March 30, 2020

By David Yager

It is now clear that sometime in the second quarter the world’s oil industry will be facing the most difficult financial challenge in its existence. Storage will be full, production will exceed demand by 10 million barrels per day or more, and unhedged production will only fetch a fraction of lifting and operating costs. Free cash flow from production is collapsing. Even the world’s lowest cost producers will operate at a loss.

Natural gas, the rump of the business in recent years, looks positively prosperous by comparison. Thankfully, it will help pay the bills for the next few months for operators which own some.

Western Canada Select was below US$5 a barrel on March 27. Canadian storage is filling fast. It costs more to ship some oil than it is worth. Depending on the product mix, hedging contracts, debt obligations and take-or-pay shipping commitments, some companies could stop producing, fire everybody, spend nothing on operating and still hemorrhage cash. Balance sheets will be decimated. Lenders will hold their noses and hopefully slash the cost of letters of forbearance.

Oil consumption contraction is breathtaking. Jet fuel alone, some 8% of the world’s 100 million barrels of daily oil demand, is forecast to be down 50% by April. Demand for gasoline and diesel for cars and trucks, half of every refined barrel, is plummeting. The International Energy Agency opined March 26 that in the next two months oil demand could fall by a staggering 20 million barrels daily as one in five barrels has no buyer.

The rapid and varying country-by-country responses to halt the spread of COVID-19 has resulted in the most unprecedented decline in world oil demand in history. Nobody moves, nobody gets hurt. Transportation by air, sea and land has dropped precipitously taking oil consumption with it.

So here we are.

The other thing that has dropped precipitously is the genius behind Saudi Arabia and Russia’s publicly stated commitments in early March to flood the market with more oil, resulting in a price and market share war. The idea these countries would increase production to punish each other at the same time the world quit buying their product is so fundamentally flawed it defies belief.

Tankers of Saudi crude will arrive in the Gulf of Mexico and other offloading ports with no place to store the oil. Russia will be shutting in production when all the storage tanks in Europe and China are overflowing. What were they thinking? Do they not read the news in Riyadh and Moscow?

Their petulant, selfish and myopic political posturing demonstrates massive ignorance or disdain for the world markets they serve and for their important role in a planet they share. Surely even oil haters would accept this as the textbook definition of predatory product dumping to destroy higher cost competitors.

Governments have an obligation to protect domestic industries from such clearly egregious trade practices. In North America we can do that. And we must.

Preparations for the worst is underway. Thousands of layoffs have already taken place with thousands more to follow. There has been continuous talk about government aid programs at multiple levels; a series of financial support initiatives ranging from debt relief to income supplements to stimulus programs for well abandonments and site reclamation. That this is needed and coming is in the news every day. Income supplements will certainly help unemployed workers, but the balance sheet and cash flow support measures will likely be inadequate.

Someday the COVID-19 global pandemic will end and we’ll do something else. Things will get better because they can’t get worse. Lots of time for reflection down the road.

But today the oil industry is a special and different case. Most people don’t comprehend the size and breadth of the infrastructure required to keeping oil producing and civilization moving; the massive network of thousands of specialized service and product suppliers which employ millions of people across North America.

Because if you shut this machine off even for a few months, who will be around to turn on the lights when the power comes back on?

When storage fills and millions of barrels of daily production are shut in because there is no place to put it, the economic and logistical damage will be staggering, particularly in North America. Some speculate oil may go to no bid like it did during the painful but brief Canadian price crash of late 2018.

The structural damage to supply infrastructure won’t be immediately apparent. With so much oil in storage there will be no short-term shortage of crude when demand rises.

But when the recovery everyone is praying for gets underway, only then will people realize what happened to the still-essential oil supply chain. The 45-year determination of the west to rid itself of being held hostage by foreign oil producers will be materially damaged.

It is glaringly obvious that North America’s political leadership must take a longer-term view than tomorrow’s televised news conference and endless platitudes of deep concern in the public interest.

Politicians have figured out what they must do to preserve the airline industry. It is simple. Send money until they are permitted to resume selling tickets.

Oil is more complex. It is time to have a serious and more intelligent discussion of what it is going to be required to preserve, stabilize and secure the North American oil industry.

Here’s my contribution.

**********

North America is very close to being self-sufficient in petroleum. Using simple oilpatch vernacular, if they were so inclined the signatories to the recent USMCA Trade Agreement (United States, Mexico, Canada) could tell the rest of the world’s petroleum producers to pound sand.

The combined oil production for North America is 19.3 million b/d comprised of the US at 13 million b/d, Canada 4.5 million b/d and Mexico 1.8 million b/d. What could become fortress North America produces nearly 20% of the world’s oil.

This is very close to pre-COVID demand. Normally North American consumption totals 24.4 million b/d comprised of the US at 20 million b/d, Canada 2.4 million b/d, and Mexico 2 million b/d.

In the current market environment, if North America had a coordinated strategic oil supply policy, we could be completely insulated from the current global oil market chaos. Assuming a 20% reduction in consumption, we’d need about 19.5 million b/d. That would be in near-perfect balance with supply.

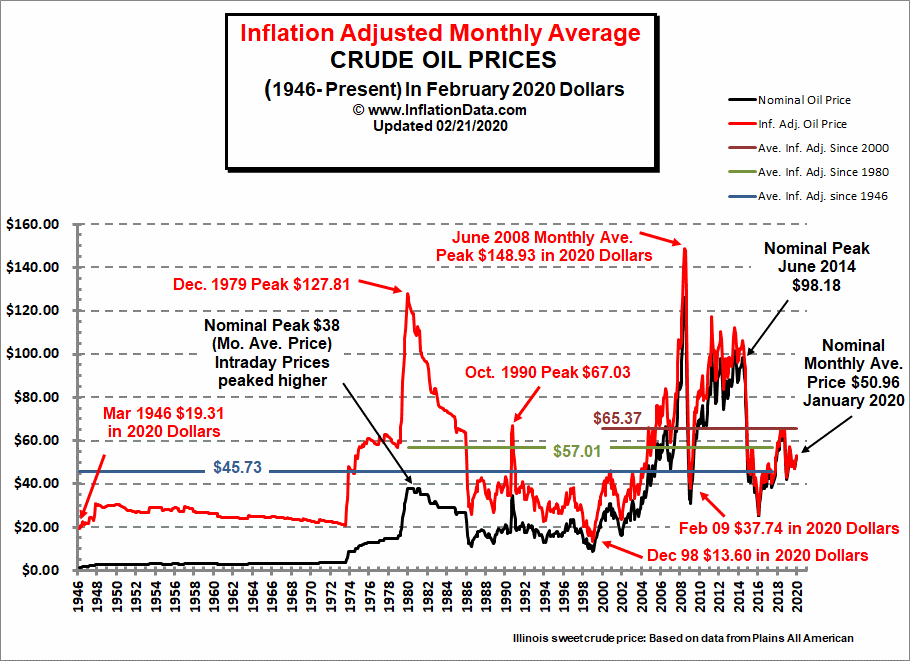

The USMCA should be expanded to incorporate preferential policies for domestic production and a floor price of US$45 a barrel. When world prices rise domestic prices would rise in kind. When they collapse US$45 will be the basement. North American taxpayers, who will be funding financial support for their oil industry one way or another, would pay more at the gas pump. Consumers would still get a US$20 a barrel inflation-corrected break on average oil prices this century (see chart below) but would be spared the future compound interest on borrowed money for wage subsidies or balance sheet support required to sustain the continent’s oil producing infrastructure. Individual investors, mutual funds and pension funds would be spared hundreds of billions in investment losses. Having an essential industry like the oilpatch working every day during the COVID-19 mess would be a valuable contribution to sustaining a crippled economy.

US$45 a barrel is not charity. According to the following chart, in inflation-corrected 2020 dollars this is the average price for the last 74 years. Even then not every producer would be profitable. There will not be enough free cash generated to sustain aggressive capital programs or prevent a massive correction and/or consolidation among high cost producers and over-levered producing and supply companies.

Source: www.inflationdata.com based on the price of Illinois light sweet crude with data from Plains All American, a pipeline and midstream company.

But the support infrastructure to keep the production on stream would be supported by consumers and producers, not a complex and incredibly inefficient patchwork of wage subsidies, loan guarantees, and other government-managed survival programs.

Of course, this will be attacked because it will be seen as the heavy hand of government interfering in the “free market”, a myth the oilpatch cherishes and repeats with near-religious fervor. But surely at a time like this we can admit that a global free market in oil is fraudulent. It is not a free market and has not been since OPEC started flexing its muscles in 1973.

From the end of the second world war to 1973 the price of oil was about US$3 a barrel in nominal dollars and the world thought that was perfectly acceptable. Profits were earned, oil was discovered, and consumers had reliable supplies as demand grew. The business was simple and predictable. Unlike today, WTI was not the world’s most heavily traded commodity trading an average 1.2 billion dry barrels daily, 60 times the 20 million produced or “wet” barrels which are priced off WTI.

Starting 47 years ago with the first Arab oil embargo, one way or another OPEC has been driving the bus through supply management. OPEC and other political events in the Middle East caused oil to start rising in 1973 and spiking in 1979 thanks to the Iranian revolution. The price increase caused massive investment in non-OPEC supplies from Alaska and the North Sea and helped make Canada’s oil sands economic.

For the first few years of the 1980s as more non-OPEC production entered the market, Middle East supply management took a different form. The price was sustained by the long and bloody Iran/Iraq war. Prices collapsed in 1986 when Saudi Arabia, which had shut in nearly 7 million b/d to keep the price up, refused to go it alone.

In nominal dollars oil fell from US$38 in 1979 to only $US11 in the summer of 1986, the first big price collapse. The oil industry in Canada and the US was devasted. Only another OPEC supply management agreement in late 1986 stabilized prices at about $US18. Thereafter the price of oil didn’t rise in real terms for 15 years.

This century OPEC supply management has been a curse and a blessing. Rising prices, technology and capitalist ingenuity combined to make shale oil and oil sands economic. Pressured by rising production from North America, in late 2014 OPEC production restraints fell apart and oil prices collapsed. After two years of suffering, in late 2016 the reintroduction of OPEC supply management – coined OPEC+ which now included Russia – brought the price back up.

In early March Saudi Arabia and Russia disagreed in the face of a major demand crash. You know the rest.

In North America – home of “free market” rules – US producers responded to late 2016’s OPEC+ supply management by adding another 4 million b/d of some of the world’s most expensive crude.

Oblivious to the fragility and source of oil’s floor price, this century the US embarked on an irrational strategy of suck and blow.

Starting in 2000 an act called NOPEC, or No Oil Producing and Exporting Cartels Act, started making its way through Washington. The idea was oil prices were too high due to the uncompetitive structure of the cartel. The intent was to strip OPEC members countries of sovereign immunity thus paving the way for litigation for anti-trust violations.

Wikipedia writes, “Varied forms of a NOPEC bill have been introduced some 16 times since 2000, only to be vehemently resisted by the oil industry.”*

Free market indeed.

At the same time, the US oil industry took advantage of OPEC+’s price support and increased production significantly which has put continuous downward pressure on price. This strategy collapsed the price in 2014 and again in 2020. Only this time oil had COVID-19 to contend with.

For the past five years many observers have watched the US shale oil boom with awe and amazement. Much of the growth was funded by debt, not cash flow or equity. The markets figured this out a year ago and extrapolated growth curves of rising US production have been reversed. The US shale oil party was doomed long before the horrid events of the last two months.

Canada also put a lot of oil on stream thanks to OPEC. The oil sands would not exist in their current form without non-free market supply management. That said, through forced economic efficiency oil sands production has also become a stable, long-term supply of oil, jobs, taxes. US shale oil costs a lot less up front but it doesn’t appear to have much staying power either. As is always the case, you get what you pay for.

And while it might be rightly classified as economically fragile, North America has almost achieved the oil self-sufficiency it so desperately sought decades ago. Should Mexico finally decide to use Pemex to produce oil, not buy votes, it could likely increase its output at a lower cost than US shale or Canadian oil sands.

Security of supply for strategic reasons, the big issue following OPEC’s first global muscle flex, has been largely forgotten. It was the alleged primary purpose of Pierre Elliot Trudeau’s National Energy Program in 1980. Deregulated oil prices became popular in the 1980s only because this was thought to be less awful than the below-market government mandated prices implemented during the first big oil spike of the 1970s. Governments eventually welcomed deregulation only because oil prices were going down, not up.

Looking back, one can observe the bizarre partnership between OPEC and western producers – where the former controlled supply and price and the latter pretended to be guided by free market forces – has worked well for consumers. Notwithstanding the extreme volatility for those in the business, nobody has run out of fuel and as the chart illustrates, the price in real terms has not risen materially.

But without rethinking the North American approach to oil, right now we’re looking at tossing the keys to the bus back to drivers on other side of the planet.

Supply management and pricing intervention is hardly foreign to North America. It is deemed essential for agriculture in many markets. Electricity, the next most common source of energy, is heavily regulated. The US and Canada routinely protect producers of steel and other manufactured products from foreign competition through tariffs and allegations of dumping.

The US and Canada have fought long and expensive trade disputes over softwood lumber and dairy products. Both countries have a long history of import tariffs on each other and products from other continents. This is among friends and allies!

If there was ever a case that foreign countries are intentionally dumping their product into North American markets to destroy the domestic industry, surely the behavior of Saudi Arabia and Russia over oil must be the most egregious. On March 28 Alberta Premier Jason Kenney raised the issued publicly and talked about joint action with the US. This included working together with Washington to protect the North American market and discuss import tariffs on foreign oil to support the domestic industry.

Tragically, the idea is coming out of Edmonton, not Ottawa.

Oil always gets special treatment, never favorable. Block the oil sands and pipelines and west coast tankers. Then import oil from questionable foreign countries and ship it by tanker down the St. Lawrence River. Oil producers have been vilified in one form or another for nearly 50 years for a multitude of crimes. Regarded as greedy, ruthless, price-mixing profiteers in the 1970s, this century oil has been rebranded as the end of life on earth as we know it because of carbon emissions.

Meanwhile, as oil producers were regarded as pariahs everyone bought and depended upon their products. And complained continuously about the price.

It is unlikely that North America can restructure its oil markets and supply strategies in time to fend off the looming economic tsunami. US President Donald Trump has speculated about reaching out to Saudi Arabia and Russia to try to broker something more intelligent. The venerable Texas Railroad Commission is on the record as willing to reinstate prorationing to sustain prices, something it invented nearly a century ago. The Alberta government, which now calls prorationing curtailment, has used this instrument extensively in the past, did so again a year ago, and is said to be considering it now.

Should this idea gain traction there will be immediate opposition from within the industry and the broader public.

Integrated producers likely to survive will undoubtedly be opposed. They have a business model that has survived the test of time. What they don’t make at the wellhead they capture at the gas pump.

Among the public the anti-oil industry is already on the record as opposing government support. Climate activists dug the hole in which to bury the oilpatch a quarter century ago and are eager to dance on its grave.

Everyone affected by COVID-19 is reflecting on everything from their health to their lifestyles to their decimated savings and retirement plans. This is an ideal time for the major stakeholders in the North American oil industry – corporate and political – to have a serious and objective look at the global supply situation, petroleum’s bizarre geopolitics, and the unique opportunity we have on this continent to decide we no longer want to play this game.

Get off the roller coaster and stay off. Allowing our industry to collapse today only to depend on producers like Saudi Arabia and Russia to fill the void tomorrow is utterly irresponsible.

If governments can shut down businesses, close borders, ground airplanes, force people to stay in their homes, print money like never before and order millions of people out of work, surely they can have consumers pay a few cents more at the pump for gasoline to protect this vital industry, its vast supply chain and millions of jobs.

David Yager is a Calgary oil service executive, energy policy analyst, writer and author. He is currently President and CEO of Winterhawk Well Abandonment Ltd. His 2019 book From Miracle to Menace- Alberta, A Carbon Story is available at www.miracletomenace.ca.

*Wikipedia quote attributed to the Huffington Post November 9, 2012

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats