Inter Pipeline shares surged 3.2% to C$20.91 at 4 p.m. in Toronto trading for its biggest jump since June 2, while the stock of Brookfield Infrastructure Partners fell 2% to $54.54 in New York.

Brookfield’s latest move puts additional pressure on Inter Pipeline’s board to secure a better deal from Pembina, which has offered no cash and 0.5 of its shares for every Inter Pipeline share. Pembina’s stock slipped 0.4% to C$39.25 on Thursday, making its offer worth C$19.63. Spokesperson for Pembina didn’t immediately respond to requests for comment.

“We are assuming that Pembina raises its offer in response to the higher Brookfield Infrastructure Partners offer,” CIBC Capital Markets analysts led by Rob Catellier wrote in a note to clients. “We think there is more value to Pembina shareholders if they were to acquire IPL, even at a higher price.” The bank raised its price target for Inter Pipeline to C$21.50.

Brookfield said it engaged with Inter Pipeline and Pembina and offered to acquire some Inter Pipeline assets so that Pembina could “enhance” its bid. The companies declined to discuss the proposition, Brookfield said in its statement.

No formal revised offer has been made by Brookfield and shareholders needn’t take action at this time, Inter Pipeline said in a statement. When a formal offer is made, it will be reviewed by a special committee. “A formal recommendation by the board will be made to shareholders in due course,” the company said.

The fight over Canada’s fourth-largest pipeline company follows years of failed attempts to build major projects like TC Energy Corp.’s Keystone XL and Enbridge Inc.’s Energy East, which may have made existing lines more valuable. Inter Pipeline owns pipeline infrastructure across Western Canada, connecting oil and natural gas producers with domestic and foreign customers, as well as storage assets in Europe.

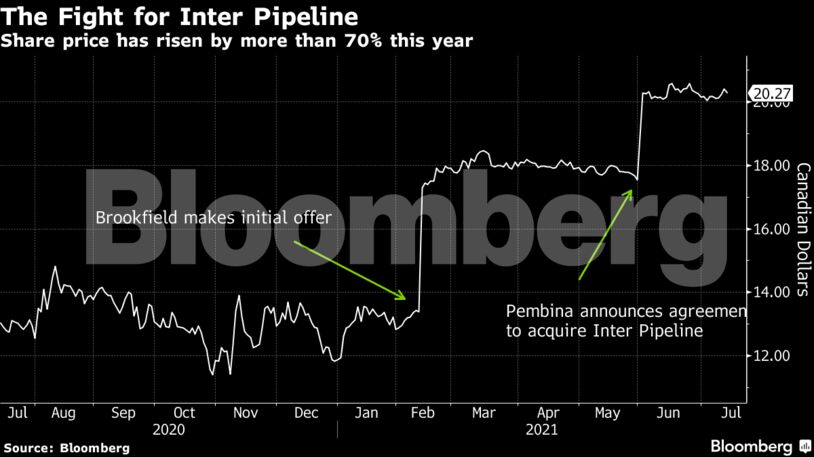

The takeover saga started in February with a C$7.1 billion offer from Brookfield that was rejected by Inter Pipeline’s board. The Calgary-based pipeline operator then announced an agreement with Pembina on June 1, and Brookfield has since revised its bid three times.

The two sides took their fight to the Alberta Securities Commission, where Pembina and Inter Pipeline challenged Brookfield’s disclosure and its use of total return swaps to build an economic stake of nearly 20% in Inter Pipeline before launching its bid and Brookfield challenged Inter Pipeline’s defensive tactics.

The merger partners won a partial victory this week. The Alberta regulator ruled that for Brookfield’s bid to succeed, it would have to get 55% of Inter Pipeline shares instead of 50% plus one, to take into account the votes attached to shares tied to the swaps. Brookfield’s own petition was denied. That decision increased the pressure on Brookfield to revise its bid again.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS