By Sheela Tobben

The lack of a geopolitical risk premium is partly due to plentiful supplies of U.S. shale and a torrent of new crude from non-OPEC countries including Brazil, Guyana and Norway. On the demand side, the U.S. and China are set to sign their limited trade deal this week, which may improve sentiment.

“We are now rolling into a period with a softer fundamental oil-market balance,” said Helge Andre Martinsen, senior oil market analyst at DNB Bank ASA. “We need actual supply disruptions to push prices close to $70. But watch out for increasing Iranian proxy activity and an acceleration of Iran’s nuclear program in the months ahead.”

Brent futures for March settlement fell 78 cents to $64.20 a barrel on the ICE Futures Europe Exchange after losing 5.3% last week. The global crude benchmark traded at a $6.12 premium to WTI for the same month.

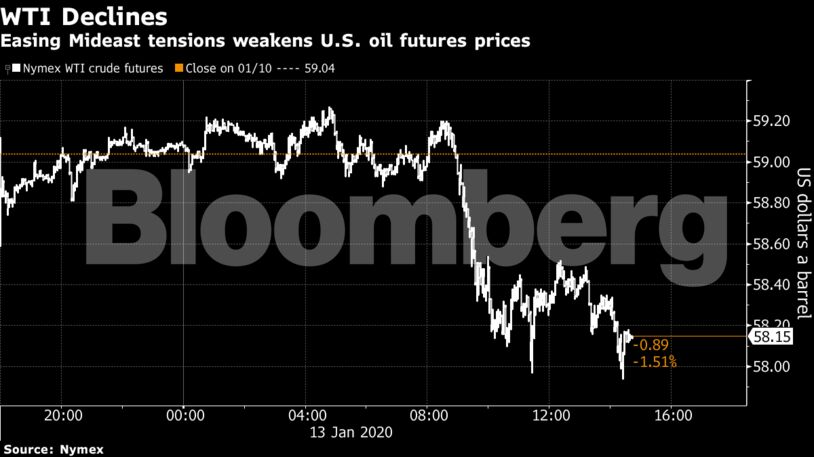

West Texas Intermediate crude for February delivery fell 96 cents to $58.08 a barrel on the New York Mercantile Exchange. The contract fell 6.4% last week, the most since mid-July.

While the chance of imminent war has lessened, relations between the U.S. and Iran remain combustible. Tehran has said it will stop abiding by limits on uranium enrichment, while the U.S. imposed new sanctions on the Islamic Republic. Oil markets are underestimating the risks in the Middle East and may be wrong in assuming Iran’s retaliation is over, said Jason Bordoff, head of the Center on Global Energy Policy at Columbia University in New York.

Meanwhile, Brazil and Guyana are set to add more than 400,000 barrels of combined daily supplies to the market this year, a volume that would offset most of the auxiliary cuts agreed to by OPEC and its allies in late 2019, according to Stratas Advisors.

| Other oil market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS