By Alex Longley

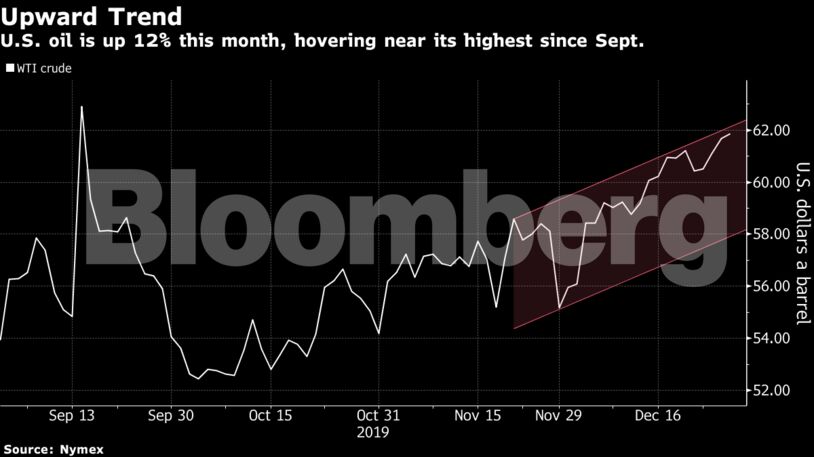

Oil is up about 12% this month after the U.S. and China made a breakthrough in their prolonged trade dispute and as the Organization of Petroleum Exporting Countries and its allies agreed to deepen output cuts. The American Petroleum Institute reported Tuesday that crude stockpiles dropped by 7.9 million barrels last week, according to Reuters. It would be the largest draw since August if confirmed by official data.

“Oil prices continue their holiday grind higher,” said Olivier Jakob, managing director of consultant Petromatrix GmbH. A “weekly stock draw could provide a final boost for the end-year print,” he added, referring to the government report.

West Texas Intermediate for February delivery rose 8 cents to $61.76 a barrel on the New York Mercantile Exchange as of 8:35 a.m. local time. Prices are heading for a fourth weekly advance, the longest run of gains since April.

Brent for February settlement climbed 5 cents to $67.97 a barrel on the ICE Futures Europe exchange. Prices are up about 9% this month. The global benchmark crude traded at a $6.22 premium to WTI.

See also: Aramco, Lebanon, Gulf Oil: A Guide to Middle East Risks in 2020

The Energy Information Administration is forecast to report a second weekly decline in crude stockpiles, according to a Bloomberg survey of analysts. American inventories are shrinking, even as the nation pumps oil at near-record levels and shale explorers boost drilling. Separately, U.S. jobless claims dropped to 222,000 in the week ended Dec. 21 from 235,000 previously, according to Department of Labor figures released Thursday.

| Other oil-market drivers: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS