By Sharon Cho and Grant Smith

“It is still all about the economy,” said Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas SA in London. “When it comes to U.S.-China trade tensions, any setbacks appear to lend support to the U.S. dollar and generate headwinds for commodities.”

Brent for November settlement fell 41 cents to $58.25 a barrel on the ICE Futures Europe Exchange as of 10:21 a.m. in London, after falling as much as 1.1% earlier. The contract lost 59 cents on Monday.

West Texas Intermediate for October delivery declined 62 cents, or 1.1%, from Friday’s close to $54.48 a barrel on the New York Mercantile Exchange. Trades made in Monday’s session will be booked for settlement on Tuesday because of the U.S. Labor Day holiday. The U.S. benchmark crude traded at a $4.02 discount to Brent for the same month.

Trade Standoff

The U.S. and China have failed to agree in the past week on at least two requests — an American appeal to set some parameters for the next round of talks and a Chinese call to delay new tariffs, said two of the people who asked not to be identified as the discussions are private.

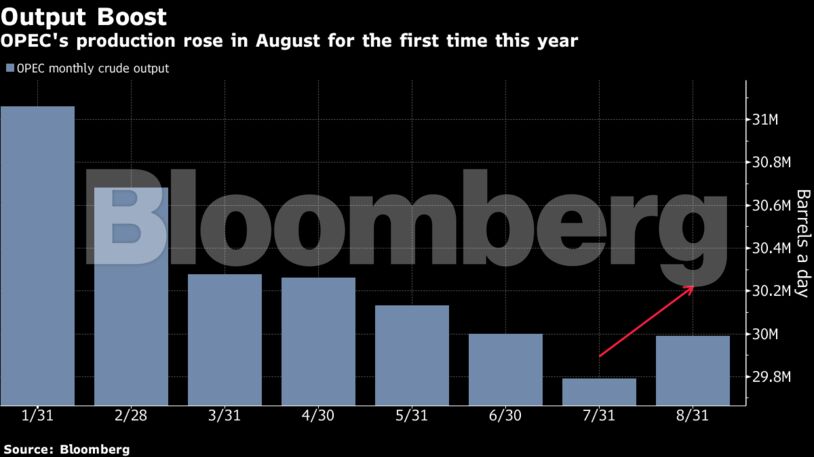

Nigeria and Saudi Arabia led the increase in OPEC production last month, which was the first since the cartel and its allies started a new round of output cuts at the beginning of the year. OPEC is struggling to prop up crude prices as the escalating U.S.-China trade war weakens global demand and as American production continues to grow.

OPEC production fell by 200,000 barrels to 29.99 million barrels a day in August, according to a Bloomberg survey based on estimates from officials, ship-tracking data and consultants. The group and its partners — a 24-nation coalition known as OPEC+ — had agreed to cut output by 1.2 million barrels a day at the start of this year. Russia aims to “fully comply” with OPEC+ caps this month, according to an Energy Ministry statement.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS