Authors: Devin Lacey, Yuchen Wang

Lithium has become a foundational element in the advancement of electrification solutions, powering innovations in electric vehicles (EVs), energy storage systems, and advanced electronics. While its role in electrification and renewable energy deployment is indispensable, the lithium market remains highly volatile, driven by shifting supply-demand dynamics and changing policies. To navigate these challenges, GLJ is excited to introduce its new Lithium Price Forecast—a data-driven model offering actionable insights into this ever-evolving market.

Background: Lithium’s Role in the Energy Transition

Lithium, particularly in its widely used form—lithium carbonate—is integral to the production of lithium-ion batteries. These batteries power a wide array of technologies, from EVs to large-scale renewable energy storage systems, making lithium essential to advancing clean energy solutions. Beyond transportation and energy infrastructure, lithium is also critical to consumer electronics and emerging technologies.

In recent years, demand for lithium carbonate has surged due to the rapid expansion of the EV market and the increasing adoption of renewable energy technologies. This unprecedented demand drove prices to historic highs as industries competed for limited supply. However, the past year has seen a significant price correction, driven by new production projects coming online and easing supply shortages. Additionally, a temporary moderation in EV sales growth has contributed to stabilizing market conditions.

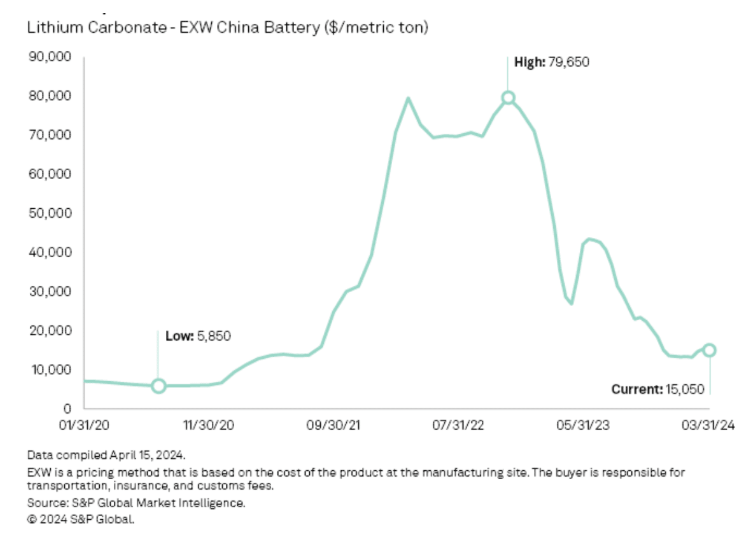

Figure 1 (below) illustrates the considerable volatility of lithium carbonate prices over the past decade, reflecting the market’s sensitivity to supply shortages and demand surges.

Figure 1 – Lithium Carbonate Historical Prices – S&P Global (2024)

Supply and Demand Dynamics

Economic headwinds in 2024, including inflationary pressures and shifting subsidy policies, slowed EV sales growth. Uncertainties surrounding potential U.S. policy changes under a Trump administration—such as rollbacks of EV subsidies and adjustments to the Inflation Reduction Act (IRA)—introduced additional caution into the market. Despite these challenges, the electrification of transportation continued to drive substantial lithium demand, particularly for lithium-ion batteries.

Global demand remained resilient, supported by a general foundation of cross-jurisdictional government incentives, global decarbonization mandates, and expanding charging infrastructure in key markets like Europe and China. While reduced subsidies in some regions temporarily cooled lithium demand, these impacts are expected to remain localized and not significantly affect the global market outlook. The long-term outlook for lithium remains strong, with robust growth anticipated as countries and industries continue advancing toward ambitious net-zero goals.

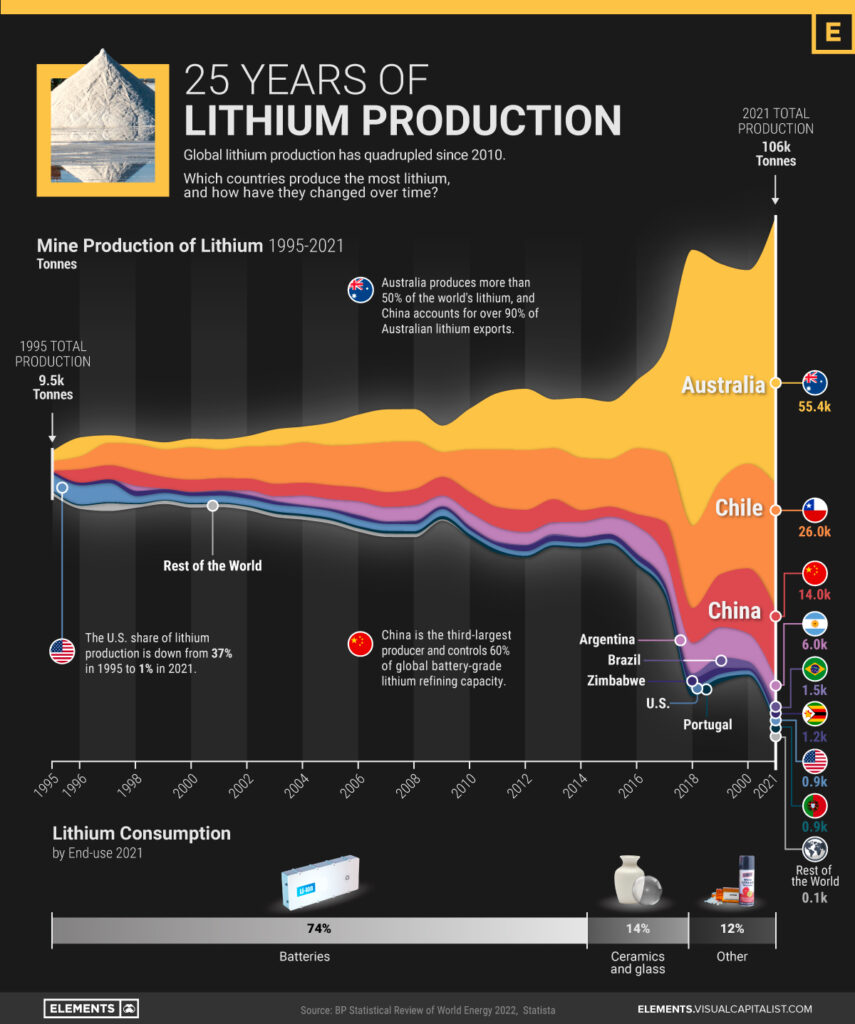

On the supply side, the lithium market in 2024 underwent notable adjustments, including production cuts in both Chinese and non-Chinese operations. Refinery production in China saw reductions, while projects in Australia, such as those operated by Pilbara Minerals and MinRes, faced delays or scaled-back plans. Capital expenditure cuts further slowed supply expansion as companies delayed or canceled projects, raising concerns about the West losing market share to China, which continues to dominate lithium refining.

Despite these challenges, some production ramps persisted, particularly in South America’s Lithium Triangle (Chile and Argentina), helping to partially offset the overall slowdown. These shifts highlight the delicate balance between managing oversupply and meeting long-term demand driven by EV adoption and energy storage needs.

Figure 2 – Lithium production by country (1995-2021) – World Economic Forum (2022)

The interplay between steady demand and constrained supply helped stabilize the lithium market in 2024. However, prices remain under pressure from geopolitical uncertainties, evolving policies, and the growing role of battery recycling technologies. These dynamics emphasize the importance of expanding supply across key regions to meet rising demand and reduce future price volatility.

The Lithium Price Forecast Model: Methodology and Key Market Indicators

GLJ’s forecast model for 2025 to 2030 leverages advanced statistical techniques to assess the complex interplay of factors driving lithium supply and demand. The model incorporates critical market indicators such as global EV sales, lithium production levels, and energy trends, to deliver actionable insights into future pricing scenarios.

- Demand Indicator: EV sales represent a primary demand driver for lithium, with the exponential growth of the EV market expected to persist. By incorporating historical sales data and forward-looking projections, the model evaluates how the increasing adoption of EVs influences lithium pricing trends.

- Supply Indicator: The production and refinement of lithium into usable forms, such as lithium carbonate, are pivotal to price determination. The model incorporates historical global production data to track trends in lithium mining and extraction. This enables an assessment of how past production levels and capacity expansions will influence future pricing dynamics.

- Energy Market Indicators: Energy market trends, including natural gas prices, are integrated into the analysis for their significant impact on production costs. As energy expenses play a critical role in lithium extraction and processing, fluctuations in these prices can influence overall market dynamics.

Key Insights from the Model

- Correlation and Predictive Power: The model highlighted the substantial influence of global EV sales, lithium production levels, and market dynamics in shaping lithium price trends. These interconnected factors stress the importance of aligning demand growth with supply capabilities, offering valuable insights into market behavior and pricing outcomes.

- Global EV Sales: A clear upward trajectory in global EV sales was identified, with this growth projected to persist through 2025-2030. This trend directly correlates with increased lithium demand, reinforcing the pivotal role of EV adoption in shaping lithium market behavior and pricing patterns.

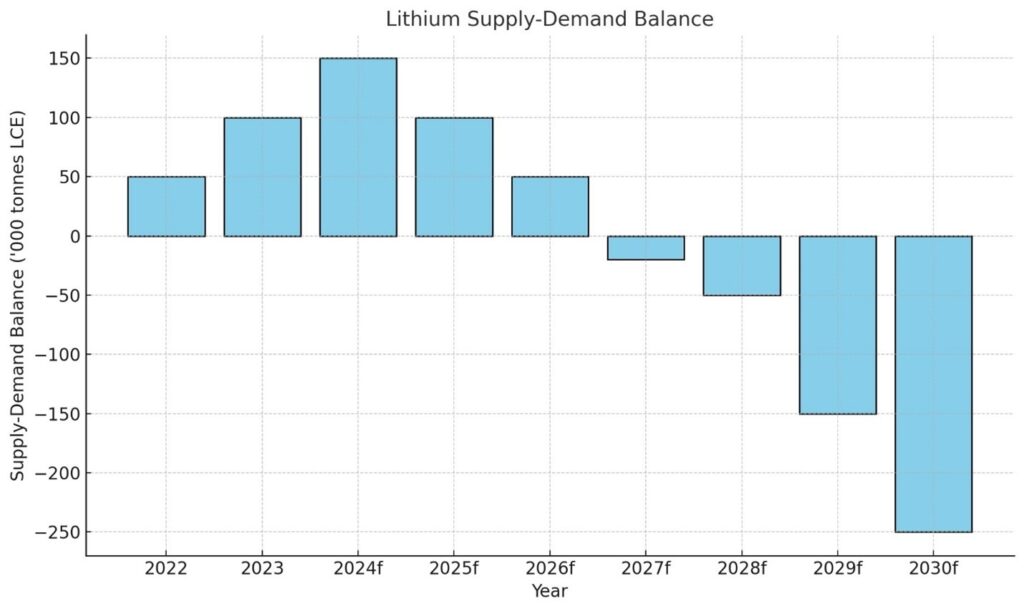

Supply Constraints and Market Deficits: Industry projections indicate that the lithium market may face a supply deficit as soon as late 2026 or early 2027. This reflects challenges in scaling lithium production to meet surging demand from EVs, stationary energy storage systems, and other applications. These findings align with broader market analyses, which highlight the difficulties in achieving sufficient supply expansion amid the accelerating global push for electrification and renewable energy adoption.

Figure 3. Supply – Demand Balance (Data by Fastmarket, 2024)

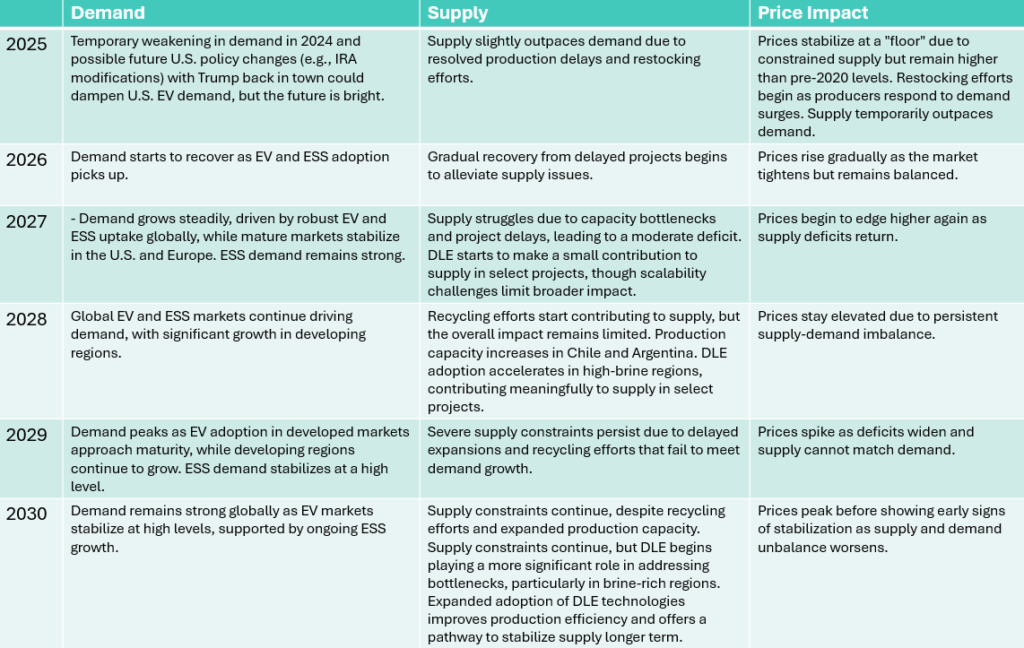

Building on the earlier analysis of demand and supply dynamics, Table 1 (below) outlines the projected lithium market trends from 2025 to 2030, focusing on the key drivers and their influence on pricing.

Table 1 – Supply and Demand Projections

Scenario Forecasting: High, Base, and Low Scenarios

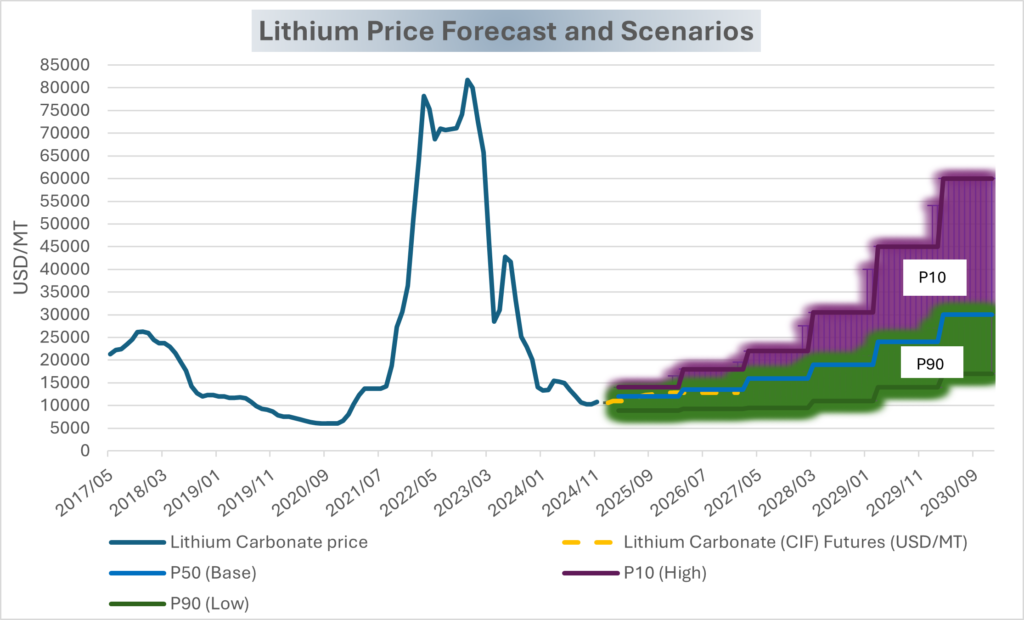

To reflect varying market conditions, the forecast presents three distinct scenarios that map potential lithium price trends over the next several years:

- High Scenario (P10): Reflects surging EV demand coupled with severe supply challenges, driving significant price increases.

- Base Scenario (P50): Assumes steady EV adoption and incremental supply growth, maintaining elevated but stable prices.

- Low Scenario (P90): Reflects slower EV growth and moderate supply increases, leading to relatively stable and lower prices.

These scenarios offer stakeholders a structured framework to anticipate and adapt to diverse market outcomes as supply-demand dynamics evolve.

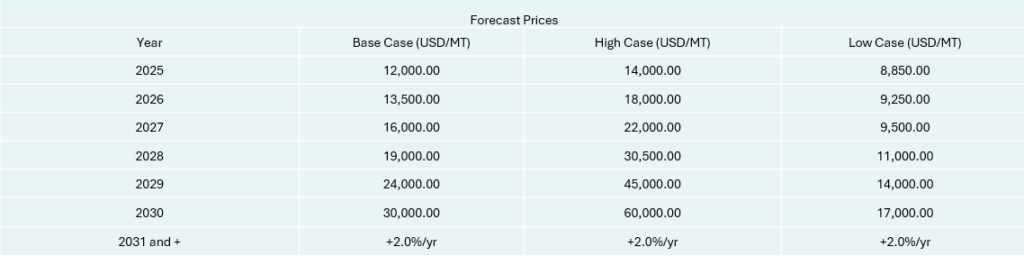

To further illustrate these forecasts, Table 2 (below) provides a detailed breakdown of lithium carbonate price projections under each scenario from 2025 to 2030, with the base scenario building off the 2-year Lithium Carbonate Futures Price. Additionally, the accompanying plots visualize these trends, offering insights into how varying market drivers influence future pricing.

Table 2 – Forecast prices (3 Scenarios)

Figure 4 – Lithium Price Forecast, Future Price and Scenarios

Conclusions

The lithium market is at the forefront of transformative global trends, driven by the growth of EVs, advanced deployment of energy storage systems, and the further deployment of clean energy technologies. GLJ’s data-driven forecast model equips stakeholders with critical insights to navigate the dynamic lithium market and effectively plan for various scenarios.

While uncertainties remain, our ongoing efforts to refine the model and monitor key market dynamics ensure that we deliver actionable intelligence to support informed decision-making. GLJ remains committed to supporting clients in navigating evolving market conditions and ensuring the success of their lithium-focused initiatives.

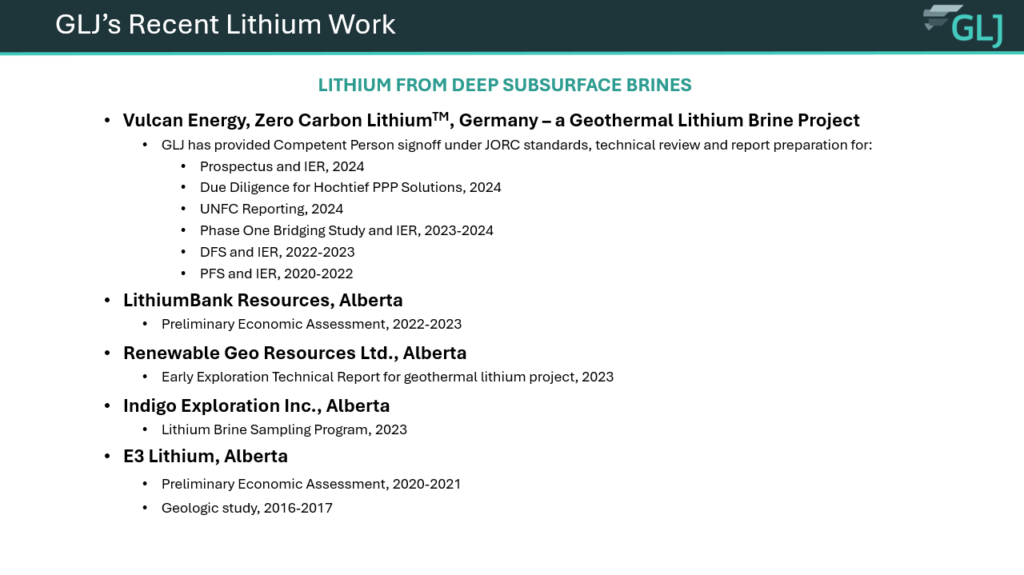

GLJ’s 50+ year history in subsurface resource assessment and upstream energy development has been leveraged to evaluate and advise on lithium brine projects that utilize Direct Lithium Extraction (DLE) technologies around the globe. DLE is a lithium production method that extracts lithium from subsurface brines, which includes those found in oil and gas or geothermal reservoirs. For more on our expertise, see the below summary highlighting GLJ’s recent lithium project experience, highlighting our proven capabilities in guiding clients through the complexities of new project development and navigating market uncertainties.

Our team is here to provide you with the expertise and support needed to drive your projects forward. Stay connected as we enhance our methodologies and track developments shaping the future of this essential commodity. Contact us at [email protected] for pricing inquiries or [email protected] for lithium brine or other project inquires.

Figure 5 – Recent Lithium Project Experience

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS