By Esteban Duarte

Calgary-based TC Energy issued C$2 billion ($1.41 billion) of seven-year bonds one day after receiving a $5.3 billion financial aid package from Alberta to go ahead with the Keystone XL pipeline. The note sale was priced at 325 basis points over the government yield curve, the tight end of spread guidance released when the deal was initially marketed. Proceeds from the issuance will be used for general corporate purposes.

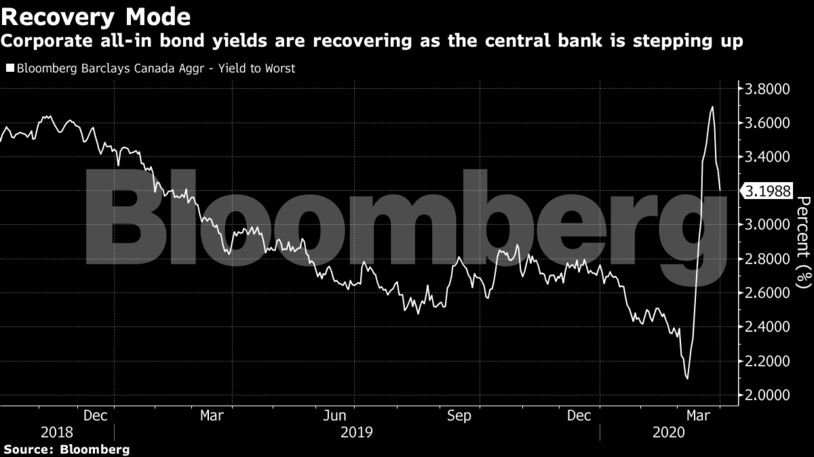

Risk premiums recovered Tuesday for a fourth straight trading day, as the Bank of Canada set an array of easing measures including cutting interest rates to the lowest since 2009, widening the collateral it takes in its liquidity mechanism and buying debt securities, including at least C$5 billion per week of government bonds.

Investors demand 243 basis points over Canada’s government bond yield, according to Bloomberg Barclays indexes. That compares with as much as 274 basis points on March 25, days before the central bank cut rates to 0.25% and announced plans to buy government securities. The first government purchase was carried out today.

TC Energy got enough orders to cover the deal by about three times, while 85 investors took part in the offering, according to people familiar with arrangers’ communications. Separately, Brookfield Renewable Partners raised C$350 million by selling bonds due in 2029 and 2030. Order books on those transactions were oversubscribed by 2.8 and 3.4 times, respectively.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: BC Energy Faces a Complicated Puzzle – Margareta Dovgal, Resource Works