By Stephen Cunningham

“Maybe there are some folks who — for whatever reason — thought they could make some quick money in this and they are learning that production is not as easy as you might think,” Brouillette said Tuesday in an interview in Washington. “You may see some of them go by the wayside.”

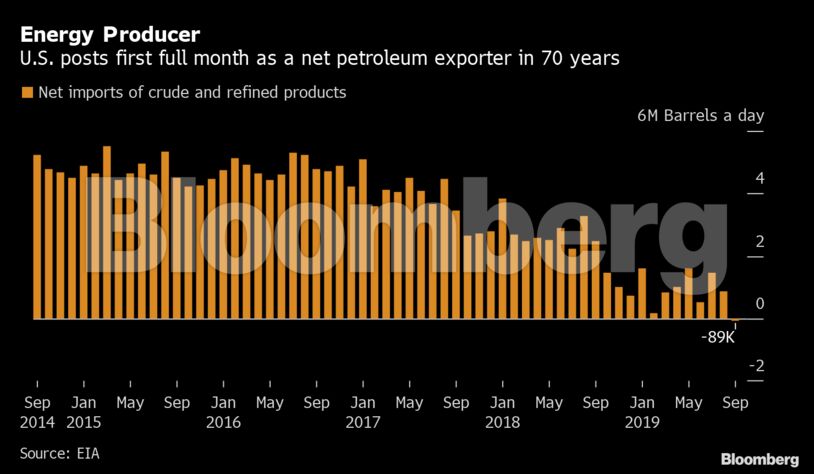

Brouillette, who replaced Rick Perry at the beginning of the month, said improvements in drilling technology meant companies are better equipped to respond to price fluctuations than in the past. And prices are less volatile than they used to be, given the new status of the U.S. as a major producer.

Saudi Attacks

In September, a drone attack in Saudi Arabia temporarily knocked out half of the country’s production, while OPEC and its allies this month announced deeper-than-expected output cuts.

“The recent events in Saudi Arabia, the recent events with OPEC — none of those had any sort of dramatic or extraordinary move of the market associated with them,” he said. “We’re just not subject to the same types of price shocks that we used to be subjected to.”

The producer group “just doesn’t matter in the same way that it did a generation ago,” Brouillette said.

According to Brouillette, one risk to the growth of U.S. production and exports comes from Democratic presidential candidates including Elizabeth Warren and Bernie Sanders who have promised to ban hydraulic fracturing, the process by which shale rock is broken apart to release oil and gas.

“It would be detrimental to the U.S. economy if folks were seriously considering that” given the shale boom has saved American consumers billions of dollars, he said.

Although flaring of natural gas remains a problem, a lack of available infrastructure doesn’t help matters, he said. “Even if we could capture the gas, it’s not clear we could get it to the marketplace. We just need more pipeline capacity.”

SPR Future

Soaring exports have also raised renewed speculation over the future of the nation’s emergency stockpile of oil, known as the Strategic Petroleum Reserve. President Donald Trump previously proposed selling off half of the reserve.

Brouillette brushed aside the suggestion that the reserve should be scaled back further or was no longer needed, given its very existence provides some assurance to markets during periods of turmoil such as the attacks on Saudi oil facilities in September.

“It’s there for a very good reason. It needs to be there for that reason and I think you will see it stay there for that reason,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS