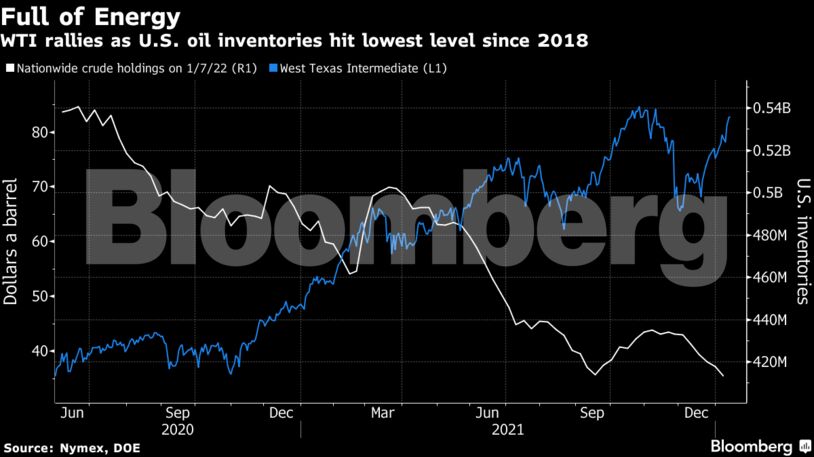

Since 2022 began WTI has surged more than 9%, joining other commodities in a strong start to the year, on signals that consumption outside Asia is largely recovering from the pandemic. The International Energy Agency has said demand is stronger than expected, while the Energy Information Administration’s latest outlook showed that global oil inventories are set to decline this quarter.

“The main factors driving prices up are external factors such as the generally positive market sentiment as omicron concerns abate and the expectation of continued dynamic economic development,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt.

Nonetheless, road traffic has thinned across Asia at the start of the year as the fast-spreading omicron variant sweeps through the region. Fewer vehicles have transited most capital cities so far this month than in December, according to mobility data from Apple Inc. In China, which is battling an omicron outbreak, efforts at containment are inflicting mounting economic damage.

| Prices |

|---|

|

On Wednesday, the EIA reported U.S. crude stockpiles sank to the lowest level since 2018. Inventories at the key storage hub in Cushing also fell.

Underlying optimism about the outlook is reflected in the market’s bullish backwardated pricing structure, with near-term contracts holding above those further out. The spread between WTI’s two nearest December contracts — the one for 2022 and for the same month next year — was at $6.46 a barrel. That’s up from less than $5 at the end of last year.

Oil’s year-to-date surge — along with gains in other raw materials — will fan inflationary pressures as central banks shift gears to battle escalating price pressures. Federal Reserve Governor Lael Brainard said tackling inflation while sustaining an inclusive recovery is the U.S. central bank’s most pressing task.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow