By David Yager

September 21, 2020

“The only thing certain about oil is uncertainty.” This earth shattering profundity was shared with me in 1990 by Dr. Subroto, then Secretary-General of OPEC.

Every time somebody predicts with great confidence what oil prices, production and demand will do next I’m reminded of his comment. Oil forecasters have been so wrong so many times in the past 30 years.

The COVID-19 pandemic has radically altered global oil markets and the behavior of every participant from reservoir to consumer. When it will end and what the world will look like thereafter is murky at best.

This was a major and unprecedented event that changed everything almost overnight. Yet based on only seven months of data, endless speculation continues about what the post-COVID oil world will be.

The most remarkable aspect of the COVID-19 mess is the unbelievable accuracy with which so many are able to forecast the future of oil markets.

While the messages are as diverse as the sources, the most common assertion is that peak oil demand has either passed or is imminent. COVID-19 has destroyed the economy and continued use of fossil fuels will destroy the world.

So it’s over for oil. Not if, but when.

But the most critical question remains unanswered. Will the pre-COVID playbook of battling climate change at almost any cost be the same after the world comes to terms with post-COVID economic reality?

It can’t be.

But the climate crisis phenomenon has too much critical mass after a quarter century to change course quickly. Or accept that its influence on public policy will be greatly diminished.

The latest entrant into the post-COVID end-of-oil thesis is BP in its 2020 version of its world Energy Outlook. BP has annually published an encyclopedic analysis of energy markets for years and has established itself as a consistent, credible and reliable source of key data.

At least it used to be. This year’s version reads more like an ESG tout sheet to convince institutional investors that BP shares should be treated like Tesla and the turbocharged FANG stocks that are dominating trading and are the only equities rising in value.

In past years BP has reported historical data and forecasted it forward. But with climate change, BP has increasingly turned its attention to the impact of government policy and low-carbon energy on the future of fossil fuels.

Consistent with the message coming out of all oil producers which have embraced the mantra of “net zero by 2050”, BP’s 2020 version is the most political ever.

The full report opens with, “In February of this year, BP announced a new purpose – to reimagine energy for people and our planet. This purpose was supported by a new ambition, to be a net-zero company by 2050 or sooner and to help get the world to net zero. Our new purpose and ambition are underpinned by four fundamental judgements about the future. That the world is on an unsustainable path and its carbon budget is running out. That energy markets will undergo lasting change, shifting towards renewables and other forms of zero or low carbon energy. That demand for oil and gas will be increasingly challenged. And that, alongside many others, BP can contribute to the energy transition that the world wants and needs, and create value doing so.”

BP no longer works just for its shareholders. It now exists for all of mankind. But we’ve seen this movie before. Years ago it nicknamed itself Beyond Petroleum. Then in 2010 BP spewed millions of barrels of oil into the Gulf of Mexico in the massive Macondo massive subsea blowout.

BP has now transitioned into weather forecasting as it lays its fossil fuel consumption and CO2 emission forecasts alongside the required emission reductions to cap what the IPCC foresees as an otherwise inevitable rise in temperature of the earth’s atmosphere.

BP has three models for fossil fuel consumption and harmful emissions which, for BP, are now the same thing. They are “Business As Usual”, “Rapid” replacement of fossil fuels by renewables, and “Net Zero” by 2050.

Source: BP Energy Outlook 2020 downloads https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/energy-outlook-downloads.html

The Business as Usual case is based on population growth, GDP and the gradual replacement fossil fuels over the next 30 years. BP sees oil demand gradually declining from the 100 million b/d at which 2020 began to about 92 million b/d by 2050.

The Rapid case is more aggressive. Here, world governments stick with the pre-COVID playbook and force the world down the path of continued and accelerating adoption of renewables. This will be assisted by ever-declining costs and technological advances. This scenario sees world oil consumption falling by nearly half, or 50 million b/d, by 2050. Half the producers in the world will have to exit the business. This will be assisted by a price collapse as supply continues to outstrip falling demand.

The disturbing case if you’re in the oil business is what the industry will look like if all these companies, producers and governments actually deliver on the Net Zero by 2050 commitment. In this case world oil consumption falls by 70% or 70 million b/d.

BP’s messaging is a significant departure from the past because it is the first time that a legacy supermajor has forecast the obsolescence of its own historic source of revenue and earnings.

And bragged about it.

The most troubling aspect is the two major decline scenarios apply pre-COVID thinking to a post-COVID world. As most know, a great deal of the penetration of renewables into the global energy mix has been forced and/or encouraged by significant government policy and subsidies. As was evidenced in Ontario past years and California in the past few weeks, the mandated replacement of fossil fuels by renewables for electricity has been expensive and risky.

California could no longer reliably supply electricity to its citizens during the recent heat wave. Refusing or being unable to supply energy on demand will most certainly cap consumption.

So who buys oil, coal and natural gas? Where is demand growth coming from? Who is BP and others speaking for or speaking to?

To offset the impact of the COVID-19 lockdown, world governments have borrowed and distributed a staggering US$9 trillion. Canada and Alberta’s borrowings and budget deficits are off the charts. There is no end in sight for aggressive spending.

Figures on the cost of achieving net zero by 2050 are huge. A recent report from the Energy Transitions Commission titled Making Mission Possible – Delivery a Net-Zero Economy puts the total cost at US$46 to US$55 trillion, or US$1.5 to US$1.8 trillion per year. It sees fossil fuel demand declining dramatically and anticipates continuous technological improvements in all non-carbon energy and materials options.

But of course the report begins by noting that the huge cost is nominal compared to the economic and human expense of doing nothing and leaving the world at the mercy of unchecked climate change.

So COVID be damned. Governments must do more, not less. There is a lot of noise from the usual suspects like the UN, IEA, environmental activists and progressive politicians that the government mandated and funded fight against climate change cannot stop just because the economy has collapsed and unemployment, bankruptcies and government spending are at record levels. Big tax increases cannot be far behind.

The converted preach that the world must not ignore climate change just because we’re all going broke. Be assured nobody involved in creating and reinforcing this message has missed a paycheque or a meal.

But when all 7.8 billion earthlings are considered, is this a force that can actually be directed and managed? When 7.8 billion people wake up tomorrow morning and do what they do every day – deal with the necessities of life like food, clothing, shelter, electricity, health, medicine, education, safety and transportation – is climate change on their mental agenda? Does it even register?

Because with the exception of the few people who still live in isolated jungle tribes in South America and southeast Asia, everybody on Earth is a fossil fuel customer at some level. Fuel. Lubricants. Electricity. Plastic. Medicine. Chemicals.

The Organization of Economic Cooperation and Development (OECD) is comprised of 37 economically advanced member countries in Europe, the Americas, and the South Pacific. South America is represented only by Columbia and Chile. The most populated part of the world, southeast Asia, has only two members; New Zealand and Australia. Africa has none.

But the OECD is not where oil demand is growing, nor has it been for some time. At 53 percent of world oil consumption, OECD economies consume more oil than the non-OECD countries combined but have much lower oil consumption growth rates. OECD oil demand actually declined in the decade between 2000 and 2010, whereas non-OECD consumption rose 40 percent during the same period. Between 2003 and 2019 China’s oil consumption more than doubled from 5.3 million b/d to 13.7 million b/d and now accounts for 14% of total global oil demand.

The population statistics are even more startling. Only 1.3 billion or 17% of the world’s 7.8 billion people live in OECD countries. The other 6.5 billion or 83% billion don’t. These are the people who want part of the good life that the wealthy have enjoyed for decades, even centuries.

The per capita primary energy consumption statistics are staggering and grossly unfair. The Energy Transition Committee’s report and International Energy Agency publish the following data in gigajoules (GJ) per person per year, and tonnes of oil equivalent, or toe.

| GJ | toe | |

| United States | 285 | 6.8 |

| Saudi Arabia | 268 | 6.3 |

| Russia | 218 | 5.3 |

| Australia | 214 | 5.1 |

| OECD Average | 173 | 4.2 |

| China | 93 | 2.3 |

| World | 72 | 1.7 |

| Brazil | 58 | 1.4 |

| Non-OECD Average | 51 | 1.2 |

| India | 29 | 0.7 |

| Ethiopia | 16 | 0.4 |

Another way to look at it is 7.8 billion people were consuming 100 million b/d of oil at the end of last year, an average of 4.7 barrels per person/year. Should the 6.5 billion people in non-OECD countries consume one more barrel per year each, this equates to an additional 18 million barrels daily.

The entire end-of-oil narrative comes from countries and organizations consuming nearly three times as much energy as the world average and four time that of non-OECD countries.

Do as I say, not as I do.

When I researched and wrote From Miracle to Menace – Alberta, A Carbon Story last year, my conclusion was that the growing public concerns over the impact of fossil fuel emissions on the climate was almost exclusively confined to wealthy countries and individuals who no longer had to worry about the material necessities of food, clothing and shelter. Fossil fuel driven prosperity created the luxury of people able to focus more their attention on emotional issues like climate change, gender equity and, more recently, racial equality.

What none of the oil prognosticators are considering is that with the economy in tatters, will what mattered in January of 2020 still be as important in January 2021?

Climate change has been a growing issue for decades, but even a year ago this was not something people were actually willing to pay for. An IPSOS poll conducted for Global News in September of 2019 revealed that while the climate was indeed a concern, 46% had no interest in paying any more in the form of taxes or higher costs to reduce carbon emissions. Only 22% would pay up to $100 more per year and only 8% would voluntarily contribute $100 to $200 annually.

That was when the economy was still frothy.

Despite all the advice about what the world must do next with oil and climate change, in global polling conducted by IPSOS in August, the environment didn’t make the list of the top five issues. They were, in order of importance, COVID-19, unemployment, poverty and social equity, financial and political corruption, and crime and violence.

Among 19,000 people surveyed in 27 countries, 60% thought their nation was going in the wrong direction while only about one-third thought their countries were on the right course. In the US 74% of Americans now believe things are going badly, an all-time record according to IPSOS. That figure was only 56% in January.

This doesn’t look like a voting populace ready to pay more for fuel and electricity today to prevent possible climate impacts in 10, 20 or 30 years. Most folks watch their bank balances much more closely than computer climate models. Groceries, not Greta.

Closer to home, the Business Council of Alberta polled Canadians about their views about the economy. This revealed 71% believed doing what our country has always done best – exploiting resources – should be a key ingredient of any economy recovery strategy. Three-quarters responded that Canada could continue to develop resources and protect the environment simultaneously.

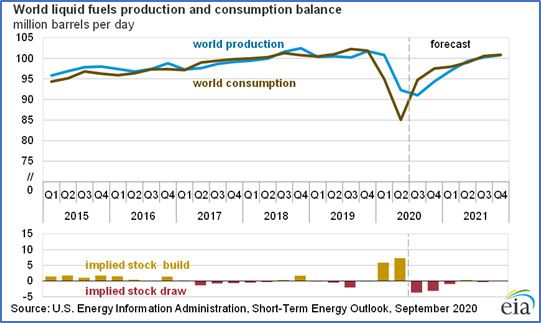

An oil forecaster without a political agenda is the Energy Information Administration (EIA) from Washington DC. Its most recent world oil price supply/demand forecast through to the end of 2021 sees a recovery to 2019 consumption levels within a year.

EIA sees demand already recovering in August with consumption at 95% of pre-COVID levels by the fourth quarter of 2020. If this data is correct, the world will exit 2021 back above 100 million b/d. In the short term, red bars on the above graph are inventory declines which will continue for six quarters after rising in the first half of 2020. US production is dropping because of reduced drilling and high decline rates in shale oil reservoirs. There is reduced investment in new supplies globally. This is causing more forecasters to predict oil prices going up in the short term, not down.

WTI traders on NYMEX clearly haven’t read or don’t believe BP’s report. At the September 18 close WTI, was rising steadily every month for the next ten years.

Other commentators believe that oil demand will never recover to 2019 levels because consumers won’t be able to afford to buy it. However, the history of gasoline prices and demand prove otherwise. Fuel demand is almost inelastic because it is essential. When it comes to the necessities of life which includes energy and plastics, will people voluntarily get by without them? Will those needing heat resume burning dried dung, grass and wood? Will those without electricity return to life without it?

The elephant in the room for the future of oil is can or will governments continue to press onward with an aggressive forced energy transition program in the post-COVID world?

The primary goal of any administration right now is put people back to work, quit borrowing trillions, and keep tax increases to a minimum.

Does replacing low cost, plentiful and reliable fossil fuels with more expensive interruptible renewable energy have anything to do with that?

What is equally significant – but never mentioned – is that fossil fuel production and consumption create significant tax revenues for governments because the entire supply chain is taxed continuously from the reservoir to the point of sale.

The allegation that fossil fuels are subsidized is based entirely on theoretical future climate costs, not cash. We’ve learned the hard way from wind and solar in multiple countries that renewables are heavily subsidized by comparison. Even when they don’t cost consumers more, the downside is the government tax stream from production to consumption is minor compared to fossil fuels, and too often negative.

New wind and solar are said to be cheap in Alberta. Sure. At the source. That’s because the line charges to get the juice to your house are baked into everyone’s bill every month whether renewables are generating electricity or not.

Isn’t that a subsidy?

Governments have borrowed and spent trillions to blunt the impact of the forced shutdown of the world economy. So far this has disguised the true extent of the damage to private sector employment, business confidence, and personal and corporate wealth. This cannot continue.

There has been strong political support for government intervention on climate change mitigation for most of this century. The end of oil narrative assumes this will continue for our collective good. Therefore fossil fuels are doomed.

But will those governing the 6.5 billion inhabitants of the developing world actually force their flock to pay more for anything? Energy and fossil fuel products included?

No.

The brute force of 7.8 billion people making 7.8 billion individual purchasing and lifestyle decisions every day will be what decides the future of oil. Post-COVID, the restricted ability of governments to intervene in the future of energy as they focus on keeping everyone alive will keep oil relevant and valuable.

David Yager is an oil service executive, energy policy analyst and author of From Miracle to Menace – Alberta, A Carbon Story. More at www.miracletomenace.ca

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow