Edge Liability Risk Management (“Edge”) was founded in 2016 on one basic principle – how to incentivize oil and gas operators to do more abandonments and reclamations. This was the question that CEO and co-founder, Lex Ewen, asked himself while involved with his first company Entrack Consulting Ltd (“Entrack”). Lex co-founded Entrack, a firm that specializes in turnkey abandonment solutions – downhole work all the way through to the reclamation certificate. The inventory of inactive wells was growing by the month but capital deployment to abandonment and reclamation activities was not following suit. “With depressed commodity prices and no regulatory push, we needed to find a way to incentivize operators to accelerate the number of abandonments and reclamations they perform annually” says Ewen. With the large volume of inactive wells in Western Canada (26,000+ in Saskatchewan and 80,000+ in Alberta at the time), along with the pending Redwater Energy ruling, it was clear that an industry solution was needed. Thus, the Edge model was born.

Edge Liability Risk Management (“Edge”) was founded in 2016 on one basic principle – how to incentivize oil and gas operators to do more abandonments and reclamations. This was the question that CEO and co-founder, Lex Ewen, asked himself while involved with his first company Entrack Consulting Ltd (“Entrack”). Lex co-founded Entrack, a firm that specializes in turnkey abandonment solutions – downhole work all the way through to the reclamation certificate. The inventory of inactive wells was growing by the month but capital deployment to abandonment and reclamation activities was not following suit. “With depressed commodity prices and no regulatory push, we needed to find a way to incentivize operators to accelerate the number of abandonments and reclamations they perform annually” says Ewen. With the large volume of inactive wells in Western Canada (26,000+ in Saskatchewan and 80,000+ in Alberta at the time), along with the pending Redwater Energy ruling, it was clear that an industry solution was needed. Thus, the Edge model was born.

As outlined in their press release of May 1st, 2019 the Edge model allows operators to transfer their liabilities to Edge for the cost of abandonment and reclamation. It can help clients shed environmental liability and provide cost certainty to abandonment and reclamation programs. However, with such a specialized model comes an equally specialized challenge. “We knew that the if we were going to be a company that only owned inactive wells we would need a robust risk management program – one that far exceeded anything seen in traditional oil and gas risk assessment” says Ewen. This is when Bryan Sigurdson (FSA, FCIA) was brought into the fold as Edge’s Chief Risk Officer.

Bryan Sigurdson, FSA, FCIA – Chief Risk Officer

Mr. Sigurdson is an actuary with over 40 years experience in insurance and risk management. Bryan is the former Chief Actuary of Co-operators Life Insurance Company and also served as the Chief Risk Officer of The Co-operators Group.

Although Bryan’s background was in the insurance and investment industries, he draws a number of parallels to Edge’s situation. “No matter the industry, the general principles of risk management are the same – identify the key risks and develop strategies to manage them,” says Sigurdson. “From day one, we knew that we needed an approach that reflected the unique nature of the Edge business model. This wasn’t going to be something we pulled off the shelf at our local insurance broker.” Bryan’s mandate has been to establish Edge’s corporate risk appetite and implement a risk management program aligned with it.

With the solution conceptualized and plans for the risk management structure in place, it was clear to CEO Lex Ewen what piece of the puzzle was missing to turn this idea into a thriving business. “Industry experience. Real oil and gas industry experience” says Ewen as he chuckles. “We needed someone with not only corporate experience, but also experience in engineering and operating an oil and gas company.” John Styles (P.Eng) was approached to vet the model and poke holes in it from a practical point of view. “As soon as Lex explained the model to me, I was in,” notes Styles. The two met at the University of Regina where Styles taught Evaluation of Oil and Gas Properties for 4th year engineering students. “John was one of my engineering instructors. Just glad I actually paid attention!”

John Styles, P.Eng, FEC – Chairman

John Styles is a professional engineer with over 30 years experience in the oil and gas industry. Mr. Styles has served as a director of a number of public companies, including Reece Energy Exploration Corp., until its amalgamation with Penn West Energy Trust in 2009. He was co-founder, Chairman, Chief Operating Officer, Chief Financial Officer and a Director of Long View Resources Corporation, a Tier 1 TSX Venture Exchange-listed public corporation engaged in the acquisition, exploration and development of oil and gas properties.

Having experience at all levels of oil and gas, John saw a number of tangible benefits for operators of all sizes. “The model allows junior companies to make strategic exits from properties or entire areas that they once saw as unsellable, while larger companies are able to use Edge as a capacity increase tool to remove environmental liability from their balance sheet instantly.”

Edge has evolved since inception and now offers a number of services including the liability transfer model, environmental due diligence, abandonment and reclamation programming and a comprehensive liability review. However, the core business model targets stalled M&A activity due to high environmental liabilities.

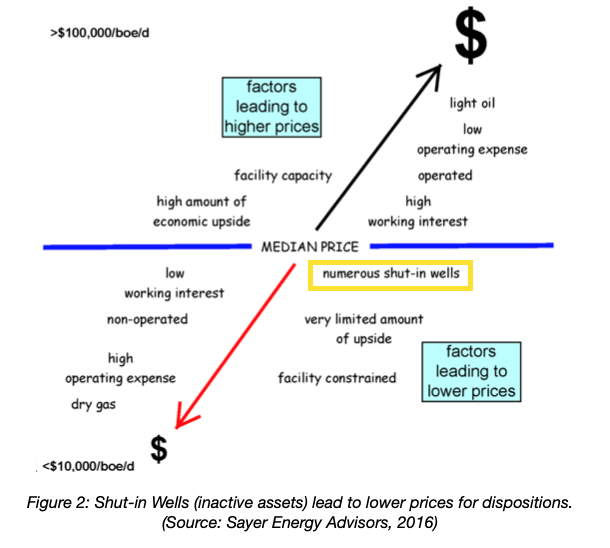

Properties with a large accumulation of inactive assets or uneconomic infrastructure impede deals for a number of reasons: buyers unwilling to pay a premium, high clean up costs, regulatory scrutiny and lenders reluctant to fund liabilities. Greg Sawchenko (VP Business Development), is the newest member of the Edge team and has been working with clients to facilitate these distressed deals. “M&A activity is at an all time low due to pipeline constraints, federal government policy, and a lack of capital in Canadian oil and gas” says Sawchenko. “Given these significant obstacles, Edge has carved out a unique piece of the market to facilitate deals that were once seen as impossible.”

Greg Sawchenko, B.Comm – VP Business Development

Greg has over 20 years of experience in oil and gas land management and negotiations. Prior to joining Edge, Greg was the VP of Land for Baytex Energy where he served as a member of their executive team. Greg also previously held the position of Land Manager for Crescent Point Energy Corp. where he was instrumental in many key transactions and contributed to the growth of the company.

During the development of the model, Edge has had a number of important milestones that required a breadth of experience to achieve. Ewen has been able to surround himself with over 100 years of combined industry experience to gain the traction and respect necessary to thrive in the oil and gas industry. “I have been extremely lucky to have been able to work with this group. These guys have given our company instant credibility.” Edge Liability Risk Management has the right team and the right model to help your company thrive and grow in an uncertain oil and gas market.

To see a full list of bios for the Edge Liability Risk Management Team, please visit www.edgelrm.com

Contact:

Greg Sawchenko

Greg.sawchenko@edgelrm.com

(587) 438-6410

www.edgelrm.com

About Edge Liability Risk Management

Edge Liability Risk Management (“Edge”) is a firm that specializes in the management of oil and gas environmental liabilities, with a focus on risk assessment. Edge’s industry leading solutions allow operators to realize higher sale multiples on properties and unlock deals for properties that were once seen as unsellable. Edge’s goal is to help operators turn their liabilities into opportunities.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow