By Kriti Gupta

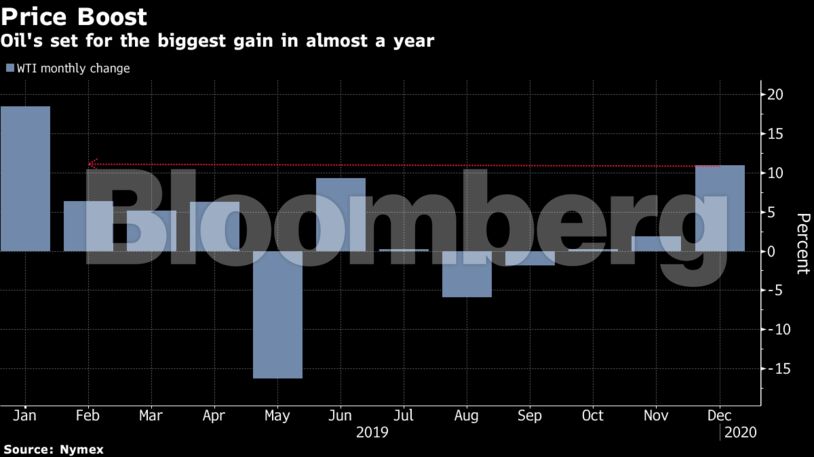

Futures rose 0.9% in New York, gaining for a third straight session as trading resumed after the Christmas break. Prices are up almost 12% this month, and have reached the highest level since mid-September. The American Petroleum Institute reported that U.S. stockpiles dropped 7.9 million barrels last week.

The inventory decrease would be the largest since August if confirmed by government data on Friday. A median forecast of nine analysts in a Bloomberg survey predicts a smaller drop of 1.5 million barrels. Meanwhile, Russia reduced production by 240,000 barrels a day in the first 24 days of December, Interfax reported, citing Energy Minister Alexander Novak.

Oil has surged about 36% so far this year, with prices recently supported by a breakthrough in the trade impasse between the the world’s top two economies. Futures have also been boosted by output cuts made by the Organization of Petroleum Exporting Countries and its allies.

Hedge funds boosted bets on rising U.S. crude prices to the highest level in more than seven months during the week ended Dec. 17, data released Friday show.

“Like the stock market, a lot of economic optimism is getting priced in,” said Phil Flynn, senior markets analyst at Price Futures Group. “With a lot of things happening come the 1st of January, you really don’t want to be short.”

West Texas Intermediate for February delivery climbed 57 cents to settle at $61.68 a barrel on the New York Mercantile Exchange. Markets were shut Wednesday for Christmas.

Brent for February settlement rose 72 cents to close at $67.92 a barrel. Prices are up 8.8% so far this month. The spread between the global benchmark crude and WTI was at $6.24, the widest since June.

Chinese data on Wednesday showed imports of U.S. soybeans surged to the highest in about two years, while American President Donald Trump said a trade pact between the two nations is “done.” He added the two sides are working on translation and paperwork, suggesting a deal would be signed before a meeting with his Chinese counterpart Xi Jinping.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works