Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

In March, we published an overview of the Pembina play focusing on ownership, production history, and liabilities in the northern part of the region. This week, we’ll leverage XI Technologies’ drilling data to give an overview of drilling trends in the formation. This follows similar overviews we’ve published drawing on XI Technologies’ enriched industry data for the Montney and Duvernay formations.

Geology in Pembina and Central Alberta

As in Grande Prairie region (Fox Creek, Kakwa, etc), there’s some overlap in terms of targeted plays. To profile the highly sought-after production in the Pembina field for example, you’ll see drilling activity targeting a range of formations, from Upper Cretaceous (Belly River, Viking) to Devonian (Duvernay, etc)

For this article, we’ll focus on the play that is getting the most attention: Cardium (and other members of the Cretaceous period).

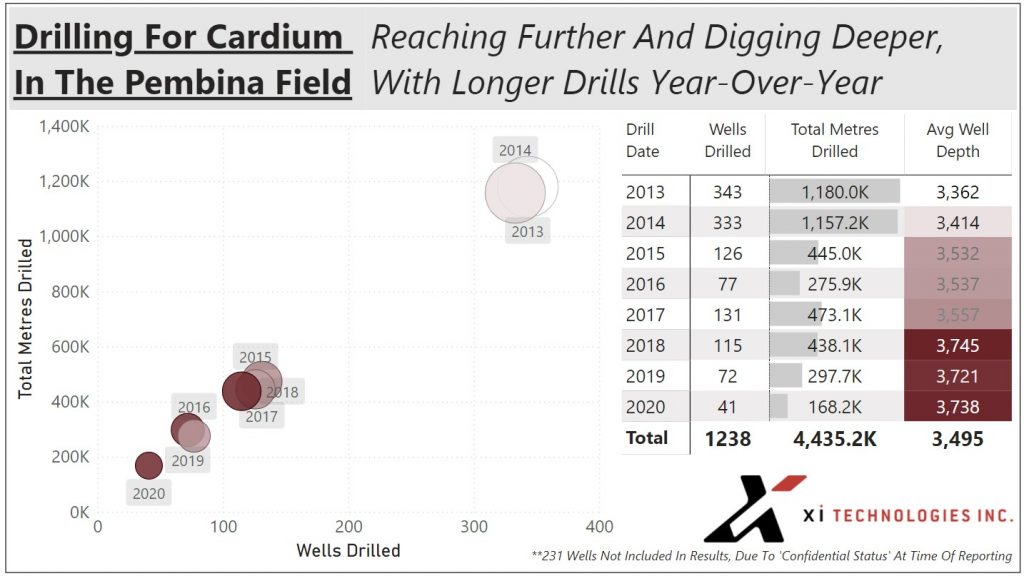

2014 marks a big shift in Pembina/Cardium drilling

It’s hard not to notice the significant drop in drilling across all Cardium players in 2014. That year represented a major turning point for drilling, as many companies turned their sights to new plays like Montney and Duvernay, while others simply pulled back investment in this well-established play.

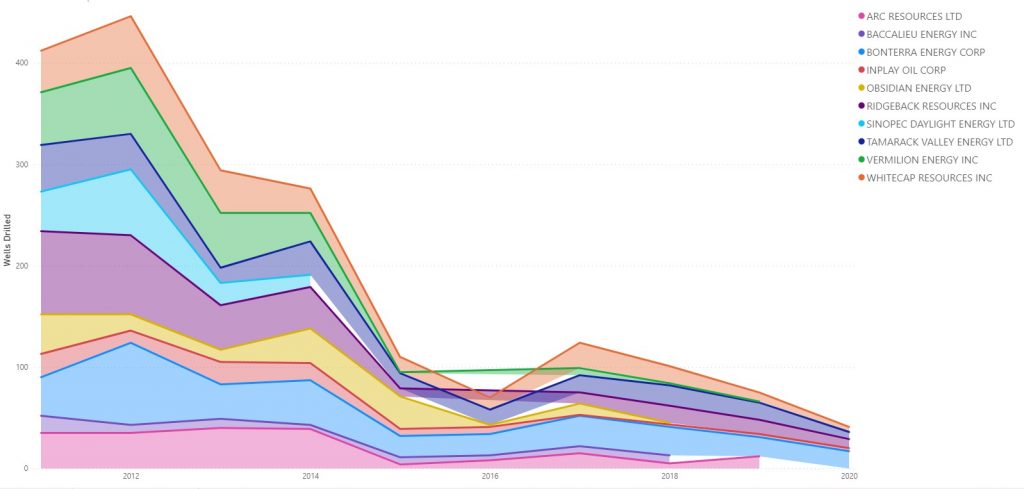

Most active operators

Bonterra Energy Corp has consistently maintained the top spot for the past 5 years of being the most active Cardium driller in Pembina, followed by Tamarack Valley Energy Ltd, Whitecap Resources Inc, and Ridgeback Resources Inc.

Looking further back in the history of this play, we see much of the same, but with a few other noteworthy findings.

Many of the top operators pre-2014 have remained active in the area since (though scaled-back significantly). For other companies, this 2014 shift may represent a different story, projecting a more permanent shift in priority in the area. Several companies who’d scaled back Cardium drilling either haven’t returned, or remain only in a very limited capacity, like Vermilion Energy Inc, Obsidian Energy Ltd, and ARC Resources Ltd.

Trends in wells drilled and well depths over time

As previously noted, and as shown here, the number of drills dropped significantly after 2014. Take note however, that while the well count dropped, the avg well length has risen from 3,300m to over 3,700m.

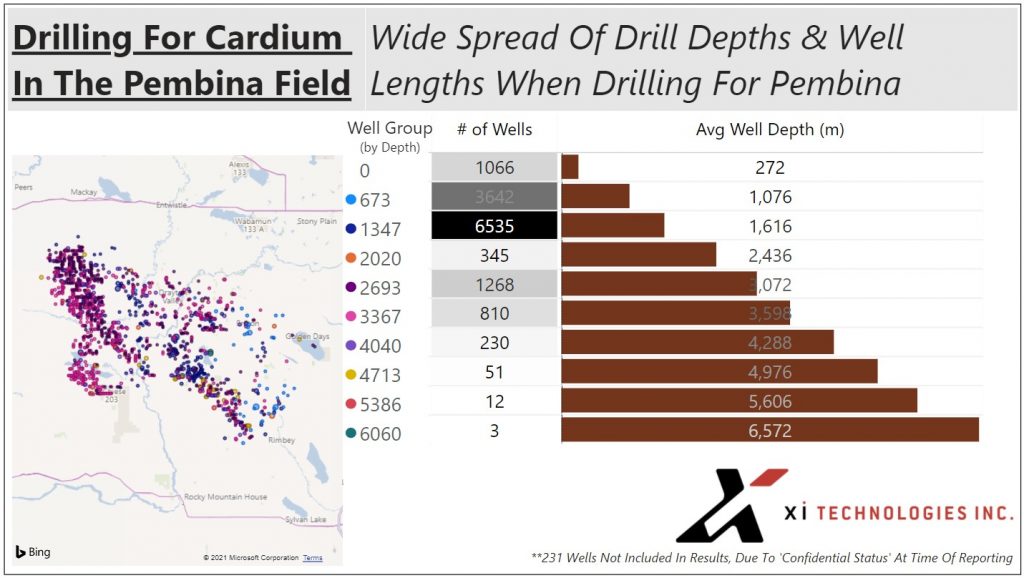

Still, as we look at the big picture of well profiling (by depth) over time, the majority of wells drilled remain in the 1,000-2,000m depth range. If renewed activity in this play continues to gain momentum, expect these figures to change with the “new normal” of longer reaching laterals has taken hold.

Click here to view a free an interactive dashboard with the above data on the Cardium Play.

To learn more about how XI’s OffsetAnalyst software can help you improve drilling research and performance, contact XI Technologies.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS