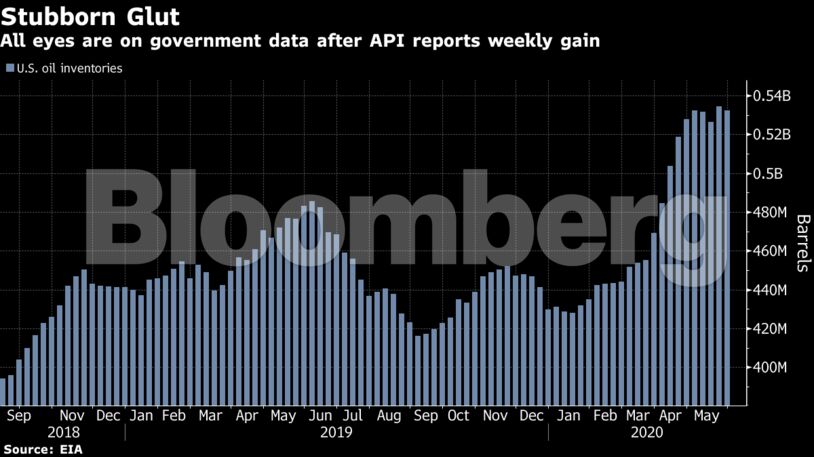

“Indications from the American Petroleum Institute show that stocks built quite a lot,” said Rystad Energy head of oil markets Bjornar Tonhaugen. “Shut-in production returning and a rise in Covid-19 cases scare traders — and markets.”

| Prices |

|---|

|

The weakness in crude prices has also been accompanied by a softer market structure in recent days. Brent futures for August were at their biggest discount to September this month on Wednesday. Similarly, key swaps that help price North Sea crude have softened so far this week, according to data from brokerage Eagle Commodities.

Meanwhile, the chaos engulfing OPEC member Libya continued, with the Sharara and El-Feel fields stopping production after brief restarts. Armed groups have forced halts at both fields, just days after the nation’s oil industry was showing signs of restarting.

Supplies of U.S. distillates, which include diesel, rose by 4.27 million barrels last week, while crude stockpiles at the storage hub of Cushing, Oklahoma, fell by 2.29 million barrels, the API reported. The Energy Information Administration is expected to report nationwide crude inventories dropped by 1.85 million barrels, according to a Bloomberg survey.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works