By Alex Longley

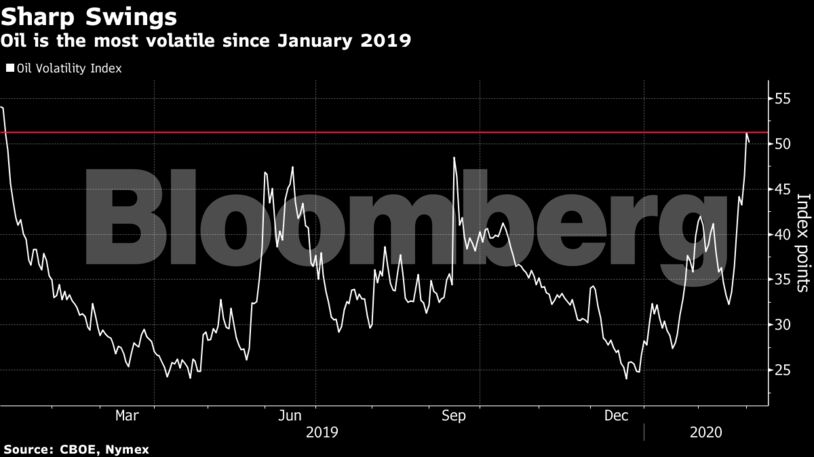

All but two of 29 analysts, traders and brokers in a global poll predicted that the Organization of Petroleum Exporting Countries and its allies will announce new curbs, with an average expectation of 750,000 barrels a day. Whether that’s enough to stabilize the market and rein in oil volatility — which has surged to the highest in more than a year — remains to be seen.

“Easing from central banks may offer some respite to markets, but ultimately what markets need to see is a peaking in the outbreaks outside China,” ING Bank analysts Warren Patterson and Wenyu Yao wrote in a report. “OPEC+ will need to surprise the market with the level of cuts if they want any chance of pushing prices higher.”

West Texas Intermediate futures for April delivery rose 3% to $48.17 a barrel on the New York Mercantile Exchange as of 8:37 a.m. local time. Brent futures for May climbed 2.7% to $53.29 a barrel on the ICE Futures Europe exchange.

The total number of coronavirus cases worldwide topped 90,000 on Tuesday. G-7 finance chiefs, including U.S. Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell, were on the rare conference call Tuesday and are among the policy makers under pressure to back up pledges to shield markets.

OPEC and its allies will gather in the Austrian capital on Thursday and Friday. The average estimate in the Bloomberg survey is only slightly above the 600,000 barrel-a-day cut recommended by the organization’s technical committee last month. Russia’s energy minister said Monday that the country is focusing on that recommendation and hasn’t received any proposal from OPEC+ for a larger cut.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS