Chinese refiners are importing record amounts of Canadian crude after slashing purchases of U.S. oil

Chinese refiners are importing record amounts of Canadian crude after slashing purchases of United States oil by roughly 90 per cent amid escalating trade tensions.

A pipeline expansion in Western Canada that opened less than a year ago has presented China and other East Asian oil importers with expanded access to the vast crude reserves in Alberta’s oilsands region.

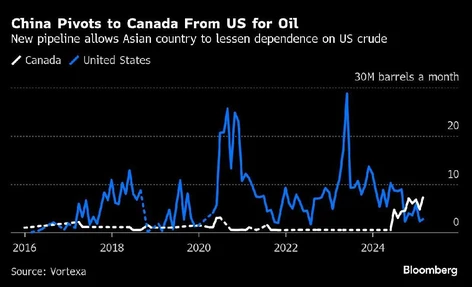

Chinese crude imports from the port at the pipeline terminus near Vancouver soared to an unprecedented 7.3 million barrels in March and are on pace to exceed that figure this month, according to data from Vortexa Ltd., which tracks waterborne oil and natural-gas shipments. Meanwhile, Chinese imports of U.S. oil have collapsed to 3 million barrels a month from a peak of 29 million in June.

The shift in North American crude flows to China — the world’s biggest crude importer — is yet another example of the economic and strategic disruptions engendered by U.S. President Donald Trump’s moves to reshape global trade relations.

To be clear, China’s appetite for Canadian crude began to grow when the Trans Mountain pipeline expansion known as TMX began funnelling Albertan oil to British Columbia’s Pacific coast in May. The trend only accelerated after Trump took office with a declared intent to impose tariffs on China and others.

“Given the trade war, its unlikely for China to import more U.S. oil,” Wenran Jiang, president of the Canada-China Energy & Environment Forum, said in a telephone interview. “They are not going to bank on Russian alone or Middle Eastern alone. Anything from Canada will be welcome news.”

Although Chinese oil imports from North America are dwarfed by those the Middle East and Russia, Canada’s oil sands provide one of the few sources of relatively cheap, dense, high-sulfur grades of crude that many of China’s most-advanced refineries are equipped to process.

For Asian refiners, Middle East crude with similar characteristics — such as Iraq’s Basrah Heavy — are expensive relative to Alberta oil given the strength in the region’s Dubai benchmark.

Bloomberg.com

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS