By Ann Koh and Alex Longley

Trump told reporters at the White house that the U.S. and China were “in the final throes of a very important deal,” though he told Fox News later that he was holding up the agreement to ensure better terms for America. While some sort of pact would be positive, it may not do much to revive crude demand unless existing tariffs are rolled back.

“The belief in a positive trade deal continues unabated,” PVM Oil Associates analyst Tamas Varga wrote in a report. “Outright prices are resilient.”

West Texas Intermediate for January delivery advanced 13 cents to $58.54 on the New York Mercantile Exchange at 10:41 a.m. London time. Brent for January settlement increased 14 cents to $64.41 on the London-based ICE Futures Europe Exchange. The global benchmark traded at a $5.88 premium to WTI.

Trump’s comments followed signals from both sides that talks were back on track after negotiators from the world’s two largest economies spoke by telephone. In China, early indicators showed that the economy slowed for a seventh month in November, highlighting how the trade war is damping growth.

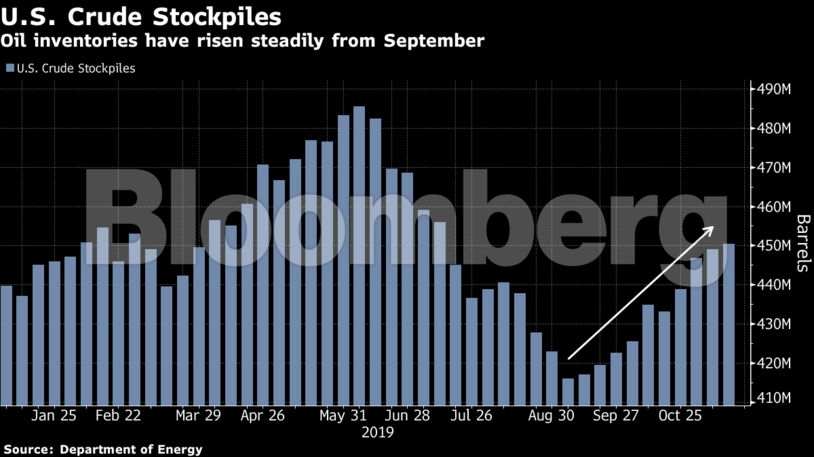

U.S. Stockpiles

While the API reported a gain in nationwide crude inventories, its data showed stockpiles at the key storage hub of Cushing, Oklahoma, fell by 516,000 barrels last week. Analysts surveyed by Bloomberg expect the government to report a 878,000-barrel decline in nationwide inventories when it publishes official figures later Wednesday. That would be the first drop in five weeks.

Stockpiles rose in nine out of the 10 weeks through Nov. 15, Energy Information Administration data show.

| Other market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works