Carbon Tax Not Achieving Objectives but Costing Big Bucks

The government likes to say that experts recommend a carbon tax as an efficient means to lower GHGs, but that expert advice usually assumes that a carbon tax is the only or primary measure used.

But the federal government has some 140 different climate policies. They claim this underlines their commitment to the task, but this analysis from the Fraser Institute argues that such an unfocused effort is costly and inefficient.

The report points out that, “the large number of different policies testifies more to an overall lack of focus than to a commitment to optimal policy making. Carbon pricing is part of the federal policy mix, but the profusion of accompanying regulations, subsidies, and mandates undermines any economic efficiency attained by the mission charge and ensures that the package as a whole will be relatively inefficient for what it accomplishes.”

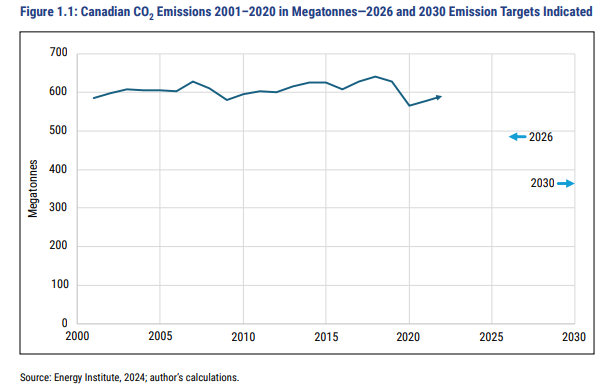

The government’s emissions reduction target is 40% below 2005 levels by 2030, with an interim target of 20% by 2026.

A recent progress report showed that emissions in 2022 were about the same as in 2021.

Reaching the 2026 and 2030 goals will require emissions to decline extremely quickly in just a few years.

The report, in fact, estimates that the government will only reach 57% of its target by 2030, and at a cost of a 6.2% reduction in real GDP and a 1.5% reduction in income per worker.

The overall emissions reduction plan will cost every Canadian worker $6700 by 2030.

Deadline Approaching for “Greenwashing” Submissions

In my last newsletter I provided details on the government’s new “greenwashing” legislation – which allows the Competition Commission to decide whether an entity’s communications on its environmental initiatives is truthful according to some undefined “internationally recognized methodology” – which doesn’t actually exist.

The immediate outcome of this legislation and unknown regulations is that many oil and gas companies – and other companies – are declining to discuss their environmental initiatives. They don’t know how they will be judged and by whom. What they do know is that the fines if they are found “guilty” can be up to $10 million – not including the significant time, resources and legal fees they would devote to fighting endless, frivolous accusations.

This is not only unfair and unreasonable to the companies, but to Canadians who would like to know what environmental goals and initiatives are being pursued by the companies and organizations they are interested in, or have invested in.

CAPP recently made a submission to the Commissioner recommending that the legislation be repealed and replaced with something that has greater clarity, but since that is beyond the remit of the Commission, then the Commissioner must ensure that the same standards of truth must apply not just to corporate entities, but to activist environment groups, non-profits, and governments.

Please consider making your own submission before September 27, 2024 (next Friday).

Feedback to the Competition Commissioner

A Year of Reckoning: Navigating Canada’s Economic and Political Landscape

It’s been three years since the last federal election, so if we abide by Canada’s fixed-election legislation, we can expect to be at the polls in about a year.

That’s a year of fractiousness that is going to be difficult for all of us. We’ve watched the economic devastation this government has wrought upon Canadians; however, most Canadians have connected the dots, and understand that the profligate federal government spending and escalating deficits is what has led to the rising costs Canadians are experiencing, and the portion of their paycheques people get to keep – because of higher taxes – leaves even less.

This economic calamity is connected to why we have the most fractious labour environment in a quarter century. When you destroy the take home value of peoples’ earnings, they rightly want to ensure their earnings are better protected. At the same time, businesses feel constrained because they don’t believe they have the room to increase prices. Both scenarios – rising wages and rising prices – have inflationary impacts.

The outcome of taming inflation is often rising unemployment – which represents one of the worst outcomes of fiscal and economic mismanagement. But higher government structural cost constructs (fixed payments such as legislated programs and interest expense), their over-regulation of Canadian companies, antipathy towards our oil and gas industry, and a focus on narrative over execution on any substantial matter has led to a forecast of Canada being one of the worst economic performers for the foreseeable future and a productivity profile that consistently lags our competitors.

The government direction is to focus on division. They will be spending this final year in Parliament trying to find the issues that will define the ‘us vs. them’ narrative they feel will align Canadians their way in an election. And that will be as much a manipulated construct as anything we’ve seen.

There is much at stake – not just the economy, but our democratic practices that are the bedrock of our nation.

My request to you, as I enter Parliament for this government’s fourth year, is to keep your eyes on the narratives the Liberal government will attempt to spin. Always ask what the motivation behind messaging is. And please contact me directly if you have any concerns about where you feel our country is heading.

Thank you.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY Joe Oliver: Fool Me Once, Shame on You. Carney and the Liberals Trying to Fool Me Four Times? Seriously?