Summary: The Government of Alberta is committed to attracting new investment every year worth billions of dollars.

That’s why it promised to cut taxes on investment and operations in Alberta by cutting the corporate income tax on July 1, 2019, and is scheduling further annual decreases until 2022. In designing its new corporate tax policy, the new Alberta government took into account Canada’s lagging competitiveness, the stimulative effect of business tax relief, the need to create new jobs and to diversify the economy.

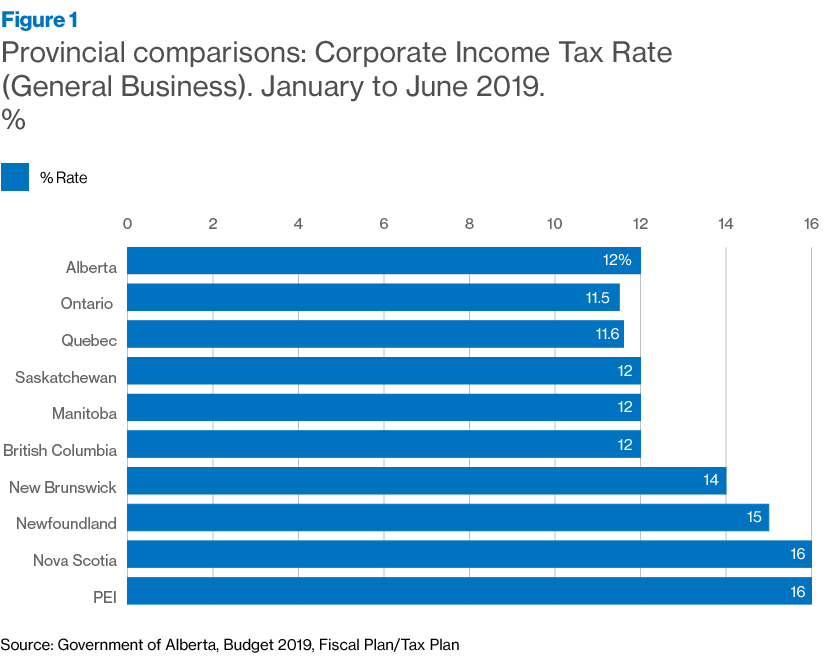

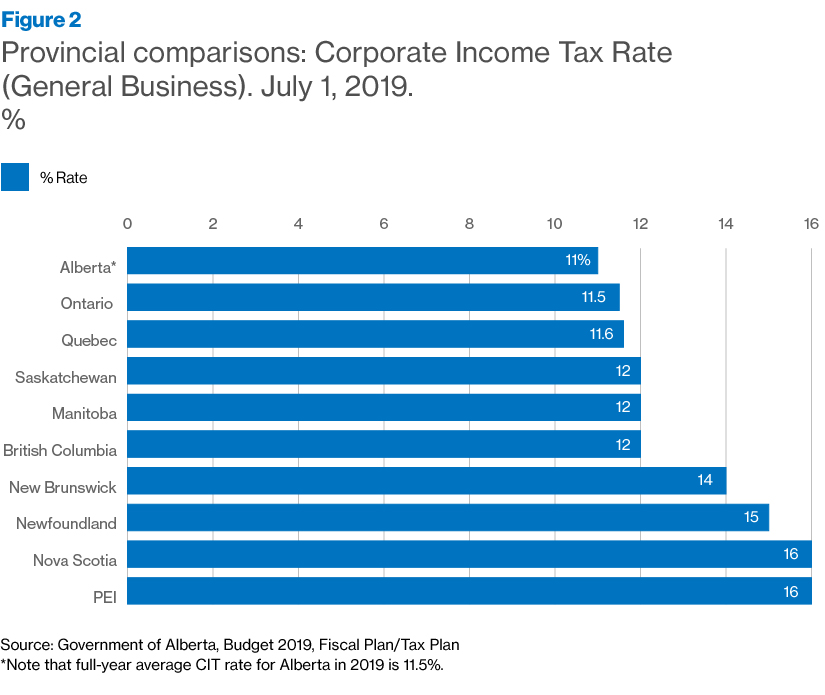

The details: As of July 1, 2019, Alberta reduced its corporate income tax rate to 11% from 12% (Figures 1 and Figure 2), making its corporate tax rate the lowest of any province in Canada. Further, Alberta will have an even more significant advantage for investment when the Job Creation Tax Cut is fully implemented in 2022.

Alberta’s planned CIT tax reduction to 8% by 2022

Alberta has committed to further planned corporate income tax rate reductions over the next two years: 10% on Jan. 1, 2020, 9% on Jan. 1, 2021, 8% on Jan. 1, 2022.

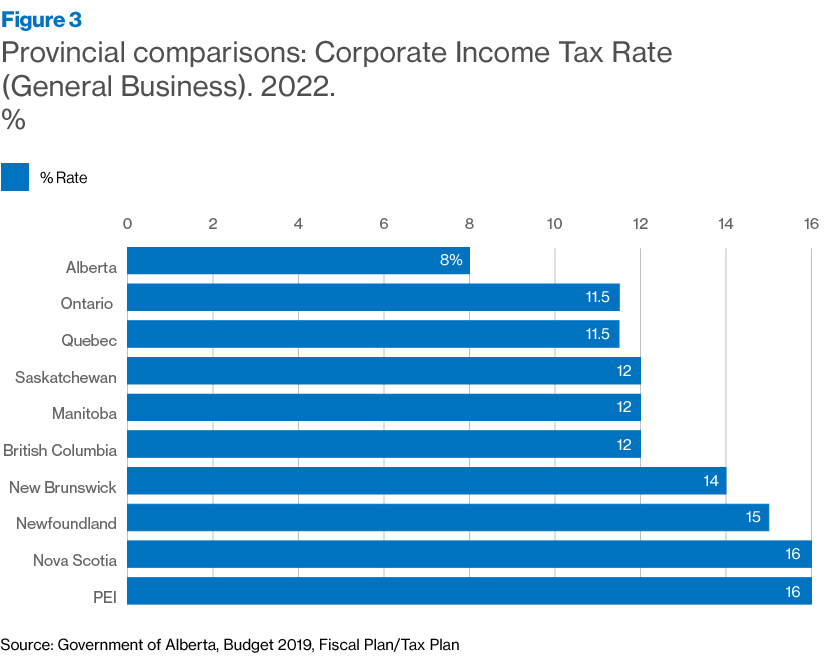

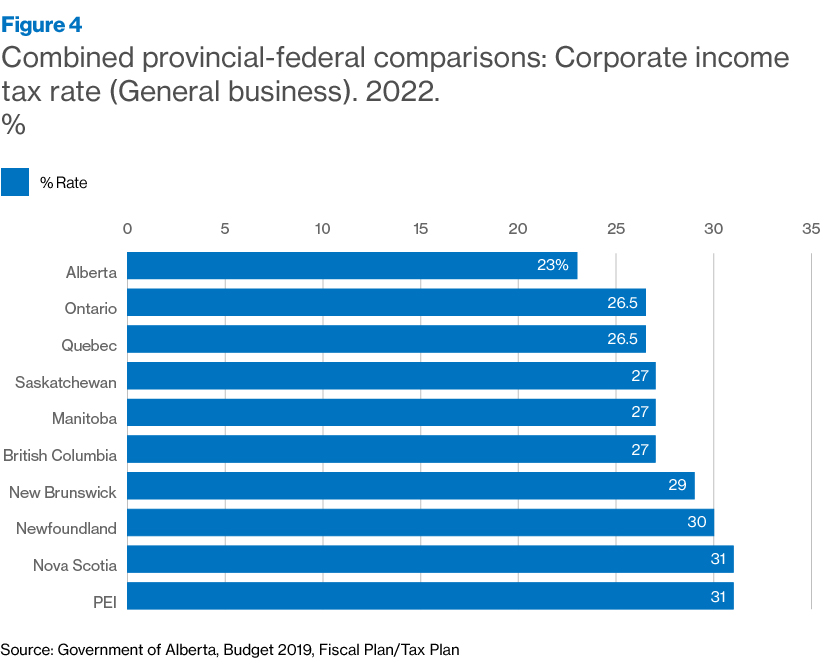

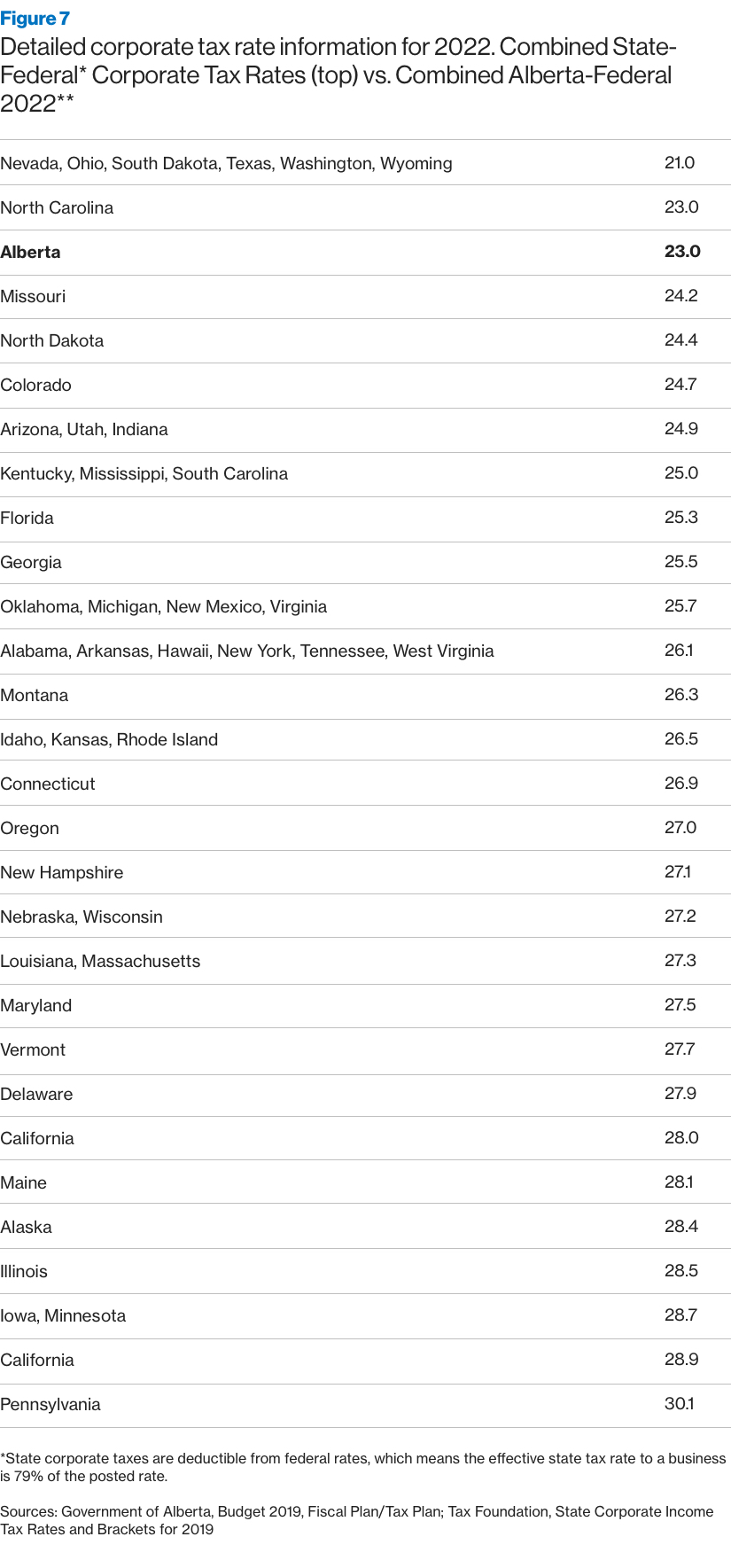

By 2022, Alberta’s provincial corporate tax rate of 8.0% will be 30% lower than the next-lowest announced provincial rate (Ontario), one-third that of neighbouring British Columbia, and one-half that of Nova Scotia and Prince Edward Island (Figure 3). As of 2022, the combined Alberta/federal corporate income rate will be 23% (Figure 4), again, the lowest of any province in Canada.

Alberta-U.S. state comparisons 2019 and 2022: Alberta soon lower than all but six U.S. states

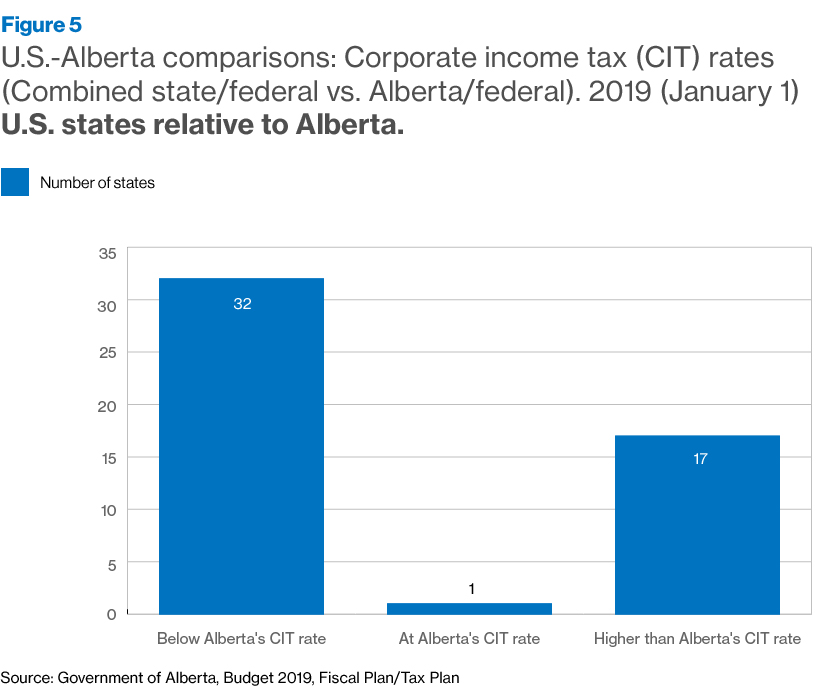

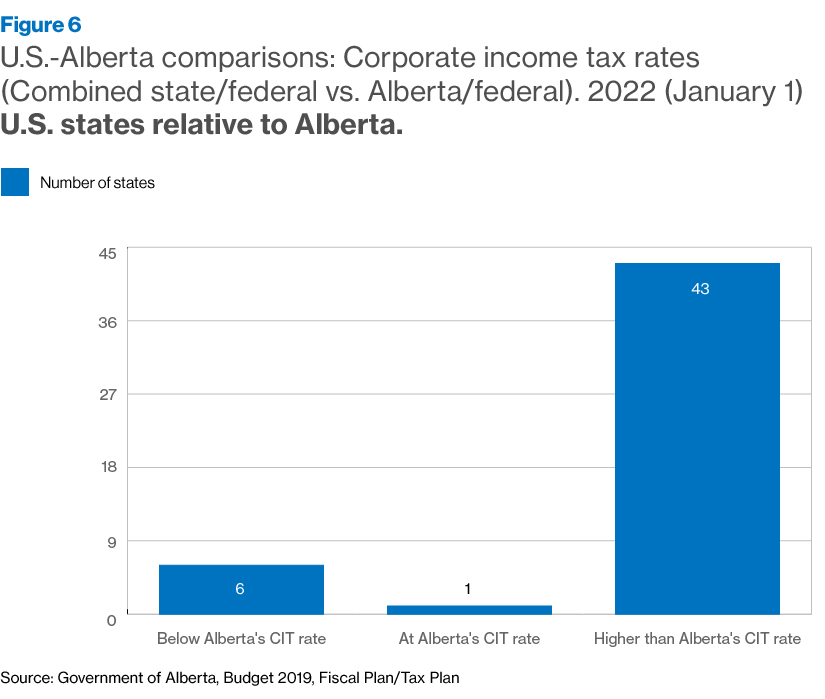

As of January 1, 2019, 32 U.S. states had a combined state-federal corporate income tax rate lower than Alberta’s provincial-federal combined rate and one U.S. state was equal to Alberta (Figure 5). As of 2022, Alberta’s combined provincial-federal rate of 23% will be lower than 43 U.S. states, equal to one U.S. state, and higher than just six U.S. states (Figure 6). For a full comparison of each U.S. state to Alberta in 2022, see Figure 7. In 2022, 43 U.S. states will have higher corporate taxes when compared to Alberta’s low corporate tax rate of 23%.

Background: Corporate taxes, investment, employment, and government revenues

Corporate tax reductions have been found to be effective in boosting economic growth and employment creation, while the opposite policy hampers growth and the potential for new employment. The new government’s taxation policy is based on work by economist Dr. Bev Dahlby, from the University of Calgary’s School of Public Policy, and economist Dr. Jack Mintz, the founder of the School of Public Policy, both experts in the field of taxation and effects upon economies. The work of Dr. Dahlby and Dr. Mintz anchored the new government’s taxation policy.

- Mintz and Dr. Dahlby’s influence on Canadian tax policy is extensive. Dr. Mintz was chair and Dr. Dahlby was part author of a landmark report in 1998 for the federal finance department under then-Finance Minister Paul Martin. The Report of the Technical Committee on Business Taxation found that Canada’s corporate tax rates and structure required modernization to be more efficient and more competitive. The committee proposed a “more neutral system whereby the corporate income tax rate for all industries is lowered toward international norms.” They also proposed several base-broadening measures to improve efficiency and fairness. “These lower rates would help make Canadian business more competitive internationally and reduce the incentives to shift income out of Canada and deductions into this country,” the committee wrote.

That report served as the basis for business tax reform starting in 2000 under the Liberal government of Prime Minister Jean Chretien, which reduced both personal and business taxes in Canada over a series of years, including a reduction in the federal corporate tax rate to 21%, from 28%.

- More recently, in 2018, Philip Bazel, Jack Mintz and Austin Thompson warned that Canadian jurisdictions were again becoming dangerously uncompetitive given U.S. reductions in corporate tax rates. The authors said Canada was at risk of losing tax revenue due to shifting investment patterns, such as from Canada to the United States and elsewhere. “Put simply, Canada and other countries will lose revenue while the U.S. gains revenue,” the economists wrote.

- In September, 2019, Dr. Dahlby and Dr. Ergete Ferede, associate professor of economics at MacEwan University, found that higher corporate taxes negatively impact investment flows, employment creation and wages. Such higher taxes also impact government revenues because of a reduction in the tax base, which leads to a smaller pie. “Tax bases almost always shrink in response to a tax rate increase because taxpayers have an increased incentive to alter their labour, savings and investment decisions,” Dr. Dahlby and Dr. Ferede wrote in their report for the University of Calgary’s School of Public Policy.

Relative to Alberta, they estimated that a 1% reduction in the provincial corporate income tax rate would boost a province’s economic growth by 0.12% four years after the initial corporate tax rate reduction and increase real per capita GDP by 1.2% in the long run.

They also estimated that Alberta’s scheduled 4% reduction in the provincial corporate income tax rate, from 2019 to 2022, would create 58,000 additional jobs by 2022 and 172,000 new jobs by 2029.

- In a companion paper also released in September, 2019, Dr. Dahlby and Dr. Ferede found that revenue losses to the provincial government due to corporate tax reductions would be $350 million annually, but will be partly offset by the effect of higher economic growth, resulting in new revenues to the provincial government.

“This reduction in long-run total revenues is only 25% of the so-called ‘mechanical effect,’ which is the revenue loss calculated from multiplying the tax rate reduction by the average CIT revenue per tax point,” they wrote in the paper. “Thus, the expansion of the economy and the corporate tax base substantially offsets the loss of tax revenue in the long run from the CIT rate cut. While a $350-million reduction in revenues is significant, it is small in the context of the $6.7 billion 2018-2019 deficit.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS