By David Yager

August 29, 2022

Natural gas has become one of the world’s most valuable commodities due to a combination of climate policies, underinvestment, and Russia’s invasion of Ukraine.

European gas is at the highest price in history. On August 25 Dutch TTF gas closed at US$94.20 per MMBtu, about $120.77 in Canadian dollars.

Incredibly, a few days earlier AECO spot gas closed at -$0.19.

That’s right. As methane prices skyrocket all over the world, Alberta’s gas went negative, at least briefly.

Unless some producers are giving it away, this is yet another example of how Alberta has the lowest gas prices in the world.

And has had for years.

Converted to US$/MMBtu, for the first three weeks of August US Henry Hub gas averaged $8.67, Dutch TTF $62.54, and Alberta AECO $2.16. Alberta gas fetched 25% of the US price and 3% of the Dutch benchmark.

At the same time Prime Minister Trudeau described exporting Canadian gas from the East Coast in the form of LNG as questionable because there has “…never been a strong business case.”

With a $120 price spread between the Alberta wellhead and European markets, producers could probably ship gas 7,500 km. in household barbecue propane bottles and still make money.

Not all Alberta gas sells at the AECO spot price. Producers and gas traders employ a variety of shipping contracts, hedges, and market pricing points to secure the greatest value for their production.

But for purposes of comparison with other producers and markets, the rest of this article will use AECO for Alberta (NGX, Alberta government), Henry Hub (CME/EIA) for the US, and Dutch TTF (CME) for Europe.

Just how low are Alberta’s gas prices? And why?

This chart from https://ourworldindata.org/grapher/natural-gas-prices shows international gas prices from 1984 to 2021. Alberta (pink) has been at or near the bottom since 1990. The highest prices in 2021 are about 20% of what natural gas costs in Europe today.

According to https://www.worldometers.info/gas/gas-production-by-country/ here’s the combined natural gas production of 97 countries with details on the top twenty.

The next 10 largest producers are, in order of declining output, Indonesia, Nigeria, Turkmenistan, Venezuela, Malaysia, Australia, Mexico, Uzbekistan, Netherlands and Egypt. They range from 8.7 to 4.6 bcf/day and in total produce 60.7 bcf/day, or 14.3% of the world total.

Most of these 20 countries are exporters. Those that don’t sell much if any gas outside of their borders are China, Saudi Arabia, Venezuela and Mexico.

Gas used to move only by pipeline, but LNG changed everything. The top 10 LNG exporters in 2021 by declining volume according to https://www.statista.com/statistics/274528/major-exporting-countries-of-lng/ were Australia, Qatar, US, Malaysia, Nigeria, Algeria, Indonesia, Oman, Papua New Guinea and Trinidad-Tobago. The US is quickly move up the ladder.

Where does Alberta fit? Production in May was 10 bcf/day. In the global ranking, Alberta would displace UAE as the world’s tenth largest gas producer.

In a planet so short of gas, why are Alberta’s prices this low?

Geography. As I explained in my book, Alberta is isolated in northwest North America. That 4.4 million people live here is only because it is a global fossil fuel warehouse with enormous quantities of coal, oil and natural gas.

Alberta’s attractions are not weather, beaches or market access.

To the west there are 1,000 km. of mountains to the Pacific Ocean. Over half of BC’s population lives in the lower mainland. It is 1,200km from Grande Prairie to Vancouver.

Up north, only 83,600 people live in Nunavut and NWT.

East? Beyond the 2.6 million people in Saskatchewan and Manitoba, Canada’s largest concentration of people is in Ontario’s “golden horseshoe” near the Great Lakes. It is 3,300 km. from Edmonton to Toronto.

To the immediate south are America’s least populated states – Wyoming, North Dakota, South Dakota and Montana. With only 3.3 million people combined, they rank 1st, 4th, 5th and 9th as the least populated states in America.

And they all produce their own natural gas.

Alberta’s gas export business exists only because of thousands of kilometers of pipelines to where the people live in the lower mainland of BC, Ontario and Quebec, and south to connect with American pipeline networks serving the major centers.

The original export pipelines – the original Westcoast line to the lower mainland of BC and the TransCanada line to central Canada – were built in the 1950s. Incremental capacity was added with the Foothills pipeline in the 1980s and Alliance late last century.

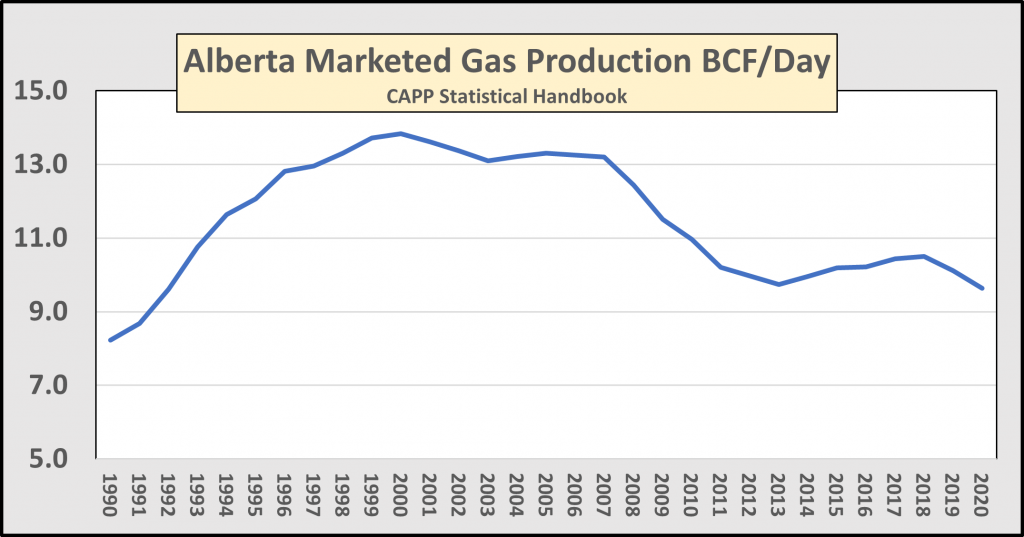

With more export capacity and deregulation of export markets, Alberta’s gas production grew significantly. From 1990 to 2000 output rose from 8.2 bcf/day to the peak of 13.8 bcf/day. As conventional oil production declined, Alberta’s economic recovery in the 1990s was powered by gas.

Gas prices, drilling and production volumes began to decline after US the shale gas revolution began in 2005. Within five years North American gas markets were completely rearranged. Shale gas from the Marcellus in the northeastern US was cheaper than Alberta gas in established eastern markets. AECO, which was nearly $10 in 2008, lost 80% of its value by 2012.

Like crude oil differentials, Alberta’s gas prices have always been lower because of transportation costs. Because of geography, that problem will never go away.

When LNG Canada is completed in 2025, western Canada’s gas market will improve immensely. But Montney gas producers must still bear the cost of shipping over 1,000 km. from Ft. St. John to Kitimat.

But what has also emerged in the past 15 years is a growing Alberta domestic market. The largest consumers are oil sands, petrochemicals and electricity generation.

According to the Canadian Energy Regulator, Alberta consumed 6.4 bcf/day of its own gas in 2020, 56% of total Canadian gas consumption. The “industrial sector” used 5.4 bcf/day, 84% of Alberta’s total.

Low gas prices certainly aren’t awful for oil sands producers, value-added petrochemicals, and electricity and gas consumers. While reduced Crown royalties from low gas prices are well publicized, there are other benefits such as rising bitumen royalties, corporate and payroll taxes in the petrochemical sector, and higher disposable incomes for retail electricity and gas consumers.

The cause of this summer’s price collapse was the temporarily restricted capacity of the Nova Gas Transmission Ltd (NGTL) system. NGTL is owned by TC Energy, the rebranded TransCanada.

The biggest change in recent years has been the development of large quantities of new gas production in the northwest, primarily from the huge Montney resource. Much of the gas is a by-product of the primary target, light crude and natural gas liquids. What this exposed is the capacity challenges of the NGTL system as more gas came from a different region of the province.

According to the Canadian Energy Regulator, NGTL is partway though a $9.9 billion infrastructure program that is intended to increase takeaway capacity by 3.5 bcf/day from 2020 to 2024. Coined “Eastgate,” fixed capacity has caused significant price fluctuations, particularly in the summer months, as gas from the northwest tries to find its way to storage reservoirs in the southeast during seasonal periods of lower gas demand and prices.

Price fluctuations have been exacerbated by maintenance and construction shutdowns and tolling arrangements that gave preferential access to contracted capacity. Producers have also been reluctant to enter into long-term shipping contracts because of low prices and challenging economic conditions.

During the summer months, spot prices have been brutal. From May to September in 2018, the average “reference price” was only C$0.88/MMBtu. US prices for same period averaged US$2.91. 2019 was worse, with AECO averaging only C$0.80/MMBtu. Henry Hub was at US$2.44.

Summer gas price collapses became a political issue for the new UCP government in 2019. By the 2020 summer season NGTL, CER and producers had negotiated a new tolling arrangement. Despite COVID lockdowns and restrictions, for these five months in 2020 AECO averaged C$1.76/MMBtu, almost double that of the previous year. By 2021 it was up to $C2.89/MMBtu, three times that of 2019.

It appeared Alberta gas producers were, by comparison, back in the chips.

But physical capacity reared its ugly head again in August 2022 as gas bound for storage was temporarily bumped. For five days from August 19 to August 22, AECO spot gas averaged only C$0.10/MMBtu. This was at the same time Henry Hub blew through US$9/MMBtu and European gas skyrocketed.

With Russian gas now a geopolitical weapon and energy prices in the daily news, it is understandable that this huge price disparity would attract media attention. It occurred at the same time that Canada hosted German Chancellor Scholz who was looking for secure, long-term, non-Russian energy supplies.

In one of many media events, Prime Minister Trudeau stated there was “no strong business case” for selling western Canadian gas to Europe via east coast LNG exports, even though the price spread was a staggering C$120/MMBtu.

Alberta’s gas price collapse was temporary and has already gone away. The August 25 futures prices for the last four months of 2022 per MMBtu were $4.70, $6.16, $6.81, and $7.48.

But they will still be the lowest in the world.

Germany’s visit to Canada educated many about the vastly changed global landscape for decarbonization, natural gas and LNG.

But the subject remains confused by politics.

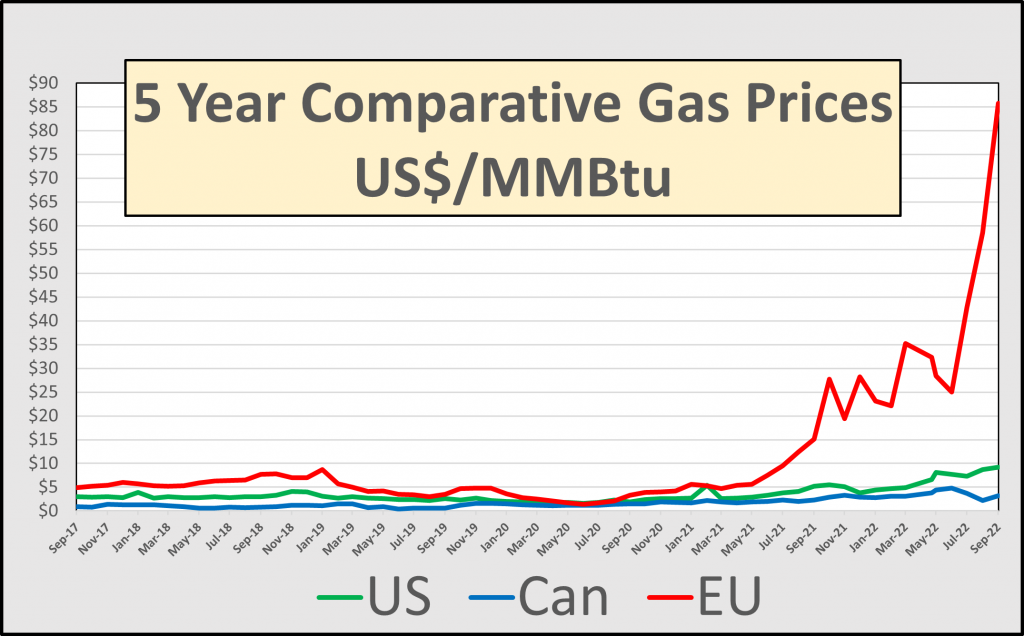

This graph illustrates Alberta, US and European gas prices for the past five years. All figures have been converted to US$/MMBtu.

As the data shows, except for the pandemic period in 2020 there has been a significant spread between US, Alberta and European prices. Seizing the opportunity, since 2016 US LNG exports have gone from nothing to as high as 13.5 bcf/day. Moving more gas out of the US is increasing domestic prices because the world’s largest producer is now connected to global markets.

Canada’s LNG exports remain at zero despite years of trying.

Since the European crisis emerged Canada has pledged more oil and gas to Europe as soon as possible. Earlier this month Finance Minister Chrystia Freeland uttered words not spoken outside of western Canada in years when she said, “We have a lot of energy. I think it is a political responsibility for us as a country to support our allies with energy security. This is a very tough moment for many European countries right now as they shift from their dependence from Russian oil and gas and I think it’s very important for Canada to step up and say, ‘We’re going to help you.’”

Because of events in Europe, there has been renewed interest in LNG exports from Nova Scotia and New Brunswick. Various comments from Ottawa indicate that the federal government will help expedite development for companies that wish to proceed.

Or so they say.

But at the same time that the Prime Minister was promoting hydrogen as the real long-term solution to Europe’s energy future, Trudeau stated, “We are looking right now and companies are looking at whether or not the new context makes it a worthwhile business case to make those investments. But there needs to be a business case. It needs to make sense for Germany to be receiving LNG directly from the East Coast. Those are discussions that are ongoing right now between our ministers, between various companies to see if indeed it makes sense.”

What is infuriating to western producers is central Canada’s perpetual political amnesia involving Quebec. It seems that Trudeau continues to go out of his way not to confront the elephant in the room on Canadian oil and gas exports, his home province.

One of the game-changing LNG export projects killed by Canadian climate politics was Energie Saguenay, a $9 billion project to create lower carbon LNG by using electricity to liquify gas. This is the same strategy as LNG Canada in Kitimat.

The project would require 750km. of pipe from northern Ontario to Saguenay and the blessing of various regulatory bodies. This would permanently connect Alberta to Atlantic tidewater with a high-capacity gas pipeline.

An original backer was Berkshire Hathaway. But what would Warren Buffet’s outfit know about the economics of LNG exports from eastern Canada?

However, Berkshire withdrew during the rail blockades in early 2020, concluding that Canada was no longer a safe and predictable place to invest. This was confirmed in July 2021 when the Quebec government cancelled Energie Saguenay for the good of the planet’s atmosphere. The federal government made a similar decision 16 days before the Russian tanks rolled into Ukraine.

Not satisfied with stranding Alberta gas and denying Europe low carbon LNG, Quebec then ensured that province would never produce any gas either by prohibiting oil and gas production.

In response to Trudeau’s LNG comments and Quebec’s natural gas decisions, two Quebec gas producers seeking financial compensation for their paralyzed investments have commented publicly.

Utica Resources CEO Mario Levesque stated, “The business case for Quebec gas is crystal clear. Quebec has enormous quantities of natural gas (about 20% of Canada’s total recoverable gas), enough to replace all Russian imports into Germany for 20 to 40 years.”

Questerre Energy Corporation CEO Michael Binnion added, “Our proven discovery is less than ten kilometers from an LNG export project with permits at Becancour and tidewater access to Europe.”

Adding more controversy and confusion to east coast LNG exports and indifference to Alberta’s rock bottom prices, a National Post article August 22 reported, “Trudeau said Canada’s best chance of helping its allies may be to continue supplying natural gas to global markets via existing pipelines to the United States, and then eventually through LNG exports on Canada’s West Coast, where the country’s only export terminal is under construction.”

One fact is clear. The largest responsible supplies of natural gas in the world that have been intentionally denied access to global markets are in Canada. There is growing criticism of Trudeau’s recalcitrance to increase LNG exports by whatever means the private sector deems viable.

What makes this more aggravating is the Liberal government’s refusal to even mention Quebec’s politically motivated interference in Canadian and international energy flows.

Back in Alberta, geography and plumbing will always keep wellhead gas prices below those of other producing regions.

When all factors like oil sands production, petrochemicals and low consumer energy prices are taken into consideration, this isn’t all bad.

But obstacles to Alberta seeking higher prices elsewhere in a world struggling with shortages is terrible national policy. This is unsustainable and no longer makes any sense politically or economically. This is yet another egregious blunder by a Prime Minister hopefully on the home stretch of his political career.

David Yager is an oil service executive, oil and gas writer, energy policy analyst, and author of From Miracle to Menace – Alberta, A Carbon Story. Find the book to www.miracletomenace.ca. He is President and CEO of Winterhawk Well Abandonment Ltd. which has commercialized a new casing expansion technology for improving annular wellbore integrity.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Alberta’s World-Class Regulator and Regulatory System – Brian Jean, Minister of Energy and Minerals for Alberta