Authors: Leonard Herchen & Yuchen Wang

Overview

The energy market has remained resilient despite recent shifts in trade policies. While tariffs on Canadian crude and broad-based Chinese imports have introduced new considerations for operational costs and international supply routes, overall price movements have remained within typical volatility ranges. Market fundamentals continue to play a dominant role, with supply and demand dynamics adapting efficiently to changing policy landscapes.

Recent U.S. tariffs on energy imports, along with retaliatory measures from trade partners, have led to some adjustments in global market flows. However, these changes have not resulted in significant instability. Crude oil and natural gas markets have responded predictably, reflecting ongoing supply management from OPEC+, increasing North American production, and consistent global demand.

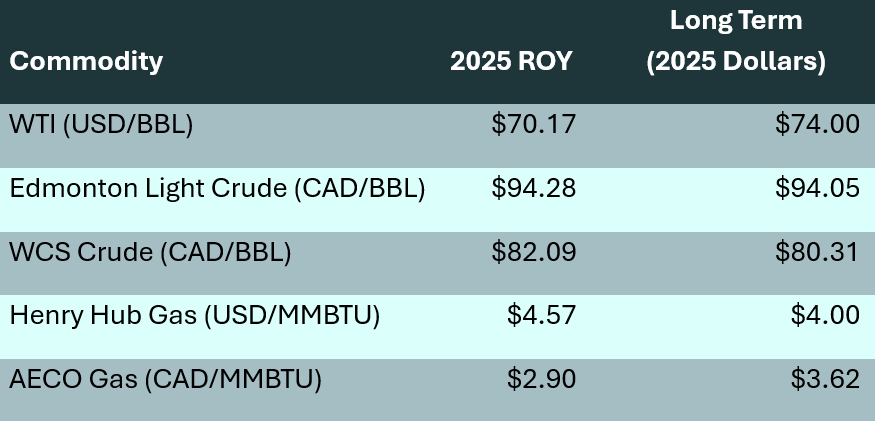

In the face of an evolving global backdrop—characterized by shifting macroeconomic conditions, trade frictions, currency fluctuations, international diplomacy, and a notably changed U.S. policy environment—GLJ analysts remain focused on market fundamentals. These forces have tested many sectors, yet the energy market has responded with consistency, demonstrating its capacity to adjust to external developments without major dislocation. Long-term real prices for WTI are projected at $74.00 per barrel and Henry Hub natural gas at $4.00 per MMBtu in 2025 USD, reinforcing expectations of steady global demand and well-managed supply dynamics.

Oil Prices

During Q1 2025, WTI crude traded within a range of $67 to $74 USD per barrel. Recently, the WTI front-month contract has risen above $71 USD, a move that may be partially influenced by heightened geopolitical tensions between the U.S. and Iran. While such developments can drive uncertainty, they appear to be only one of several factors shaping price movement. The imposition of a 10% tariff on Canadian crude and new trade restrictions on U.S. exports to China initially prompted some rebalancing. However, production gains from the U.S., Brazil, and Guyana have continued to bolster supply availability, helping offset policy-driven disruptions.

OPEC+ continues its production discipline, and global supply remains sufficient to meet demand. The International Energy Agency (IEA) forecasts a modest supply surplus of 600,000 bpd for 2025, which is expected to exert slight downward pressure on prices. U.S. crude storage levels have also increased, and the Trump administration’s planned refilling of the Strategic Petroleum Reserve (SPR) is expected to influence market sentiment.

The U.S. Energy Information Administration (EIA) projects that U.S. crude oil production will reach 13.5 million barrels per day in 2025, further reinforcing the country’s role as a key global supplier. This level of output enhances the market’s resilience to potential supply disruptions. On the refining side, operators seem to have effectively managed the evolving cost environment. Despite ongoing policy shifts, crack spreads have remained within historical norms, suggesting that tariff-related costs have been absorbed without significant impact on refined product prices.

GLJ forecasts WTI to average $70.17 USD per barrel for the remainder of 2025, reflecting the interplay between resilient supply fundamentals and the influence of shifting trade dynamics.

In April 2025, GLJ added forecasts for Ecuador’s Napo and Oriente crude grades, reflecting their rising relevance in global markets. These heavy crudes are gaining traction with refiners in North America and Asia as they seek alternatives amid shifting trade patterns and tightening environmental rules.

Natural Gas

Henry Hub natural gas prices remained above $4.0 USD per MMBtu in Q1 2025, driven by seasonal demand, LNG exports, and the growing energy requirements of data centers and other industrial consumers. AECO prices have also climbed in recent months, reaching approximately $2.30 CAD per MMBtu, supported by renewed demand strength. While Western Canada remains well-supplied, price signals have improved as expectations for stronger export demand build.

The launch of LNG Canada’s Phase 1, expected in mid-2025, will add 1.8 Bcf/d of export capacity and marks a pivotal development for Canadian gas markets. Canadian natural gas demand could increase by 9 Bcf/d by 2030, reaching approximately 27 Bcf/d, largely driven by proposed LNG export developments on the west coast. By creating direct access to Asian markets and reducing dependency on U.S. infrastructure, the project enhances netbacks, supports upstream investment, and strengthens AECO pricing.

Ultimately, sustained price recovery hinges on LNG exports relieving oversupply. In this context, continued demand growth—especially from new export facilities—will be critical in ensuring long-term market balance and investment momentum.

Following the Trump administration’s January 2025 decision to lift the moratorium on new LNG export permits, U.S. LNG projects have regained momentum. While this supports long-term growth, it introduces uncertainty for producers navigating evolving regulations and market access. International buyers continue to prioritize energy security. In Europe, gas storage levels have fallen to approximately 34% capacity, raising concerns about refilling ahead of the next winter season. In response, the EU is considering easing its 90% storage target to mitigate potential price spikes. Meanwhile, Asian LNG demand remains robust, with China increasing spot market purchases amid economic recovery and industrial expansion.

GLJ projects Henry Hub prices to average $4.57 USD per MMBtu for the rest of the year, with AECO holding near $2.90 CAD per MMBtu, reflecting market adjustments to evolving supply and demand conditions.

Lithium Prices and Renewable Energy Considerations

The lithium market remains dynamic, shaped by evolving supply chain logistics, investor sentiment, and changing demand fundamentals. Although short-term price volatility has persisted, long-term growth drivers—such as the global transition to electrification and energy storage—remain strong. Benchmark lithium carbonate prices came under considerable pressure in early 2025. In February, they dipped below $10,000 per MT, reaching a low of around $9,550, which is the lowest level seen in four years. Prices have since stabilized near $10,500 per MT. Despite these fluctuations, the sector continues to draw capital investment, supported by expectations of accelerating demand in electric vehicles, grid storage, and renewable integration.

Looking Ahead: Market Fundamentals Remain Key

Energy markets have continued to adjust to shifting trade policies and regulatory environments with limited disruption. While tariffs and evolving geopolitical conditions may alter global trade flows, energy market participants have navigated these changes with agility, reflecting the sector’s underlying strength and adaptability. Market participants have navigated these changes with agility, reflecting the sector’s underlying strength and adaptability.

GLJ’s forecast values for key benchmarks are as follows:

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS